10 Cheap Stocks With Healthy Dividends

The yields on these names from the Morningstar Dividend Yield Focus Index are both sizable and sustainable.

It's the eternal question for dividend seekers: How can you be sure the dividend stock you own today won't slice its payout tomorrow?

Dan Lefkovitz, a strategist in Morningstar's indexes group, argues that two particular factors can lead investors to stocks with safe dividends: economic moats and distance to default scores.

Companies with moats are able to successfully sustain their profits and fend off competitors; distance to default, meanwhile, measures balance sheet strength and the likelihood of bankruptcy.

"We found that the wider the economic moat and the better the distance to default score, the less likely for a firm to cut its dividend," says Lefkovitz.

Morningstar blends those two factors when constructing the Morningstar Dividend Yield Focus Index. In a nutshell, the index is a portfolio of 75 high-quality and high-yield U.S. stocks screened for consistent records of dividend payments and the ability to sustain them in the future. It not only looks to the past but also the future when determining dividend sustainability.

Here's the nitty gritty: To determine the constituents of the index, we first screen the Morningstar US Market Index--a broad market index targeting 97% of the overall market capitalization--for the highest yielding companies. (The dividend must come from qualified income, so real estate investment trusts are not included.) We then screen the high-yielding pool for companies that have a Morningstar Economic Moat Rating of wide or narrow, meaning we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's distance to default score to determine how likely a firm is to default on its liabilities. The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors) and reconstituted quarterly.

You can see the current top holdings here.

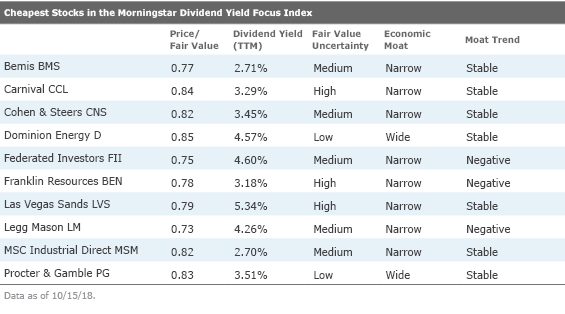

Below are the 10 cheapest stocks in the index according to our price/fair value ratios.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)