Time to Revisit Your Home Country Bias

Foreign equities are currently trading near their largest discounts to U.S. stocks seen over the past 15 years.

A version of this article first appeared in the May 2019 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Most U.S. investors’ stock portfolios aren’t global enough. Using total mutual fund assets as a proxy, the typical investor’s equity sleeve has about a 75%/25% split between U.S. and foreign equities. Most professional asset allocators would recommend a greater international weighting; the average target-date fund has about 35% of its stock sleeve overseas, and replicating the global market cap would suggest upping the foreign stake to roughly 45%. Keeping a globally diverse stock portfolio should improve diversification without sacrificing return over the long haul.

If you have maintained a U.S. bias over the past five years, congratulations. U.S. stocks have trounced their foreign counterparts during that period, with the S&P 500 gaining nearly 10% annually versus less than 2% for both the MSCI Emerging Markets and MSCI EAFE indexes. However, if you’re looking for a chance to reduce your home country bias, history suggests that now is a reasonable time to do so.

According to a multitude of valuation metrics, international stocks are currently hovering near their highest discounts seen versus U.S. stocks during the past 15 years. As of May 2019, the trailing 12-month price/earnings ratio of the S&P 500 stood at 18.9, versus 14.6 for the MSCI EAFE Index and 12.1 for the MSCI Emerging Markets Index. Those are whopping 23% and 36% discounts. The chart below shows how these discounts have varied over the past 15 years. Although both markets have typically traded below U.S. stocks, when their discounts have reached current levels, it normally hasn’t persisted. And in rare instances, both markets have even traded in line with the U.S.

Of course, valuations can take a long time to revert, and other factors, such as expected growth rates and political developments, can explain differences in valuations across markets. Still, many studies have shown that valuations have predictive power of returns over longer horizons, so investors considering upping their foreign stake should keep a long-term view.

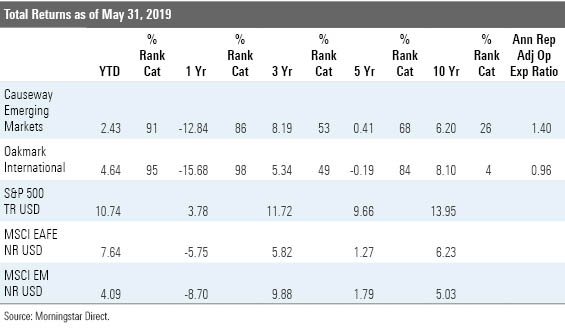

Here are a couple ways to gain access to these potentially attractive markets. Both funds shown below come recommended by Morningstar analysts yet have placed in the bottom decile of their respective peer groups so far this year, potentially increasing the opportunity for additional mean reversion within these underperforming asset classes.

Causeway Emerging Markets CEMVX

Morningstar Analyst Rating: Bronze

Morningstar Rating: 3 stars

This Bronze-rated fund attempts to outperform the MSCI Emerging Markets Index by combining bottom-up and top-down factors into a quantitative model. Approximately 75% of the model’s weighting is allocated to stock-specific factors, and the remaining 25% incorporates top-down elements because macroeconomic issues can often overwhelm bottom-up factors in emerging markets. The portfolio typically sports a value bias, as the model shuns excessive valuations. In addition, Causeway's well-regarded fundamental team helps spot risks that quant models may overlook, such as political or off-balance-sheet risks.

Arjun Jayaraman and MacDuff Kuhnert have capably guided this strategy since its 2007 inception, and Joe Gubler joined as a comanager in 2014. This team has built a strong record here and at Causeway International Small Cap CVISX, Causeway Global Absolute Return CGAVX, and Causeway International Opportunities CIOVX. That said, this fund isn’t for the faint of heart; it’s calendar-year returns have ranged from negative 18% to 39% over the past five calendar years, and it’s typically more volatile than the average emerging-markets competitor.

Oakmark International OAKIX

Morningstar Analyst Rating: Gold

Morningstar Rating: 3 stars

This fund reopened to new investors in December 2018 in the wake of outflows and dismal performance. The strategy is still the largest actively managed fund in the foreign large-blend Morningstar Category, so we’re closely monitoring capacity, but it remains a fine pick for now with a Gold rating. The fund's high-conviction, value-oriented manager has proved himself through multiple market cycles and is backed by a deep team. David Herro is one of the most tenured and decorated non-U.S. stock-pickers working, but he hasn't been a one-man show for a while. Eight analysts and managers who are steeped in subadvisor Harris Associates' absolute value style support him.

That seasoning is key for implementing the fund's contrarian, long-term-focused approach. This fund buys stocks at steep discounts to the team's estimates of underlying business values. This often involves investing in the midst of fearsome news or macroeconomic events, such as buying Japanese shares after 2011's catastrophic earthquake and tsunami or buying U.K. stocks after the 2016 Brexit vote. The result is a portfolio that pays little heed to index or average peer group allocations, and that can often look out of step with peers and benchmarks. Patience has paid off here in the past, though.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)