What Investors Can Do as Brexit Remains a Question Mark

With the range of outcomes from Brexit remaining broad, stay focused on the big picture.

Download the special report, Brexit: A Morningstar View, to read our key insights about Brexit’s impact on investors globally.

A version of this article appeared on Morningstar.co.uk.

The House of Commons is due to vote on the Brexit deal U.K. Prime Minister Theresa May had negotiated with European Union on Tuesday. This previous planned vote was pulled at the last minute in December after it became clear the deal did not have the needed support.

The proposed deal leaves the UK in close allegiance with the EU until at least 2020, during which time the UK would no longer be a member of the Union but be subject to many of the rules and regulations. The transition period buys politicians time to negotiate a final deal and avoids a cliff-edge Brexit, but critics argue the U.K. would be surrendering control to the EU.

The outcome of the vote remains uncertain with both main political parties split on the best Brexit outcome. But the U.K. is due to leave the European Union on Friday March 29, 2019 – regardless of whether a deal has been struck with the remaining 27 member states. There are broadly five options on the table: four Brexit scenarios as modelled by the Bank of England earlier this month and a fifth option – to stay in the EU as a result of a second public referendum.

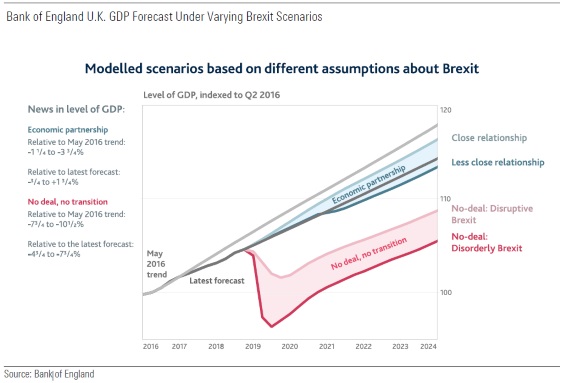

Forecasts Vary Widely The Bank of England has mapped four likely scenarios for the outcome of Brexit; a deal which leaves the U.K. in a close relationship with the European Union, a deal resulting in a less close relationship between the two, a no-deal Brexit with disruptive outcomes, and the fourth most damaging to the economy – a no-deal disorderly Brexit. We would add a fifth scenario to this modelling, a second referendum resulting in a Remain vote. We assign a 30% probability of a worst case, disorderly, no-deal Brexit.

Opinion is divided as to which is the most likely of these scenarios. Bank of England Governor Mark Carney has stated that the worst-case scenario, a “no deal disorderly” Brexit is not the most likely outcome; this scenario forecasts a 33% fall in house prices, a collapse in sterling to below parity with the dollar, a hike in interest rates to 5.5%, and a nearly doubling in the unemployment rate to 7.5%.

The best-case Bank of England scenario of a close-relationship “soft” Brexit also seems unlikely, due to the time constraints.

While many Remainers both public and political are in favour of a ‘People’s Vote’, a second referendum may not be logistically feasible. It requires an Act of Parliament with the backing of the majority of MPs – a cross party initiative which could result in further resignations leaving both main political parties weakened. Neither party wishes to do this with a General Election in the offing.

The Electoral Commission also requires six months between announcing a referendum and the vote itself, taking us past the Brexit deadline of March 29 as triggered by Article 50. An extension to this deadline is possible but it requires approval by all 28 EU member states.

The odds currently imply a 40-50% probability that an agreement not will be reached by the March 29 deadline – meaning there will either be a no-deal hard Brexit or an extension of Article 50 or a withdrawal of Article 50.

Morningstar assigns a 30% probability of a disorderly exit from the EU without a deal, a conservative estimate given “no-deal” is in no one’s interest, including the EU and even the hardest Brexiteers.

What Should You Do? "Brexit is difficult to analyse because of the indirect and tenuous connections it has on investment fundamentals," says Morningstar Investment Management's Dan Kemp.

"We therefore believe that when investors depart from long-term, fundamentally sound investment analysis, they can drift dangerously into speculation. The first thing to acknowledge about the fundamentals is that the U.K. economy is not the U.K. equity market. We do not need to predict the U.K. economy to know what might happen to U.K. stocks. The U.K. is unloved, reasonably cheap, and fundamentally healthy."

Given that political circumstances are so difficult to predict, Kemp recommends putting them to one side and focusing on valuation instead. And remember, investment is not about what happens in the next few days, weeks or even months, but over the next years and decades.

However, volatility can be your friend by offering quality assets at cheaper prices than previously available. U.K. assets appear in the main to be undervalued, especially compared to other developed market equities. We find U.K. equities to be somewhere between 30% to 45% cheaper than the U.S. market on a combination of valuation metrics.

Asset quality in the U.K. has a long history of durability, and Kemp says his team sees no evidence of change. He concludes: "Leverage is under control and below pre-crisis levels. Plus, it is one of the least crowded trades in the marketplace."

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)