Passive, Active, ... Whatever

Low costs drive superior stock-fund results, not indexing.

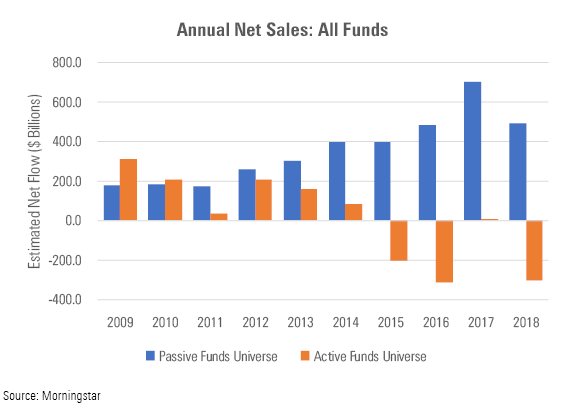

Actively Disliked It's no secret that actively run mutual funds are unpopular. They have suffered net outflows for three of the past four years. Meanwhile, the combination of index mutual funds and exchange-traded funds has enjoyed positive net sales.

The grim news (for active managers) appears below. The universe consists of all mutual funds and ETFs, save for money market funds and funds of funds. For convenience's sake, I classify all index funds as "passive," although many ETFs hold idiosyncratic portfolios that should properly be regarded as active. But such funds are almost always small and thus immaterial to the overall picture.

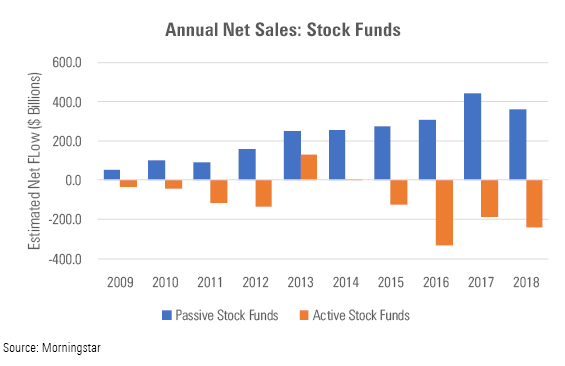

It's also no secret that most indexing occurs with stocks. The only reason that active funds remained competitive from 2009 through 2012 was that active bond funds handily outsold bond indexers. That ended in 2013, when the reputation (although not performance) of bond-fund leader PIMCO Total Return PTTRX imploded.

At least active bond funds enjoyed a nice run. As a group, active equity funds have registered no net inflows over the past decade, save for a brief stretch during 2013-14. Over the full 10-year period, from 2009 through 2018, they logged $1 trillion in net redemptions. That's no way to make a living.

Data Check At this point, your sympathies are likely to be muted. Actively managed stock funds received their just desserts. Had they performed better, they would have retained investor loyalties. However, as we also all know, their average returns were well below those of index funds.

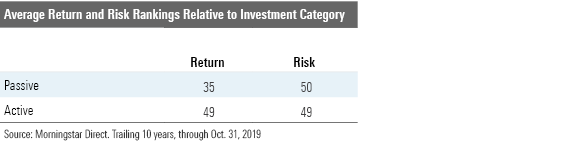

Let's test that belief. Using the same universe and a similar time period (in this case, the trailing 10 years through Oct. 31, 2019), we can calculate the 10-year average category rankings for both active and passive stock funds. If actively run equity funds were indeed generally worse, their collective failure should be readily apparent.

It was. The average risks for passive and active equity funds were similar, albeit with more outliers for the active funds. But the returns were not. The typical index fund placed just outside the top third of its category for the decade, while the typical active fund was ... typical. It could scarcely be otherwise: All children cannot be above average.

(Yet, you protest, the average return percentiles for both passive and active equity funds each are below 50. How can that be? Good question. That puzzled me for a while. The oddity owes to an additional screen I neglected to mention: oldest share class. Using only one share class per fund prevents overcounting funds that have multiple share classes, but it also slightly improves the field, because the oldest share class tends to be cheaper than its successors.)

Meeting Expectations The index fund result was as predicted in this space's "Revisiting International Equity Indexing," published two weeks ago. That article explained how U.S. stock index funds have ridden style tailwinds over the past decade, while their international cousins faced a headwind. (Market-cap-weighted index funds are neutrally positioned with respect to the markets, but not to their actively run rivals. Within Morningstar Categories, index funds can be hurt or helped by their disparities in investment style.)

Consequently, the 10-year return percentiles for most domestic-stock index funds place near the top quintile, while those of the international indexers cluster around the 50th percentile. Combining those two results leads to an expected average return percentile of about 35 for the universe of all equity index funds--precisely what they did achieve. (My apology for this rather boring paragraph, but it illustrates how all the data pieces must fit, or else the researcher has erred.)

The percentile difference between passive and active equity funds translates to a total return difference of about 50 basis points per year, which, as Jack Bogle would say, sums to real money over time. That performance gap also closely mimics the expense difference between the two groups, which is narrower that you might think, because 1) the oldest share classes of active funds are relatively cheap; and 2) most internationaland small-company index funds aren't priced near zero.

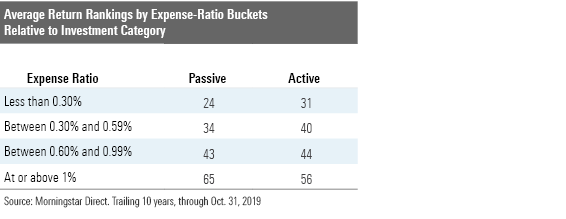

Expense-Ratio Buckets Which leads to the following question: If, on average, stock index funds have outgained their active competitors by approximately the amount of their differences in expense ratios, then might active stock funds that are priced similarly to index funds fare equally well? Does equity indexing's advantage come solely from costs, as opposed to structural features?

This column is not the first to pose such queries, but I think it offers a clearer answer than most. No, there are not significant performance benefits to equity indexing above and beyond its usual (but not inevitable) cost advantage.

The support for that statement appears below. Once again, the table shows the 10-year category rankings for passive versus active equity funds, although this time I have omitted the risk scores, because they are largely similar. This time, though, funds are sorted into four expense-ratio buckets: 1) less than 0.30%, 2) more than 0.30% but less than 0.60%, 3) more than 0.60% but less than 1.00%, and 4) more than 1.00%.

The Cost Driver The conclusion seems obvious. Expense differences explain just about everything. True, index funds slightly beat their active rivals within the two lowest expense-ratio buckets, for reasons (technical details) that aren't worth explaining here, but the overwhelming effect came from the expense-ratio sorting. Each group in a lower-cost bucket always outperformed each group in a pricier bucket. Whether the groups were passive or active was beside the point.

Of course, there are nonperformance reasons for preferring index funds, such as transparency, ease of selection, and less need for monitoring. Index funds also don't "blow up," as can the most extreme of active funds. (Although this danger can be avoided when investing in actively managed stock funds by buying only the cheapest offerings, which almost always are conservatively run.) There is no question that the practice of indexing confers many benefits.

But higher total returns are not among them, if the active fund dares to match the indexer's costs.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)