Our Ultimate Stock-Pickers' Top 10 Dividend-Yielding Stocks

We find several actionable ideas that yield more than the S&P 500.

While the vast majority of our Ultimate Stock-Pickers are not dividend investors, a handful of them--Amana Trust Income AMANX, Columbia Dividend Income LBSAX, Oakmark Equity & Income OAKBX, and Parnassus Equity Income PRBLX--focus more heavily on income-producing stocks in their pursuit of investment return. Warren Buffett at Berkshire Hathaway BRK.B has spoken highly of companies that return capital to shareholders and is not against investing in and holding higher-yielding names, with three of Berkshire's top five holdings--wide-moat rated Wells Fargo WFC, Bank of America BAC, and Coca-Cola KO--accounting for about one third of the insurer's equity portfolio and yielding more than the S&P 500.

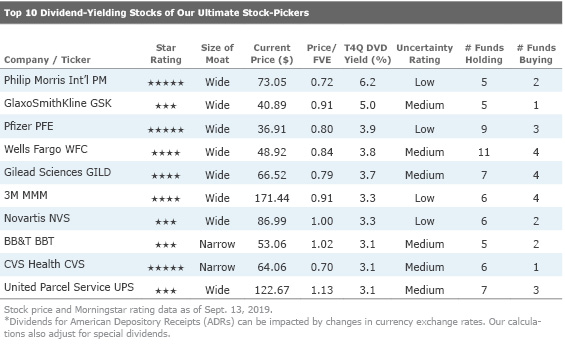

As you may recall from previous articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers, we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages, which, in our view, should allow them to generate the excess returns necessary to maintain their dividends over the long run. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are currently priced to yield more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

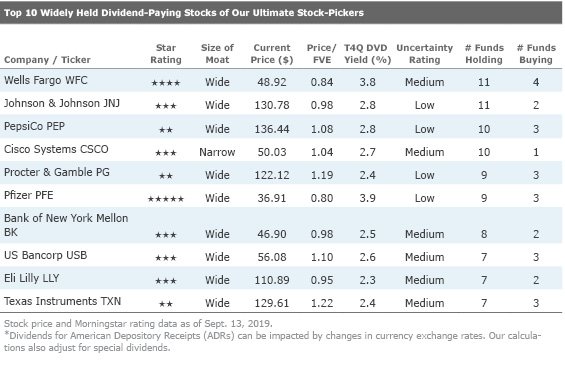

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and one that lists stocks that are widely held by our Ultimate Stock-Pickers and are priced to pay dividends in excess of the S&P 500, which is currently yielding just under 1.9%. We should note that the dividend yield calculations in each of these two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Given the lower levels of turnover at our top managers, and the characteristics of the stocks we are highlighting, there tends to be very little change in the list of top 10 dividend-yielding stocks from one period to another. During the second quarter, wide-moat rated GlaxoSmithKline GSK and 3M MMM, and narrow-moat rated BB&T BBT, replaced narrow-moat Kimberly-Clark KMB and wide-moat rated Unilever UN and PepsiCo PEP, with market movements into more defensive stocks driving the change in yields and positioning. In fact, most of the names on the top 10 dividend-yielding list moved either up or down on the list since last time around, but the number one dividend-yielding stock, Phillip Morris International PM, maintained its top positioning. Meanwhile, wide-moat Wells Fargo and Pfizer PFE moved up the list as another wide-moat rated stock, Gilead Sciences GILD, and two narrow-moat rated names, CVS Health CVS and United Parcel Service UPS, moved down. The list of top 10 widely held dividend-paying stocks also remained fairly consistent, with eight of the 10 widely held dividend-paying stocks on the list this time around also on our previous list. Wide-moat rated US Bancorp USB and Eli Lilly LLY were the two new names on the list, replacing wide-moat rated Comcast CMCSA, where a price increase decreased its yield below that of the S&P 500, and CVS Health, which was sold by Boston Partners All Cap Value Fund BPAIX during the period.

Top 10 Dividend-Yielding Stocks of Our Ultimate Stock-Pickers

The market has made a substantial recovery since the fourth quarter of 2018, though trade-related concerns remain. The S&P 500 Index closed at 2,351.10 on Dec. 24 and has subsequently rebounded to around 3,007.39 at the end of last week, representing an increase of about 28%. The price/earnings multiple of the S&P 500 is currently 22.4, higher than its long-term average. As a consequence of multiple expansion, several defensive sectors that have tended to be associated with higher-dividend yields—such as utilities, consumer defensive, and healthcare—have actually had lower yields due to investors pushing their stock prices higher. Searching for yield in this type of environment can be fraught with risks, including everything from price risk to the risk that a firm cannot meet its commitment to its dividend, which is why we tend to focus on stocks with low and medium uncertainty ratings, eliminating names with higher uncertainty ratings from our screening process.

Looking more closely at the list of top 10 dividend-yielding stocks, there are quite a few attractively priced quality names to consider. Six out of the top 10 dividend-yielding stocks are materially undervalued, including wide-moat rated Philip Morris International, Pfizer, Gilead Sciences, Wells Fargo, 3M, and narrow-moat rated CVS Health. The average price to fair value estimate for these top dividend-yielding stocks is 86%, reflective of about a 15% return to fair value in addition to the yield on the securities themselves. The list, itself, is overweight the healthcare sector, which contributed five of the top 10 dividend-yielding stocks, while the financial services and industrials sectors each contributed two names to the list.

Contrast this with the list of top 10 widely held dividend-paying stocks, which had a more balanced sector distribution, with three financial services stocks, three healthcare names, two consumer defensive stocks, and two technology names in the mix. The aggregate valuation gap was also far less for the list of top 10 widely held dividend-paying stocks, which had an average price/fair value of 99%, implying that shares are fairly valued. The most widely held stock that was also present on the top 10 dividend-yielding stocks list this period was wide-moat rated Wells Fargo, which is currently trading at around a 20% discount to our analyst's fair value estimate of $58 per share.

Top 10 Widely Held Dividend-Paying Stocks of Our Ultimate Stock-Pickers

Given the lower levels of turnover at our top managers, and the characteristics of the stocks we are highlighting, there tends to be very little change in the list of top 10 widely held dividend-paying stocks from one period to another. There also tends to be a fair amount of overlap with our list of top 10 dividend-yielding stocks, with wide-moat rated Wells Fargo, Pfizer, and PepsiCo, and narrow-moat rated CVS Health, appearing on both lists this time around. Continuing a recurring theme, the majority of names on our list of top 10 widely held securities are held by eight or more of our top managers.

Having covered many of the undervalued names on both of these lists in prior articles—with recent issues of our Ultimate Stock-Pickers concept providing more detailed analyses of wide-moat names like Wells Fargo and 3M—we would encourage investors to search out those pieces. In this particular edition of Ultimate Stock-Pickers, we are highlighting three undervalued and high dividend-yielding wide-moat stocks—Philip Morris, a cigarette manufacturer, and two large drug manufacturers, Pfizer and Gilead Sciences—that we feel long-term investors should be considering.

Philip Morris International PM

Wide-moat rated Philip Morris International has been our top dividend-paying stock for the last four issues of our dividend-focused editions of Ultimate Stock-Pickers. This stock is currently trading at almost a 30% discount to Morningstar analyst Philip Gorham's fair value estimate of $102, which implies a forward 2020 multiple of 18 times earnings per share and a dividend yield of 5%. As Philip Morris has received a lot of press recently after announcing that it is in talks to merge back with Altria (which had completely spun off its international tobacco operations during 2008), we thought it would be worthwhile to revisit the storyline for both firms.

Although the market did not appreciate this news, Gorham thinks that this potential deal makes a lot of strategic sense. For him, a major part of Philip Morris' story is the company's investment in reduced-risk products. Gorham is specifically positive about the company's development in heated tobacco products, as they most closely replicate the smoking experience and so should attract smokers looking for a less risky alternative. He believes that Philip Morris' premium multiple over peers is appropriate because the company has claimed a first-mover advantage, at least temporarily, through the early commercialization of its heated tobacco product, the iQOS. One big question about Philip Morris has been the regulation of the iQOS in the United States. The FDA has allowed Phillip Morris to market this product in the United States but crucially has not decided whether this product can be marketed as a modified risk product. As things currently stand, the iQOS will be regulated as a tobacco product in the U.S., which Gorham views as positive because strict regulations are likely to keep barriers to entry high.

Gorham sees the potential merger as a reversal of the decision to separate Philip Morris and Altria 11 years ago. In some ways, he thinks the strategic reasons laid out to separate the two firms are less pertinent now than they were previously, as the class action litigation risk Altria was trying to isolate within the U.S. entity has eased and value was arguably not created for shareholders by separating the international business. The advent of cigarette substitutes has driven the decline rate of cigarette volumes higher, from around 3% a decade ago to 5% now, which Gorham believes has prompted a space race among manufacturers to build portfolios of new products across multiple categories. Gorham also sees more regulatory risk these days, with more assertive regulators clamping down on the marketing of both cigarettes and emerging categories. While Gorham recognizes that higher risk and accelerating volume declines may explain investors' negative reaction to the re-merger talks, he thinks the market is not fully recognizing the positives from a merger.

In Gorham's view, this overlooks a number of key benefits of this deal. First, this merger would align the interests of the two parties around the distribution of the iQOS, Phillip Morris' heated tobacco product. Altria plans to test market iQOS in Atlanta next month, under license from Phillip Morris, and is likely to roll the product out in the U.S. more broadly next year. Under the current structure of the deal, Gorham expects the revenue to be entirely incremental to Philip Morris, while cannibalizing Altria's cigarette brands (which will be dilutive to that firm's profitability). Altria will also pay an undisclosed royalty to Phillip Morris on iQOS sales in the U.S. As these heated tobacco products are likely to lack the economies of scale of cigarettes for many years, Gorham estimates margins on the devices to be around 10% of the full retail price and breakeven at discounted prices. As such, under the existing corporate structure, Altria is not financially motivated to migrate its volumes from Marlboro to iQOS—something that would be solved if there were to be a merger between the two companies. Further, Gorham sees scale advantages coming from the potential merger of equals. In his view, scale is important in cigarette manufacturing due to the historical inverse correlation between scale and the average cost of sales and postures that large manufacturers have a cost advantage over smaller ones. Gorham regards these cost synergies as an added bonus rather than a key driver of this deal, anticipating that about 2% of combined entity operating costs last year could be easily trimmed. That said, he also thinks that total cost savings are likely to go much higher, as there will be scale advantages in tobacco leaf procurement and additional cost savings if Phillip Morris imposes its zero-based budgeting strategy on the U.S. operations.

Pfizer PFE

Wide-moat Pfizer, which is rated 5-stars with a low uncertainty rating, caught our attention on the list of top 10 dividend-paying stocks this time around. Morningstar analyst Damien Conover maintains that Pfizer's shares are undervalued and expects that economies of scale, patents, and a powerful distribution network should allow the company to earn an economic profit for years to come. In his view, Pfizer's size establishes one of the largest economies of scale in the pharmaceutical industry. In a business where drug development needs a lot of shots on goal to be successful, Conover thinks that Pfizer has the financial resources and the established research power to support the development of more new drugs. He is currently positive about the state of Pfizer's drug pipeline, which, after many years of struggling to bring out important new drugs, is now on pace to launch several potential blockbusters in cancer, heart disease, and immunology.

Conover asserts that patents give the company time to develop the next generation of drugs before generic competition arises. While Pfizer holds a diversified product portfolio, Conover sees some product concentration, with the company’s largest product Prevnar, a vaccine used to prevent infection caused by pneumococcal bacteria, representing just over 10% of total sales. That said, he does not expect typical generic competition for the vaccine due to complex manufacturing and relatively low prices for the product. Further, Conover anticipates that new products will mitigate the eventual generic competition of other key drugs in Pfizer's portfolio. In addition, he thinks that the company's powerful distribution network sets up the firm as a strong partner for smaller drug companies that lack Pfizer's resources. Pfizer's entrenched consumer and vaccine franchises, in his view, create an added layer of competitive advantage, stemming from brand power in consumer healthcare and manufacturing cost advantages in the vaccines division.

Recently, Pfizer divested its off-patent business, Upjohn, to Mylan, a large generic drug developer. Conover thinks this will strengthen Pfizer's competitive positioning and wide moat, having exited a business that carries drugs with low pricing power in order to focus on innovative core drugs. Conover expects that divesting Upjohn (close to 20% of total sales) should enable Pfizer to accelerate its growth rate. With the majority of the Upjohn drugs facing increasing generic competition, Conover had expected this group to post 5% average annual declines over the next five years. After the divestiture, Conover anticipates that Pfizer's remaining innovative business line should be able to generate a five-year compound annual growth rate of close to 5%, up almost 200 basis points from the combined entity's growth outlook. Additionally, Pfizer should net close to $12 billion in cash from the divestiture, which Conover expects to go to debt repayment, setting up a stronger balance sheet that should allow Pfizer to make additional acquisitions to further drive growth in innovative new drugs.

Gilead Sciences GILD

Wide-moat Gilead Sciences has remained on the top 10 dividend-paying stocks for the past several dividend-themed editions of Ultimate Stock-Pickers. The shares are currently trading at a 23% discount to our analyst's fair value estimate of $84 per share. The company produces therapies for various life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C, although the company has expanded its focus to include pulmonary and cardiovascular diseases and cancer. Morningstar analyst Karen Andersen appreciates the company's stellar profit margins with its HIV and HCV portfolio, as therapies for these diseases require a comparatively small salesforce and inexpensive manufacturing. Andersen expects that patent protection on Gilead's newer HIV regimens and Gilead's continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades.

In her view, Gilead's moat was formed by its leadership position in the treatment of HIV, with patented products that form the backbone of today's treatment regimens. Andersen notes that despite numerous competitors, the company has established leading market share, serving 80% of treated HIV patients in the United States, and spectacular profitability with its convenient, effective, and safe treatments. Although key patents are beginning to expire in Europe, and next-generation products could struggle to provide sufficient differentiation for reimbursement in all key markets, which puts pressure on the HIV franchise beginning in 2021, she is confident that the firm will be able to continue earning an economic profit. Andersen's confidence comes from the fact that the firm has shown that it can translate its extensive understanding of the drug discovery and development process in HIV into new therapeutic areas. She notes that despite initial criticism of the high price that Gilead paid for Pharmasset in early 2012, the $11 billion acquisition gave Gilead the most valuable hepatitis C drug in the industry and also demonstrated the firm's ability to recognize the potentially unique nature of Sovaldi's safety and efficacy profile compared with other, toxic nucleotide analogs. Andersen thinks the firm's experience with another nucleotide analog, tenofovir, a key ingredient in all of Gilead's HIV combination regimens, probably contributed to its recognition of Sovaldi's value at an early stage in its development.

Given the political environment, medical reform has been an issue that weighs on investors’ minds. Andersen recognizes that Gilead has exposure to potential drug pricing reform in the U.S. and thinks the firm is particularly exposed to reform in Medicare Part D, which she estimates to be 28% of sales. However, Andersen argues that Gilead does not rely on large price increases for sales growth, so the inflation cap could have minimal impact, although she acknowledges that greater catastrophic phase coverage responsibilities could weigh on the firm.

If you're interested in receiving e-mail alerts about upcoming articles from the Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Burkett Huey has an ownership interest in Berkshire Hathaway. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)