Stock Market Outlook: Global Equities Are Starting to Look Attractive

Energy, particularly midstream and refining, is the most attractive sector. Technology has also become compelling.

Amid political turmoil around the world, the Morningstar Global Markets Index dropped 14% in the fourth quarter to Dec. 20, leaving the broad measure 10% below where it had started 2018.

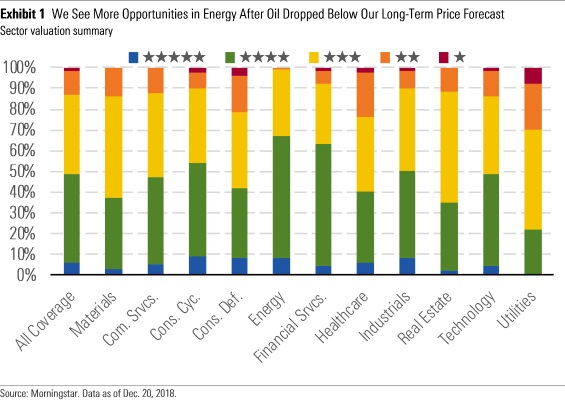

From a bottom-up perspective, global equities are beginning to look attractive. The median stock across our 1,500-plus coverage trades at a 14% discount to our estimate of fair value. Entering the fourth quarter, we had pegged the typical stock as fairly valued. Not surprisingly, we also see more strong buying opportunities, with 6% of our coverage trading at 5 stars, up from 2% a few months ago.

- Following a plunge in oil prices, the energy sector now ranks among the most attractive. But because U.S. shale production is likely to limit the long-term upside to oil prices, we think investors are more likely to find value in the less-price-sensitive areas of the sector, namely midstream and refining.

- Technology is another area where a sharp drop in shares has rendered a once-overpriced sector more palatable. Here, we think semiconductor stocks are the best bet. While the near-term outlook is weak after a couple years of tremendous growth, secularly growing demand for processing power, connectivity, and sensing capabilities in a wide variety of devices bodes well for the long term

Sector Outlooks

Basic Materials: Fewer Buying Opportunities Than in Most Sectors Communication Services: Attractive, Sustainable Yields on Offer Consumer Cyclical: Firms That Blur the Lines of Digital and Physical Are Set to Excel Consumer Defensive: Meaningful Opportunity in Tobacco Energy: A Drop in Oil Prices Has Made Energy Stocks More Attractive Financial Services: Value in Banking and Asset Management Firms Healthcare: Specter of ACA Repeal Hangs Over Fairly Valued Sector Industrials: Trade Tensions Lead to Attractive Valuations Real Estate: Only a Few Opportunities in Fairly-Valued Sector Technology: Semiconductor, Software Firms On Sale Utilities: Investors Once Again Treating U.S. Utilities as a Safe Haven

/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)