7 Upgrades Highlight July Ratings Changes

Morningstar analysts rated 149 strategies in July.

Morningstar rated 149 strategies overall in July. Five of those strategies are new to coverage, including three SMAs.

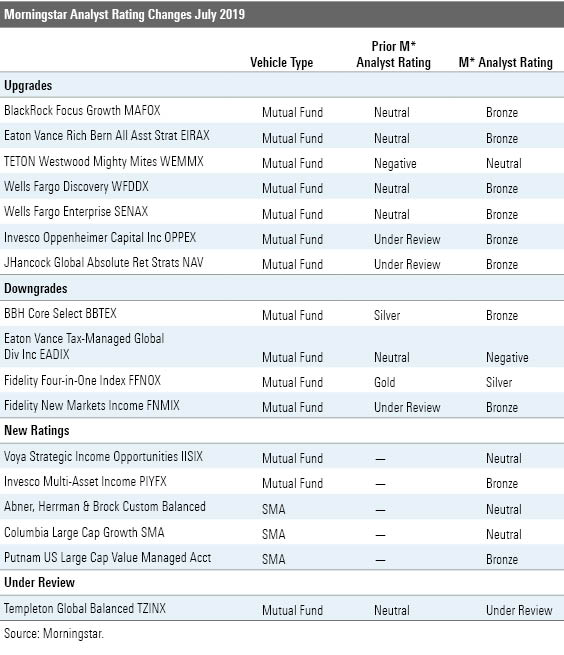

Amid the updates, manager research analysts affirmed the Morningstar Analyst Ratings of 132 strategies, upgraded seven strategies, and downgraded four. Analysts also placed one fund under review. A select group of ratings are showcased below followed by the full list of ratings for the month.

Upgrades Wells Fargo Enterprise SENAX has overcome the 2016 loss of its longtime lead manager as increased conviction in the fund's current team earned it an upgrade to Bronze from Neutral. Michael Smith and Chris Warner now guide this strategy. Smith and Warner joined as comanagers in 2011 and 2012, respectively, and assumed additional management responsibilities when veteran skipper Tom Pence stepped down in 2016. Smith and Warner follow their predecessor's rigorous and disciplined approach. It focuses on identifying mid-cap U.S. stocks that have the potential to benefit from disruptive change and can increase revenue, earnings, or cash flow faster than market expectations. The strategy has not missed a beat under the comanagers' watch, and the duo has proved it can carry out this fund's established process successfully.

BlackRock Focus Growth MAFOX improved to Bronze from Neutral following a fee cut that dropped its previously high expense ratio to below average relative to similarly sold funds. The cut lowers the hurdle rate for an accomplished manager. Lawrence Kemp and his U.S. growth team have proved adaptable since taking over on Jan. 1, 2013. The team applies a bottom-up, research-focused approach to assemble a portfolio of 40-50 stocks. While it boasts a relatively compact portfolio, the team diversifies across three types of businesses: superior, durable, and periodic growers. In other words, they look for dominant (often pricey) market-share takers, sustainable growers trading in temporary lulls, and more economically sensitive companies. Its strong bench, disciplined process, and more compelling price tag make the strategy a Morningstar Medalist.

Downgrades BBH Core Select BBTEX dropped to Bronze from Silver because of its shrinking asset base and our decreased confidence in its ability to outperform over the long haul. This fund has taken investors on a rollercoaster ride over the past decade. For several years after the current management team took over in 2005, it was a standout performer, with returns that ranked in the top 1% of the large-blend Morningstar Category from Nov. 1, 2005, through the end of 2012. The fund has had a much tougher time since, trailing the large-blend category and its S&P 500 benchmark each year from 2013 through 2018. This long stretch of underperformance has taken a toll on the fund's asset base, which had shrunk to $2.2 billion by mid-2018, down from more than $6 billion in 2013. By the end of 2018, the fund's asset base fell below $800 million, forcing the team to sell several positions to raise cash and meet redemptions, which resulted in a huge capital gains distribution. Outflows slowed considerably in the first half of 2019, but uncertainty remains.

Eaton Vance Tax-Managed Global Dividend Income EADIX fell to Negative from Neutral on the back of unfavorable structural changes to the fund’s process. The portfolio was previously broken into three sleeves: core equity, dividend capture, and preferred stock and bonds. Since Chris Dyer took charge in September 2015, however, the nonequity component has shrunk, with Dyer and comanager Mike Allison doubling down on a dubious dividend-capture tack. In this sleeve, the managers buy high-yielding foreign stocks that pay annual dividends in the first half of the year and hold them just long enough to receive tax-advantaged income. The approach generates high portfolio turnover and large portfolio allocation swings. It does not bode well for investors.

New Ratings Voya Strategic Income Opportunities' IISIX unconstrained mandate lets it express unique views within a broad opportunity set. However, it will take a longer record to judge whether this flexibility is a boon or a bust. The strategy receives a Neutral rating. Matt Toms has been a member of this fund's portfolio management roster since its 2012 inception, and the firm's fixed-income CIO since mid-2016. In late 2017, Sean Banai and Brian Timberlake joined Toms. Banai and Timberlake lead the multisector and quantitative groups at the firm, respectively. In its early months, the fund was run as a multisector strategy, but by mid-2013 the firm wanted an investment menu that was less hemmed in by traditional expectations. The strategy adopted a cash bogy, a duration range of negative two to six years, and more flexibility to hold whatever fixed-income sectors or esoteric fare offer a relative-value opportunity. The fund has yet to endure a full market cycle, and the team still needs to prove that it can use its flexible mandate to clients' benefit.

Invesco Multi-Asset Income PIYFX boasts a strong, long-tenured management team and an attractive price tag, supporting a Bronze rating. Led by CIO of global asset allocation Scott Wolle, the strategy features a nine-person investment team with decades of experience and an average firm tenure of 14 years. The managers have run this strategy since late 2011. Management seeks to deliver a yield of 2%-3%, currently above that of the 10-year U.S. Treasury, while keeping capital preservation and total returns in mind. It invests in higher-yielding assets such as high-yield bonds, emerging-markets debt, and preferred equities and uses government debt to adjust the overall beta and duration of the portfolio. Management adds a tactical overlay through systematic positions on equity and bond index futures that are applied to all of Invesco's global asset-allocation strategies. These tilts have added value over time. Finally, fees are competitive across the board.

/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)