High Earners Juggle Retirement, College Funding

Their 401(k) assets crossed the $1 million mark, but could they be doing more?

This article is part of Portfolio Makeover Week.

Matt and Emma have accomplished much in their adult lives thus far.

The pair, both 40, met and built their careers at the same large technology firm: Emma is a software developer and Matt is a project manager. Their careers are rewarding, both intellectually and financially; Emma earns $170,000 and Matt $120,000. They have two children, a son, 15, and a 10-year-old daughter. The family loves to travel, and sporting events--especially college basketball--are a shared passion.

But like many in their age range, they're juggling multiple financial priorities. They've amassed a portfolio of more than $1 million in their 401(k)s, and they're also saving for college using 529 plans for each of their children. The day-to-day outlays also add up: They live in an expensive part of the country with pricey housing, and they're also sending their children to private schools. Both their mortgage and ongoing tuition payments are hefty, meaning that carving out the funds for additional savings is a challenge.

Now that their portfolio has gained critical mass, the couple said they'd like another set of eyes on their investment choices.

"We don't have a financial advisor," Matt wrote. "And anything we have done and set up has been through our own research. By no means are we an expert in anything."

The pair also wonders if they should be doing more on the retirement savings front.

"Our main concern is having most of our retirement assets in the 401(k)," Matt wrote. He went on to note that as their salaries have ramped up, income limitations have shut the couple out of direct Roth IRA contributions.

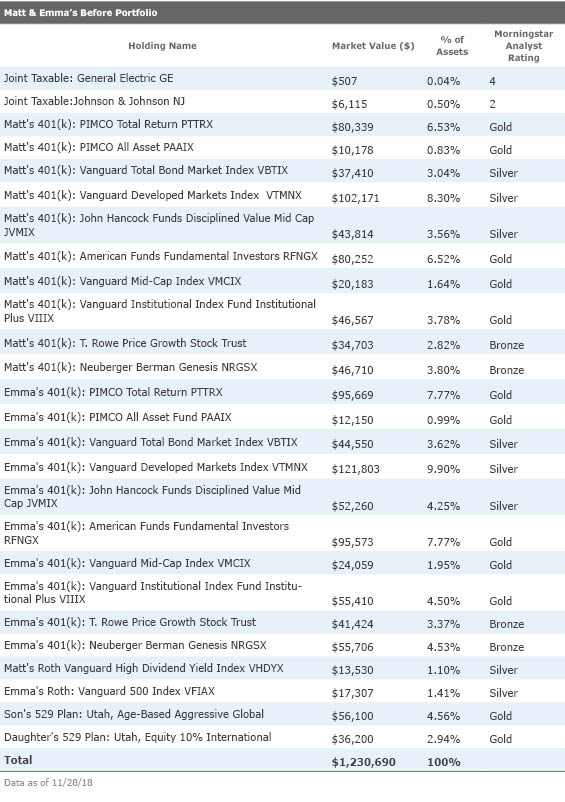

Asset Allocation -- Before

Matt and Emma's 401(k) plan, which holds the bulk of their assets, is first-rate. It features more than 20 fund choices, including topflight core funds and solid diversifying options. All of the options in their plan receive Medalist ratings from Morningstar's team. Their plan is also extremely low cost: Administrative expenses are low, and the individual-fund options are generally inexpensive institutional share classes. For example,

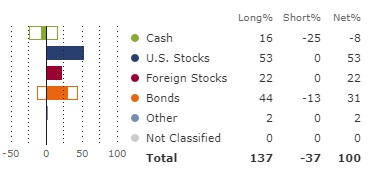

Their total portfolio's asset allocation is reasonable given their ages: They hold roughly 75% of their assets in stocks and are well diversified geographically: U.S. equities represent about two thirds of their equity portfolio and foreign stocks make up the remainder. While their portfolio is fairly diversified across styles and sectors, nearly 30% of their equity assets land in the large-growth square of the style box. (A 23% weighting would be "neutral" relative to the total U.S. market capitalization.)

They hold a mix of active and index products from a variety of investment providers: While

Their holdings outside their 401(k) plans are a fairly small piece of the pie. Their taxable brokerage account holds two stocks,

Finally, Matt and Emma have set up 529 plans for their children, both in the Gold-rated Utah my529 plan. Their 15-year-old's college fund is in the Age-Based "Aggressive Global" option, which features roughly 50% of assets in stock. The 10-year-old daughter's assets, meanwhile, is invested in an equity-only asset mix.

Asset Allocation -- After

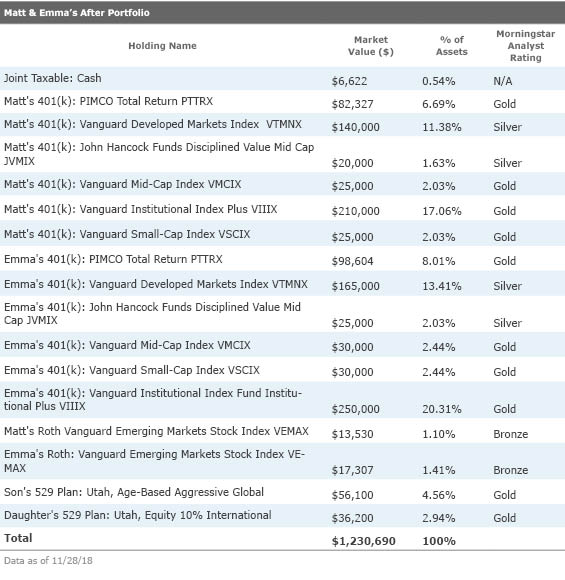

At first blush, it might seem that Matt and Emma should be saving a larger share of their paychecks for retirement than 6% of their salaries. But their employer match brings their total annual contribution up to 12%, so I think their retirement plans are generally on track. Given that Matt and Emma would like to be able to cover tuition at an instate public university for their kids--the tab for which is currently running in the $25,000 range--it's reasonable for them to stick with their current contribution rates for their retirement plan and steer any additional funds to the 529s. Once private school and college funding are in the rearview mirror, they should be able to turbocharge their retirement savings by contributing at a higher rate than they are currently. It's also a worthy goal for them to target higher contribution amounts to their retirement plans as they receive bonuses and/or raises.

Given the quality of Matt and Emma's 401(k), I don't see a problem in them using that account as their main retirement-funding vehicle, as it features institutional pricing that they'd have trouble matching on their own in an IRA or brokerage account. Nor is there any issue with them allocating their portfolios in a similar fashion; because their ages are the same, both should run with heavy stock allocations and focus on the best-of-breed options within their plan.

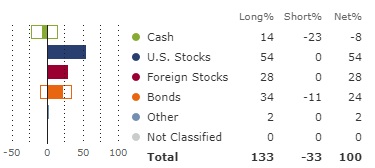

That said, I think it's reasonable to make a few adjustments to their portfolios. Matt and Emma don't characterize themselves as especially risk-averse, so I think they could reasonably target a more aggressive asset allocation of at least 80% and maintain that weighting for another decade. Equity valuations aren't especially cheap, obviously, so if they want to target a higher equity weighting they could consider directing new contributions to equities rather than making a wholesale switch at this juncture. In addition, my After portfolio includes a slightly heavier allocation to foreign stocks, primarily to take advantage of their long time horizons but also to harness potential undervaluation in foreign stocks relative to U.S.

My After portfolio also aims to neutralize the growth bias of the portfolio's equity component: Given that so much of this couple's human capital is riding on their employer, which operates within the high-flying technology sector, that portfolio bet leverages up their exposure to the fortunes of growth companies. To help reduce that bias and lower their portfolio’s costs even further, I focused the bulk their portfolio on market index funds. I retained a position in the Silver-rated

On the fixed income side, I employed PIMCO Total Return; while its volatility has historically been higher than Vanguard Total Bond Market Index, its more eclectic portfolio provides it with the opportunity to earn above-market returns. If Matt and Emma feel trepidation about having so much riding on a single actively managed fund, they could reasonably split their bond allocation across that fund and Total Bond Market Index. Given Matt and Emma's long runway to retirement, I don't see a strong case for employing

Because Matt and Emma don't have an emerging-markets fund option in their otherwise-excellent 401(k), I like the idea of them using their Roth assets to gain exposure to that beleaguered sector. Their existing provider, Vanguard, fields an excellent option,

.

Finally, I don't see a great need for them to save in their taxable brokerage account until they've maxed out their 401(k) and IRA contributions. Rather, they should use that account to hold liquid reserves for their emergency fund. Given their high salaries, the fact that it can take longer to replace high-paying jobs, and the fact that both of their salaries are riding on the fortunes of a single firm, I'd recommend running on the high side of the usual three to six months' worth of living expenses for their emergency fund--as much to one year's worth of living expenses.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)