Technology: A Few Hurdles, but Tech Stocks Continue to Run

No attractively priced subsectors, but cybersecurity is a hot topic.

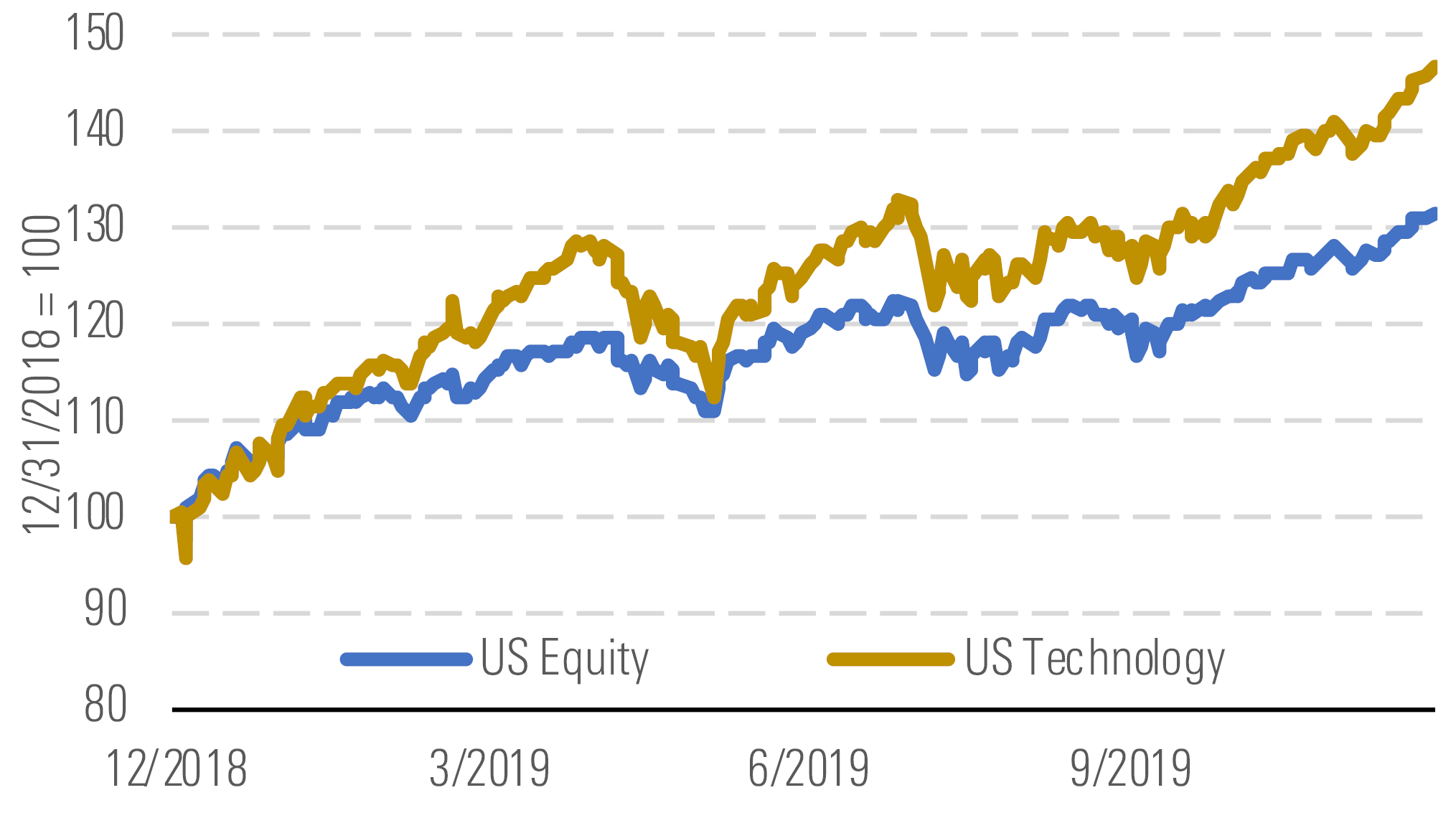

Technology stocks remained on fire in 2019, bouncing back from lows at the start of the year. The Morningstar US Technology Index is up 47% year to date as of Dec. 31, outperforming the U.S. equity market, which rose 31% over 2019 (Exhibit 1). Technology snapped back in early 2019 with some optimism that the U.S. and China can reach trade agreements and avoid a full-blown trade war, an issue that caused the markets and the tech sector to fall in the fourth quarter of 2018. Such concerns reared their ugly heads again in the second quarter of 2019, most notably with the U.S. ban on selling into Huawei, a significant manufacturer of smartphones and network equipment.

After a bounceback in May, tech outperformed the broader market. - source: Morningstar

Yet the market has shrugged off such concerns in the second half of 2019, significantly outperforming the broader market. Huawei has not proved to be a major headwind to growth, while Apple iPhone sales, which move the needle for not only Apple but dozens of suppliers, appear to be on the rebound. Our valuations throughout all of 2019 assumed that a U.S.-China trade war will eventually subside, and with U.S. tech's rally in the second half of 2019, the market appears to concur.

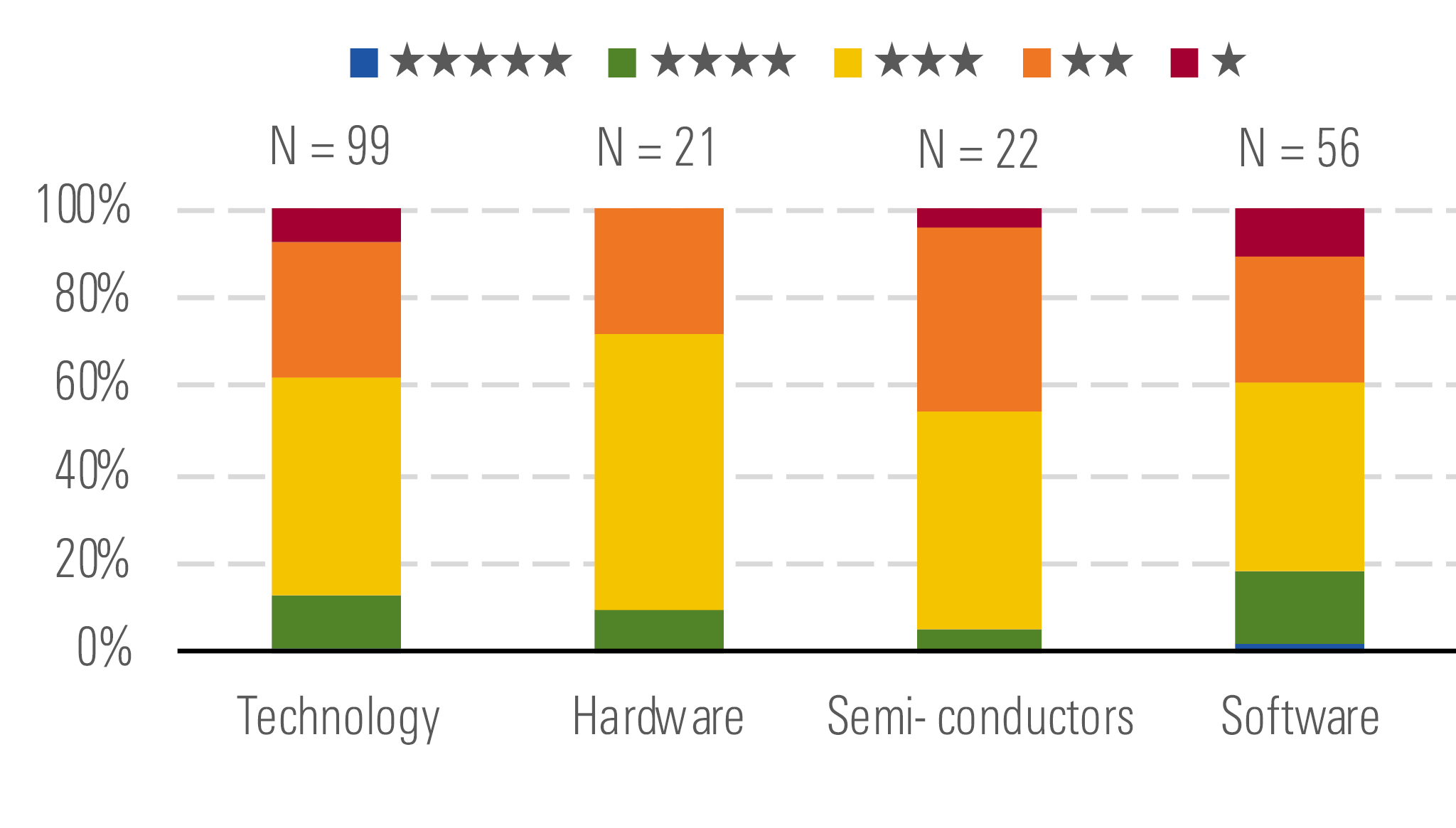

The median U.S. technology stock is 11% overvalued, in our view, and we see no subsectors where the median stock is attractively priced. Semiconductors appear to have the fewest opportunities today, as this sector has rallied significantly since the start of 2019, when U.S.-China pessimism was at its highest. Software also largely appears overvalued to us. We again attribute the lack of attractive U.S. tech stocks to less pessimism around trade tensions (Exhibit 2).

Tech is now broadly overvalued after a strong 2019. - source: Morningstar

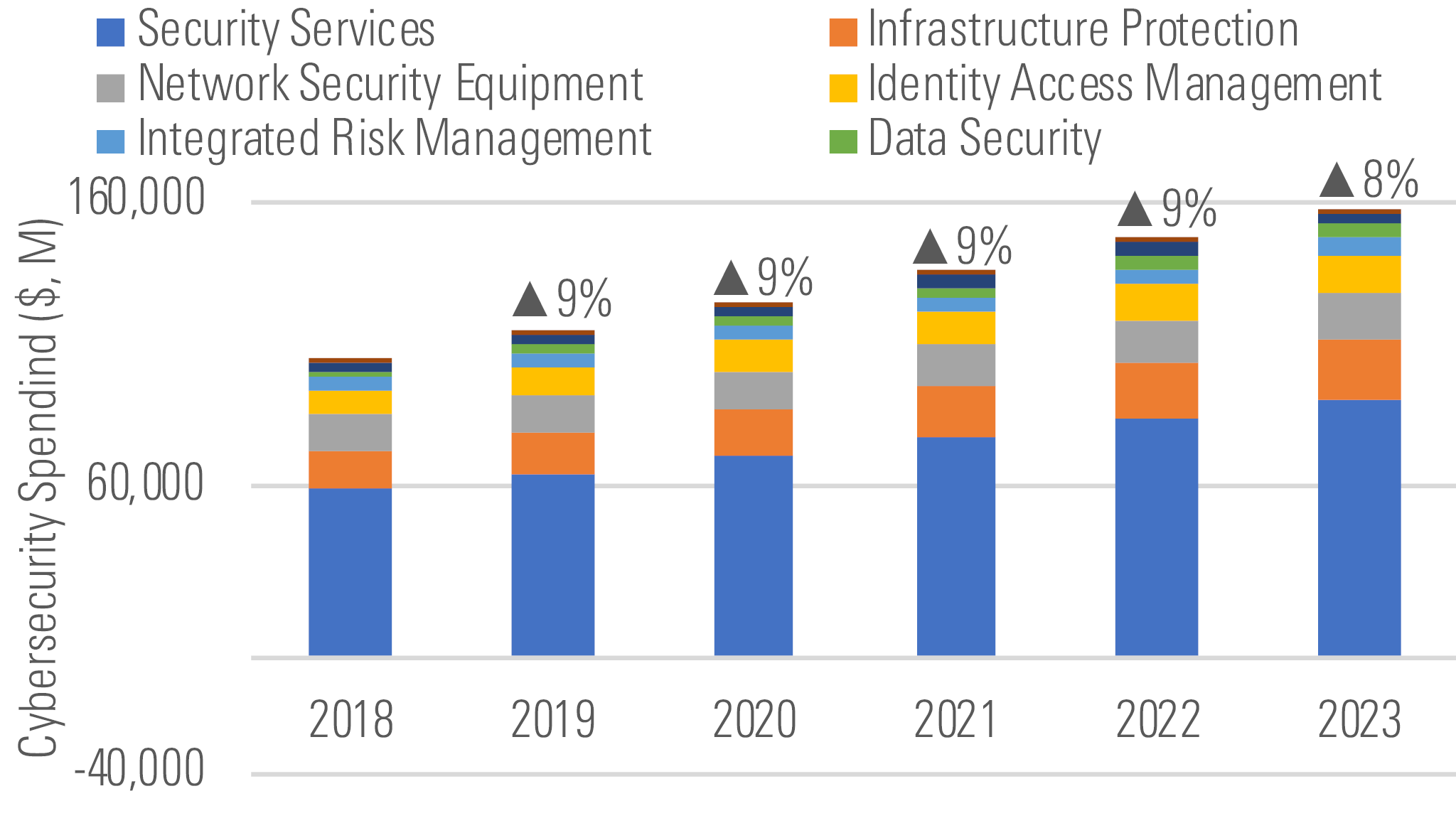

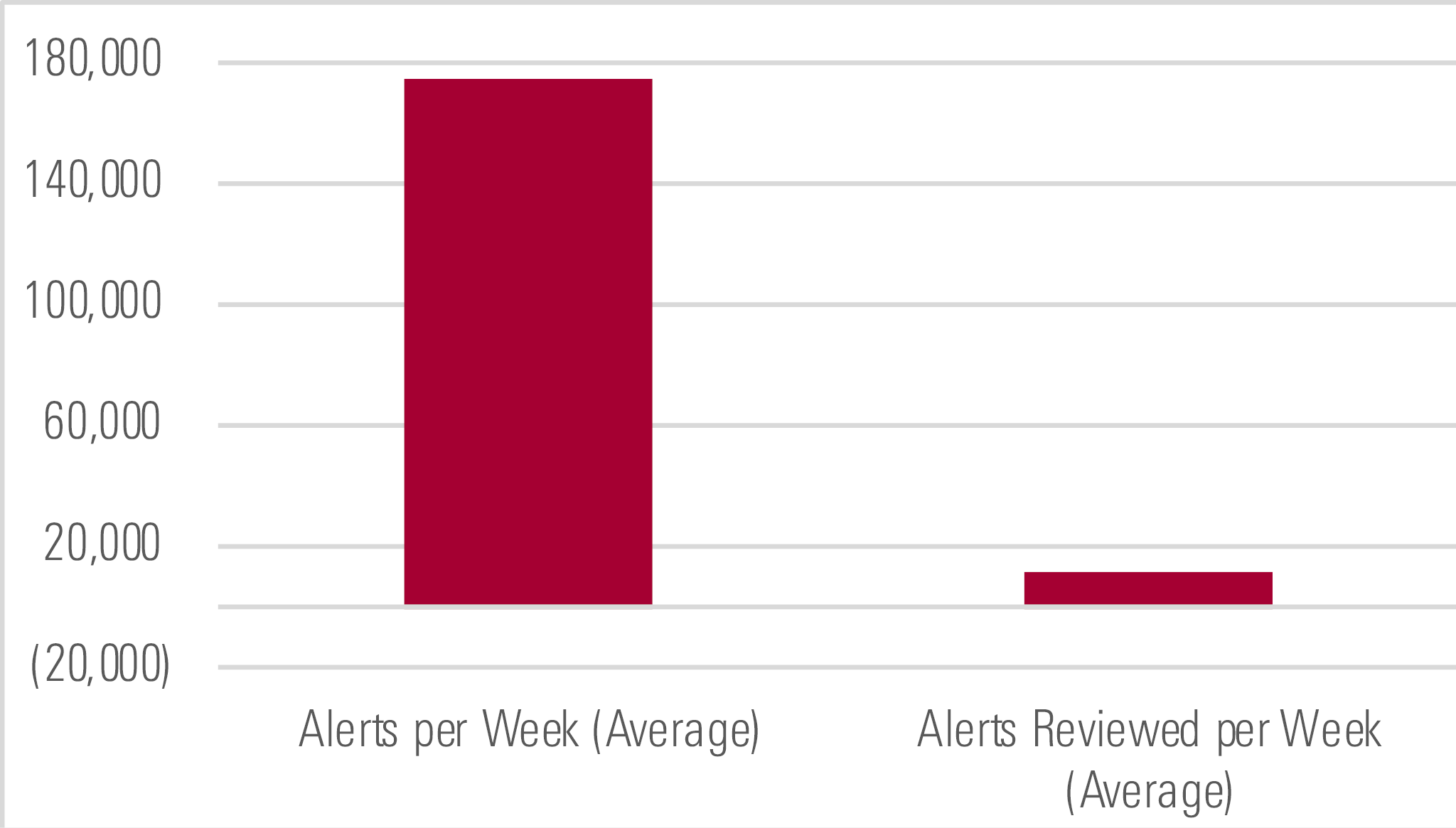

Looking across U.S. technology trends, cybersecurity is at the forefront of business and government decision-makers' minds. Why? Because several hundred data records were stolen in the time it took to read this paragraph. The cybersecurity vendors we cover have formed economic moats by becoming part of the lifeblood of customers, and we believe the potential disruption associated with changing from these vendors is not worth the risk. We think the $100 billion-plus cybersecurity market will grow at a five-year CAGR of 9% (Exhibit 3). We expect certain areas, such as security for cloud-based workloads and applications, alongside automation solutions, to outpace more traditional offerings. In short, IT managers face too many alerts and not enough time to review them all (Exhibit 4).

Cybersecurity spending should rise at a 9% CAGR through 2023. - source: Morningstar

IT managers face too many cybersecurity requests to review. - source: Morningstar

Top Picks

Intel INTC Economic Moat: Wide Fair Value Estimate: $65 Fair Value Uncertainty: Medium

Wide-moat Intel trades at an attractive discount to our fair value estimate of $65 per share. The chip titan's comprehensive product portfolio tailored to computers from the data center to the edge gives us confidence in the firm's long-term growth prospects, despite a declining PC market. We applaud Intel's scattershot approach to address challenges in computing (artificial intelligence and cloud), connectivity (5G), and memory (3D NAND and 3D XPoint). Its acquisitions (Altera, Mobileye, Nervana, and Movidius) have unlocked new growth vectors for Intel to tackle while augmenting the capabilities of its old guard in client computing and data center.

Palo Alto Networks PANW Economic Moat: Narrow Fair Value Estimate: $305 Fair Value Uncertainty: High

Narrow-moat Palo Alto Networks became the firewall market leader in 2018, and we expect its growth rate to outpace peers as it expands its portfolio in high-growth areas for cloud-based cybersecurity, analytics, and automation. Complexities associated with managing a multitude of products from various software and hardware vendors and a dearth of cybersecurity talent leads our view that firms and government entities are clamoring for consolidated security platforms. We believe that Palo Alto's security platform is at the leading edge and will remain in demand as customers prefer to add on existing Palo Alto subscriptions.

VMware VMW Economic Moat: Narrow Fair Value Estimate: $202 Fair Value Uncertainty: High

We believe that VMware's position as the commonality between public clouds, private clouds, and on-premises ecosystems gives it an enviable position. Coupled with VMware planting a flag that it'll be the way to deploy and use applications across any networking environment, we expect this software giant to repeat double-digit top-line growth. Shares have pulled back as a result of soft near-term sales, concerns about broader IT spending, and VMware's recent large acquisitions. Yet this decline overlooks VMware's thoughtful strategic shifts into hybrid-clouds and containerized applications.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)