Don't Bash Bonds

The value of fixed income depends on the vantage point.

In the years since the global financial crisis, fixed-income investing has been much maligned. Pundits have asserted that bonds are “return-free risks,” that “the 30-year bond bull market is over,” and that interest rates, the kryptonite for bonds, have nowhere to go but up. Meanwhile, turbocharged equity-market returns may have left less-experienced investors wondering why they would ever own anything other than stocks in a portfolio.

Morningstar’s family of multi-asset indexes illustrates the point. The five indexes, whose asset allocations are determined by Morningstar Investment Management, are diversified across asset class—stocks, bonds, commodities, and real estate—and offer a range of exposure across the risk spectrum. (These indexes serve as the benchmarks for Morningstar’s allocation fund categories.) Their 10-year returns through 2018 tell the story of a bull market for stocks (Exhibit 1).

Even after a tough fourth quarter for stocks at the end of last year, the Morningstar Aggressive Target Risk Index, with 95% in equities, returned an annualized 10.6%. Its counterpart, the Morningstar Conservative Target Risk Index, with only 20% in equities, returned 4.4%. The Morningstar Moderate Target Risk Index, with a traditional balanced fund allocation of 60% to equities, returned 8.0%.

Of course, as any advisor will point out, you don’t include bonds in a portfolio to maximize long-term total return. You do so to provide income, diversify equity market risk, dampen volatility, and even preserve capital—an especially useful function for those who have moved from the accumulation to decumulation stage of life.

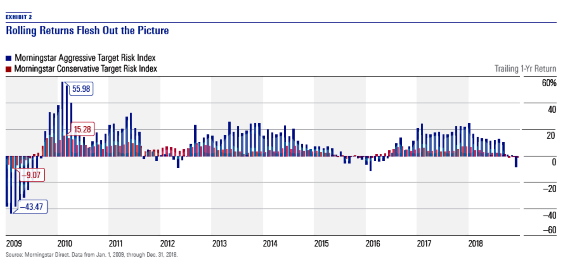

Rolling Ups and Downs Investors might better appreciate the value of fixed income in a portfolio with the help of rolling returns analysis, which provides a fuller picture of the range of possible outcomes. There were 120 12-month periods in the 10 years through the end of 2018 (i.e., from January to January, February to February, and so on). Compare the stock-heavy Aggressive index to its bond-heavy cousin. The Aggressive index posted positive returns in 78% of the 12-month rolling periods over the past 10 years, while losing money in 22%. The Conservative index, for its part, produced positive returns in 87% of the periods.

But it’s the magnitude of losses that really separates the two indexes (Exhibit 2). Only during the worst of the 2008–09 bear market did the Conservative index lose more than 5% over the course of 12 months. The Aggressive index, on the other hand, lost more than 5% in several 12-month periods including the 2011 taper tantrum, the shaky markets of 2014–15, and in calendar year 2018, when interest-rate hikes hurt stocks more than bonds.

For the Conservative index, bonds served their purpose during those difficult times, cushioning the blow of plummeting equities. Since mid- 2009, the Conservative index has not lost more than 2% over any 12-month period. The benefit of bonds is clear for the parent of a college-bound high schooler, an aspiring homebuyer, a wedding saver, or a retiree.

Even long-term investors might have been better off holding less-aggressive asset allocations over that period, however, if risk factored into their decision-making. As Exhibit 1 shows, the Aggressive Target Risk Index had a much higher standard deviation than its conservative counterpart. Granted, volatility is part and parcel of investing in stocks. Investors expect to be compensated for that if they can hang on tight. For example, even after steep losses in 2009, the Aggressive index was up nearly 56% for the 12 months through February 2010.

Overall, however, equity returns may not have been commensurate for the risk over the decade ending in 2018. When evaluated on risk-adjusted returns, whether by Sharpe or Sortino ratio (which, like the Morningstar Rating for Funds, focuses on downside risk), the rank order of the five indexes switches: As seen in Exhibit 1, the Aggressive index comes out worst, and the Conservative index ranks best.

Lost Decade The vastly superior performance of the Aggressive index over the decade may settle the case for investors in it for the long haul. But even investors who can white-knuckle through the rough spots aren't always going to get a worthy payoff. The final column of Exhibit 1 shows how each index fared during the stock market's so-called "lost decade," from 1999 to 2009.

With an annualized return of 2.1%, the Aggressive index was more or less on track with inflation. That’s not even close to the kind of return that equity investors expect over the long term. Investors who chose a middle ground fared far better than equity-heavy investors, as evidenced by the 3.9% return of the Moderate index. Meanwhile, the Conservative index returned a not-too-shabby 5.2%.

That atypical time period isn’t an argument against tilting toward stocks for the long term in most cases—even if talk of another lost decade ahead is coming from some corners today. But it is a reminder that in choppier market conditions, bonds allow for a smoother ride. When stocks fall, risk-conscious investors will appreciate owning a diversified mix of assets that zig and zag in different directions.

In the words of Eric Jacobson, a senior Morningstar manager research analyst focusing on fixed income, “The bond market has arguably been a lot calmer than the pundits.” U.S. Treasury yields have not spiked out of control; the municipal market hasn’t collapsed; and the eurozone crisis has been contained—at least so far. Bonds have continued to serve their time-honored functions of providing income, diversifying equity market risk, and serving as portfolio ballast, dampening volatility for investors.

Future of Fixed Income That said, the landscape for fixed-income investing looks very different now than it did before the financial crisis. Massive stimulus has greatly increased the supply of developed-market government debt on the market. Investor capital has flown from traditional actively managed fixed- income strategies to index trackers, albeit to a lesser extent than on the equity side. The traditional providers of bond market indexes, the investment banks, have a diminished role compared with the pre-2008 world.

Against that backdrop, Morningstar is refreshing its fixed-income index family of more than 100 bond indexes. The changes, which will be introduced in the second quarter, run the gamut from adjusting methodologies to broadening the sectors and markets included in composite benchmarks and provided as subindexes.

One of the most important guiding principles is striking the right balance between completeness and investability. Another is making those features understandable and accessible to users across the spectrum of institutions, advisors, and investors: Portfolio information such as sector and individual holdings data will be available across a variety of Morningstar outlets.

Note: The target risk indexes discussed in this article will have a name change later in 2019. The Morningstar Aggressive Target Risk Index will be rebranded as the Morningstar US Aggressive Allocation Index, and so forth. This shift is part of the expansion of the current Morningstar Target Risk Family of Indexes into Australia, Canada, Europe, Japan, and the United Kingdom. The new index family will be referred to as the Morningstar Global Allocation Index Family and will follow a consistent methodology across regions.

This article originally appeared in the Summer 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)