Strong Market Lifts More Stocks Above Fair Values

Energy remains the cheapest sector under Morningstar coverage, and consumer cyclical looks attractive, particularly travel and leisure firms.

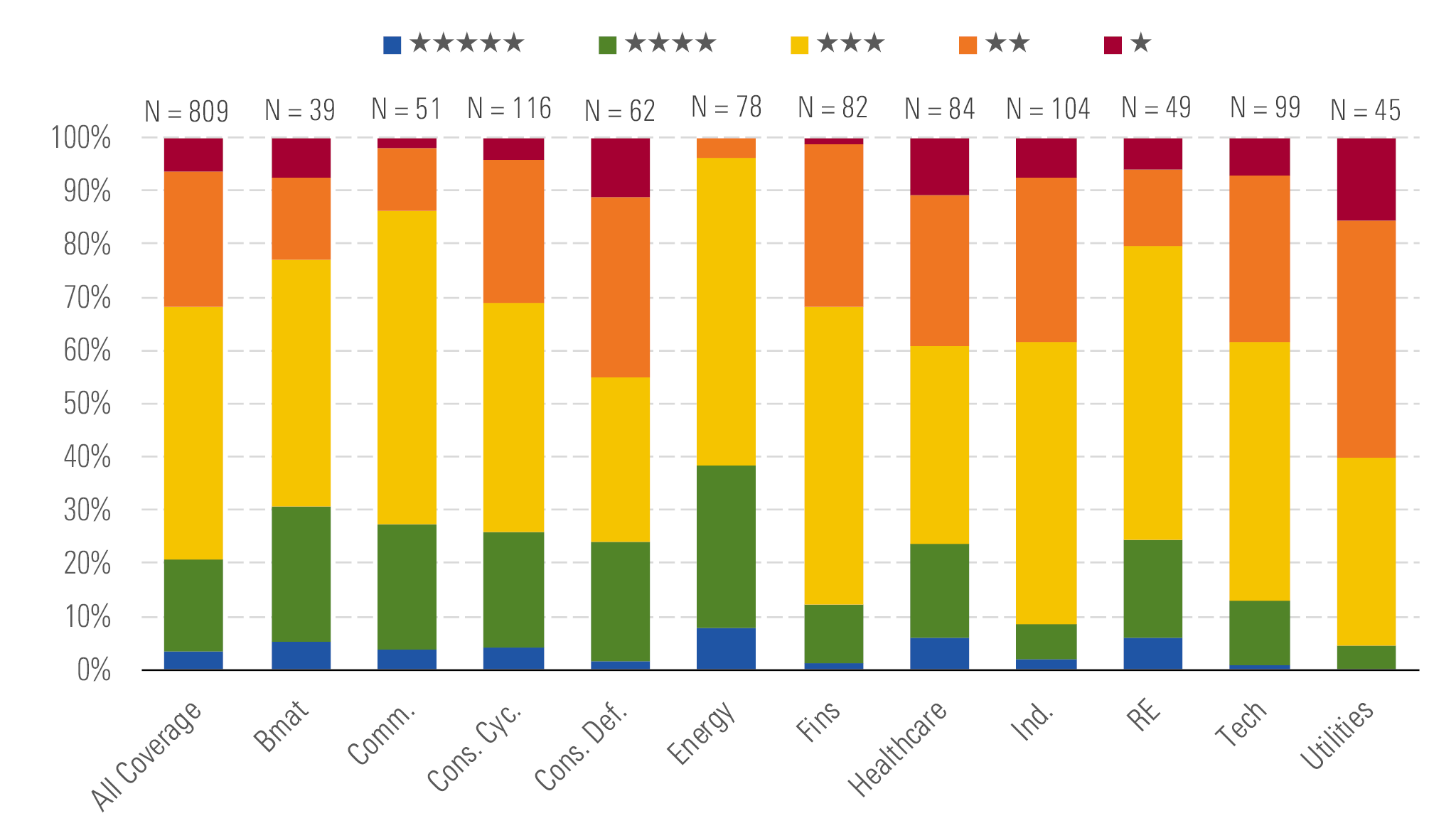

With the Morningstar US Market Index climbing nearly 10% in the fourth quarter of 2019, the median stock in our North American coverage now trades at a 3% premium to our fair value estimate compared with a 2% discount near the end of the third quarter. Of the roughly 800 North American stocks we cover, 32% have an overvalued rating of 1 or 2 stars compared with only 21% with an undervalued rating of 4 or 5 stars. Only three of the 11 sectors we cover have a median stock with a price/fair value ratio below 1: energy, consumer cyclical, and communication services.

- Energy remains the cheapest sector in our coverage. The long-term economics of supply and demand point to oil and natural gas prices of $55 per barrel (West Texas Intermediate) and $2.80 per thousand cubic feet (Nymex)—levels that make many U.S. energy stocks attractive at today's prices.

- Consumer cyclical stocks also look relatively attractive. Those looking for a bargain in the sector may want to take advantage of the uncertainty plaguing travel and leisure, which trades at a 12% discount to our valuations.

- Technology stocks were on fire in 2019, and we don't see much value in the sector today. The median U.S. technology stock is 11% overvalued, and we see no subsectors where the median stock is cheap.

Energy Continues to Hold the Largest Share of Buying Opportunities - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TNJY62P2RRG2PP5MMRLA5IZXYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)