Technology: Sector Looks More Expensive Than at the Beginning of 2019

Opportunities now most common in software and online media.

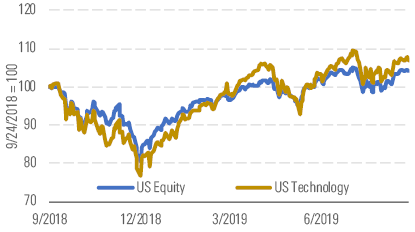

Despite trade-related choppiness, the Morningstar US Technology Index is up 28% year to date as of Sept. 24, outperforming the U.S. equity market, which rose 20% over the same interval (Exhibit 1).

Despite a strong Q1, tech had a volatile Q2 and Q3. - source: Morningstar

Technology stocks snapped back nicely in early 2019 with some optimism that the U.S. and China could reach trade agreements and avoid a full-blown trade war, which had caused the markets and the tech sector to fall in the fourth quarter of 2018. Such concerns mounted again in the second quarter, triggered by the U.S. ban on selling into Huawei, a significant smartphone and network equipment maker. Market sentiment improved in the third quarter, though, as Huawei didn't prove to be a tremendous headwind, all while optimism remains that a trade deal will come to pass. We continue to believe that a highly interwoven tech supply chain will still be quite difficult for the U.S. and China to unwind. In turn, our valuations assume a deal (and resumption of sales into Huawei) at some point.

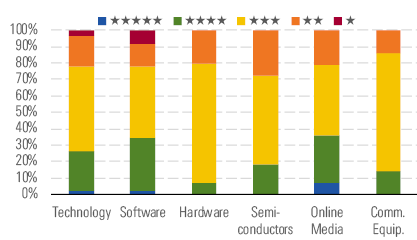

The median technology stock is 3% undervalued and inching closer to our fair value estimate today, rallying back after being 9% undervalued at the end of the second quarter. Roughly 26% of the sector carries a 4- or 5-star rating. Buying opportunities are more common in software and online media than elsewhere (Exhibit 2).

Online media is the most attractive subsector of tech. - source: Morningstar

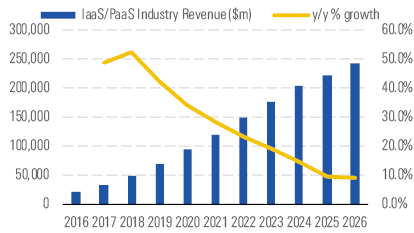

In our view, the single most important trend in technology remains the ongoing shift toward cloud computing, which we think is having ramifications on dozens of stocks across our coverage. Some undervalued names with favorable cloud computing exposure include Microsoft and Salesforce.com. In short, both startups and enterprises, in efforts to reduce the high fixed costs associated with running on-premises IT hardware and software, are shifting more workloads to infrastructure-as-a-service, or IaaS, vendors, such as Amazon's Web Services, Microsoft Azure, and Google (Exhibit 3).

Cloud computing remains a dominant secular trend in IT spending. - source: Morningstar

We anticipate that AWS will remain the market leader, while Microsoft continues to generate tremendous growth with Azure. Google Cloud and Alibaba's AliCloud should also carve out healthy positions in IaaS in the long run.

Top Picks

Intel INTC Economic Moat: Wide Fair Value Estimate: $65 Fair Value Uncertainty: Medium Wide-moat Intel trades at an attractive discount to our fair value estimate of $65 per share. The chip titan's comprehensive product portfolio tailored to computers from the data center to the edge gives us confidence in the firm's long-term growth prospects, despite a declining PC market. We applaud Intel's scattershot approach to address challenges in computing (artificial intelligence and cloud), connectivity (5G), and memory (3d NAND and 3D XPoint). Its acquisitions (Altera, Mobileye, Nervana, and Movidius) have unlocked new growth vectors for Intel to tackle while augmenting the capabilities of its old guard in client computing and data center.

Palo Alto Networks PANW Economic Moat: Narrow Fair Value Estimate: $305 Fair Value Uncertainty: High Narrow-moat Palo Alto Networks became the firewall market leader in 2018, and we expect its growth rate to outpace peers as it expands its portfolio in high-growth areas for cloud-based cybersecurity, analytics, and automation. Complexities associated with managing a multitude of products from various software and hardware vendors and a dearth of cybersecurity talent leads our view that firms and government entities are clamoring for consolidated security platforms. We believe that Palo Alto's security platform is at the leading edge and will remain in demand as customers prefer to add on to a Palo Alto subscription than manage another vendor.

VMware VMW Economic Moat: Narrow Fair Value Estimate: $194 Fair Value Uncertainty: High We believe that VMware's position as the commonality between public clouds, private clouds, and on-premises ecosystems gives it an enviable position. Coupled with VMware planting a flag that it'll be the way to deploy and use applications across any networking environment, we expect this software giant to repeat double-digit top-line growth. Shares have pulled back because of soft near-term sales, concerns about broader IT spending, and VMWare's recent large acquisitions. Yet this decline overlooks VMware's thoughtful strategic shifts into revenue streams that will keep it front and center of the larger trends of hybrid-clouds and containerized applications.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)