28 Terrific Funds

Russel Kinnel sent the fund universe through a filter and found some intriguing options.

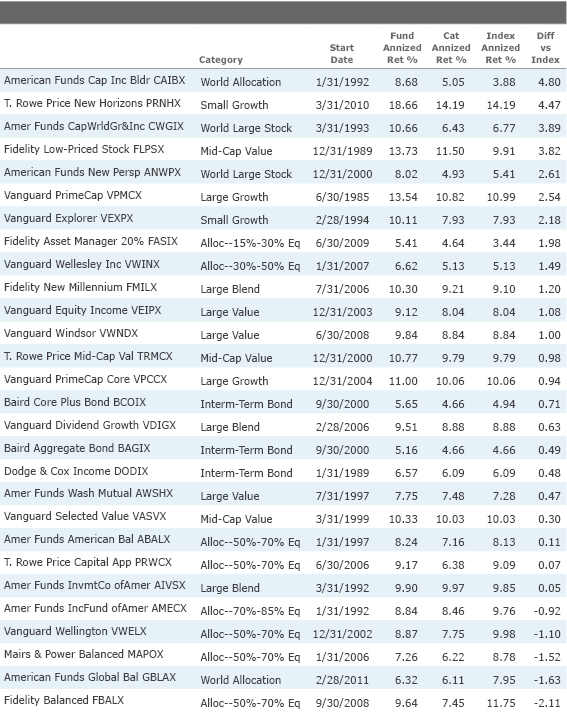

It’s time once more for my annual screen for fantastic funds. With just a few key screens, I pared down the universe of more than 8,000 mutual funds to just 28.

The final number changes a bit each year depending on how many funds pass all the tests. With so many funds, you can be very choosy. It’s a purely quantitative test—I don’t make exceptions just because I like a fund.

Here are the screens:

Cheapest quintile of broad level category groupings. Morningstar studies show that funds in the cheapest quintile are a much better bet than higher-cost funds, so this is the first test and a pretty good first screen in general. I've used the broad level category groupings, which sometimes include just one category and sometimes add a few that should have similar prices together. For example, all large-cap U.S. equity funds are in one grouping. Others like bank loan or convertibles are by themselves because there are no comparable categories. In the past I just used categories. Moving to category groupings knocked a few funds out of the box mostly on the growth side because growth funds tend to charge a little more than value. It also bounced a couple sector funds that would have passed otherwise.

Manager investment of more than $1 million in the fund. We've found that funds in which at least one manager has invested more than $1 million of his own money are more likely to outperform than those without such alignment of interest. The $1 million and up bracket is as high as the SEC's brackets go, unfortunately.

Morningstar Risk rating below the High level. Our Morningstar Investor Return studies have found that highly volatile funds are harder for investors to hold, and investor returns tend to trail total returns by a greater margin in those funds.

Morningstar Analyst Rating of Bronze or higher. This fundamental, forward-looking rating factors in qualitative and quantitative measures. So only funds recommended by Morningstar analysts make the grade.

Parent rating of Positive. You want a good steward with a strong investment culture when you invest for the long haul. The longer you invest, the more you realize how important this is.

Returns above the fund's benchmark over the manager's tenure. Rather than looking at a standardized time period, look at the period of the manager's tenure. I start with the start date of the longest-tenured manager on a team and insist that the fund beat the benchmark over that time period. I used returns through July 2018. There is a minimum five-year manager tenure, too, to weed out those with less meaningful track records.

Category benchmark for allocation categories. Many balanced funds have one equity benchmark and one bond benchmark rather than a blend of the two. That means they have either a very high or very low bar depending on which is the primary benchmark. Our category benchmarks are blended mixes of stocks and bonds, which makes them a better fit. In a few cases, I used category averages because the index returns didn't go back far enough.

No institutional share classes. I exclude these to help you get a list you can use. (I allow funds called institutional if the minimum investment is $25,000 or less.)

No funds of funds. The screens just won't work as well with this type.

Closed funds are not screened out. Many people still own them and want to know if they still make the grade.

This year, 28 funds passed the test. For a change, I thought I’d review in the order of their margin of victory versus their benchmark. Be forewarned that awesome performance draws assets and spurs funds to close if they are run by good stewards.

- source: Morningstar Analysts

American Funds Capital Income Builder

CAIBX

480 basis points annualized above benchmark

This fund puts the firm’s global reach to good use. This Silver-rated fund includes a bond stake that accounts for about 25% of assets. American Funds are now available in No Transaction Fee networks as well as the traditional advisor-sold ones.

T. Rowe Price New Horizons

PRNHX

446 basis points annualized above benchmark

Good things are clearly happening on T. Rowe Price’s growth team. Henry Ellenbogen has proved to be a step ahead of the competition on fast-growing small companies, including some that were private when he first invested in them. Given the fund’s massive $25 billion asset base, I doubt it will be opening in the near future.

American Funds Capital World Growth & Incom

e CWGIX

389 basis points annualized above benchmark

This fund earns a Gold rating owing to its skill plying a strategy that is somewhere between equity-income and dividend growth. The managers aim for a before-fee yield near that of the MSCI All-Country World Index, and that seems to have steered away from the more treacherous territory of higher-yielding stocks.

Fidelity Low-Priced Stock

FLPSX

381 basis points annualized above benchmark

Joel Tillinghast pulls off the near impossible by generating strong returns with a sprawling portfolio and huge asset base. It’s an impressive feat.

American Funds New Perspective

ANWPX

261 basis points annualized above benchmark

Yes, it’s another global equity from American offering strong management and low expenses.

Vanguard Primecap

VPMAX

254 basis points annualized above benchmark

No, it doesn’t have the greatest outperformance of the Primecap family, but it has the longest track record, going back 33 years. Although the last of the original founders figures to retire fairly soon, Primecap has done a good job of hiring analysts and managers to keep the firm hitting on all cylinders.

Vanguard Explorer

VEXPX

213 basis points annualized above benchmark

This fund lacks the management stability of the above funds. It seems to have been constantly changing subadvisors, though that has ebbed of late. Still, Vanguard’s cost advantage and some decent subadvisors have kept the fund ahead of the curve.

Fidelity Asset 20%

FASIX

198 basis points annualized above benchmark

Fidelity has an excellent taxable-bond team, and that’s apparent in a fund like this that features 20% in stocks with the rest in bonds and cash. The core bond portfolio in this fund is run by the team that runs Silver-rated

Vanguard Wellesley Income

VWINX

149 basis points annualized above benchmark

There are few better bargains in mutual funds than this fund, which charges just 0.22% for Investor shares and 0.15% for Admiral. Subadvisor Wellington has deeply skilled teams to run the value-oriented equity portfolio and the high-quality bond portfolio. It really shows the benefits of simplicity.

Fidelity New Millennium

FMILX

119 basis points annualized above benchmark

John Roth’s record here since 2006 is outstanding despite a pedestrian three-and five-year record. The reason it has lagged lately is that he likes cyclical value plays more than most of his large-blend peers. At a time of FAANG (Facebook, Amazon.com, Apple, Netflix, and Google [Alphabet]) dominance, being underweight tech and overweight energy is a lonely place. Still, the fact that he is ahead of the S&P 500 indicates he has some skill as a stock-picker even if not a sector rotator.

Vanguard Equity-Income

VEIPX

108 basis points annualized above benchmark

Under lead manager Michael Reckmeyer, the fund has been a steady performer. Reckmeyer and his team at Wellington run two thirds of the portfolio, and Vanguard’s quantitative equity group runs the other third. That expertise comes at the cost of just 0.26% in fees.

Where Are the Rest of Primecap and Dodge & Cox? Primecap and Dodge & Cox funds have been mainstays of these lists over the years, but fewer made the cut this year. In most cases, it was the risk rating that tripped them up. Quite a few from Dodge & Cox and Primecap have high overall Morningstar Risk ratings and thus did not pass all the tests. But as you can see from our Analyst Ratings, we do still have a high opinion of them.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)