Energy: Opportunities Remain Following Saudi-Related Oil Volatility

Oilfield-services stocks look particularly attractive, trading at levels we haven't seen in some time.

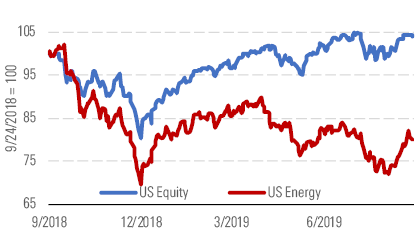

It was a comparably poor third quarter for energy stocks, with the sector falling 5% quarter to date as of Sept. 24. During that same period, oil prices fell by roughly 2%, continuing the recent trend of energy stocks underperforming oil prices. Historically, energy stocks and oil prices have moved in tandem.

Global Energy Index vs. Global Equity Index. - source: Morningstar

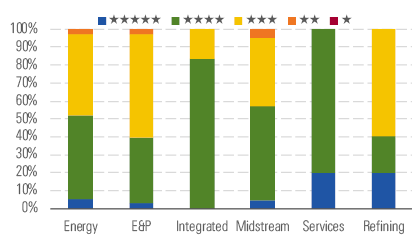

This had led to opportunities in the energy space even with oil prices slightly above our unchanged midcycle price of $55 per barrel (Exhibit 3). As of Sept. 24, 2019, the median price/fair value in our North American energy coverage was 0.83, making energy the cheapest sector by this measure. We see particular opportunity in oilfield-services stocks, which remain at valuation levels that we have not seen in some time.

Energy star rating distribution for sector and by key industry. - source: Morningstar

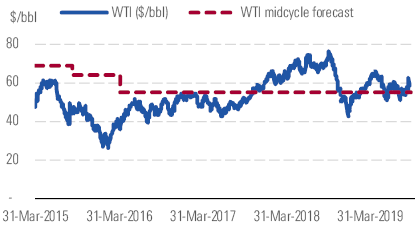

Our long-term oil price forecast is below current prices. - source: Morningstar

Although there hasn’t been much change in our long-term view of the energy space since the end of the last quarter, oil prices have gone for a wild ride in the interim period. The attack on Saudi Arabia’s Abqaiq oil facility has at least temporarily choked off 5.7 million barrels of oil per day of output, which corresponds to about 6% of global production. Oil prices rose more than 10% on the first trading day after the disruption but have since settled down as Saudi Arabia has pushed to get production back on line as soon as possible. We would urge investors to continue to focus on the long term, and not get too caught up in the near-term fluctuations that may come as more details on the Saudi situation come to light.

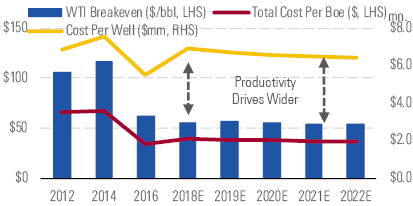

We see $55 as the fully loaded cost for the marginal barrel of oil that will balance global supply and demand in the long run. We expect this marginal barrel to come from a U.S. shale well. Shale wells today are much cheaper on a per barrel basis than the large, complex megaprojects that would have set prices in a world without U.S. shale. Over the long run, we think U.S. shale well cost inflation will remain subdued, owing greatly to the no-moat nature of many shale services, and that wider adoption of current technologies coupled with decades of attractive drilling opportunities will contain unit break-evens (Exhibit 4).

Oil break-evens to remain relatively flat. - source: Morningstar

Top Picks

Enbridge ENB Economic Moat: Wide Fair Value Estimate: $47 Fair Value Uncertainty: Medium We see 35% upside in wide-moat Enbridge's stock. We believe the market doesn't realize the full potential of the company's growth portfolio, which is highlighted by the Line 3 replacement project. Even though Line 3 continues to face opposition and delays, we expect the pipeline to be built. Additionally, safeguards remain in place in the unlikely scenario that the project is canceled. Enbridge can recoup the capital spent on the project plus a healthy return on capital through toll surcharges. We expect Enbridge to generate significant free cash flow and increase its dividend 10% in 2020 and 3% thereafter.

Enterprise Products Partners EPD Economic Moat: Wide Fair Value Estimate: $35.50 Fair Value Uncertainty: Low We don't think investors appreciate Enterprise's leading position as the exporter of incremental hydrocarbon, whether liquefied petroleum gas, oil, or ethane. We expect NGL production and exports to sharply exceed consensus U.S. NGL production estimates, which imply that the U.S. cannot supply enough ethane to meet the $150 billion-plus steam cracker expansion underway, and U.S. NGL exports will actually decline. Also, Enterprise Products Partners is well positioned for the master limited partnership investor base transition, as the industry shifts toward a total-return-based approach versus focusing solely on distribution growth.

Schlumberger SLB Economic Moat: Narrow Fair Value Estimate: $60 Fair Value Uncertainty: High Schlumberger remains our top oilfield-services pick. Schlumberger has the highest international share of revenue among peers, making it best positioned to take advantage of the coming capital expenditures rebound in international markets, which investors are neglecting. Also, we think the company is poised to gain market share and improve margins via its efficiency-boosting integrated project initiatives.

/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)