Does Your Mutual Fund Own Uber?

Mutual funds' most widely held private company will soon go public.

Uber's stock will start trading on May 10, 2019, the latest in a spate of high-profile initial public offerings. It will go public a decade after its founding, having raised more than $20 billion in the private market, according to PitchBook, including from some well-known mutual funds.

Prominent startups have had no trouble raising cash in recent years, which delayed IPOs and prompted some mutual funds to invest as their market caps grew. Morningstar's 2016 report revealed that ride-sharing firm Uber was the most popular choice, with 52 funds owning it at the time. Uber's terms meant managers weren't allowed to simultaneously invest for a period of time in its U.S. competitor Lyft, leading to just two funds investing in Lyft as of 2016. (Fidelity eventually invested in Lyft in 2017 and was that company's most prominent pre-IPO mutual fund backer.)

In 2017, corporate culture clashes and legal challenges led to the ouster of Uber's founder Travis Kalanick as CEO. Dara Khosrowshahi, formerly of Expedia, took the reins with the goal of repairing the firm's issues in anticipation of an IPO, which now follows on the heels of Lyft's March debut.

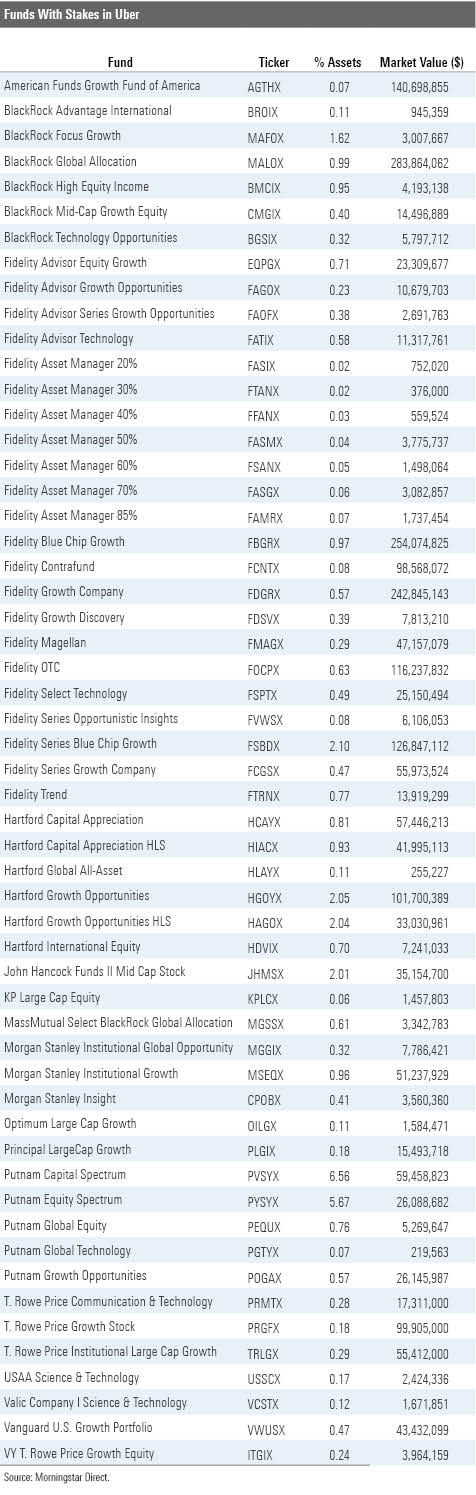

Most mutual funds don't have much on the line with Uber's IPO. The majority held positions under 0.50% of portfolio assets, as of the latest disclosure, and only seven had stakes of over 1%. (See the table below.)

David Glancy's Putnam Capital Spectrum PVSYX and Putnam Equity Spectrum PYSYX are exceptions. Uber consumed roughly 7% of Putnam Capital Spectrum's assets recently. Putnam Capital Spectrum first bought shares in 2015 and built a position under 1% at the time. But the fund's asset base is a fraction of the size it was then, dwindling from $10.7 billion to $810 million as outflows inflated the Uber stake even after accounting for valuation markups. Putnam Equity Spectrum has walked a similar path, with its Uber stake now at nearly 6% of assets. Glancy's charges showcase the risks of investing in largely illiquid companies in a mutual fund vehicle that can face daily redemptions.

Pitchbook expects Uber to go public at $44-$50 per share, within the range of where most funds recently valued it and above where some Fidelity and BlackRock funds initially purchased it in 2014. Lockup periods are common, though, so fund managers won't necessarily be able to sell on the IPO.

The bigger question is how Uber will fare in the public market. It's losing billions of dollars a year as it heavily subsidizes its rides and tries to maintain its market share advantage in the United States, at which Lyft has chipped away. It's also faced regulatory concerns in certain jurisdictions and lawsuits from drivers. The company's long-term growth ambitions may extend beyond its traditional transport and Uber Eats delivery service, but it's still a ways from profitability. And Lyft's public market debut hasn't inspired confidence, with the stock down more than 20% since its late-March listing.

Time will tell what these early-to-Uber fund managers decide to do with their stakes, and whether others jump on board once it's public.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)