4 Stocks Buffett Might Buy--If He Could

With $116 billion in cash on Berkshire’s balance sheet you’d think nothing was beyond its reach, but asset size precludes meaningful investment in small and mid-caps.

There are many contexts in which Berkshire Hathaway’s BRK.B $480 billion market cap is a positive. Berkshire’s reinsurance businesses General Re and BHRG are good examples. As Buffett points out in his February letter to shareholders:

"No company comes close to Berkshire in being financially prepared for a $400 billion [mega catastophe]. Our share of such a loss might be $12 billion or so, an amount far below the annual earnings we expect from our non-insurance activities. Concurrently, much--indeed, perhaps most--of the [property/casualty] world would be out of business."

Buffett estimates insured losses from 2017's three hurricanes that hit Texas, Florida, and Puerto Rico are around $100 billion, and Berkshire's share around $2 billion after taxes. But, he says, the net cost from the three hurricanes reduced Berkshire's GAAP net worth by less than 1%. Elsewhere in the reinsurance industry there were many companies that suffered losses in net worth ranging from 7% to more than 15%, he said.

Berkshire’s size and financial strength allow it to pounce quickly when it sees an attractive opportunity, and to close the deal quickly, many times using cash. Berkshire is often able to negotiate a great price for an asset during tough markets, when capital is drying up and other prospective buyers are running scared. Case in point: Berkshire’s 2008 purchase of $5 billion of Goldman Sachs preferred shares, days after Lehman Brothers declared bankruptcy and shares of big banks were spiraling downward.

Berkshire's on the lookout for deals now. In the shareholder letter, Buffett discussed how he would like to redeploy some of the very low-returning $116 billion in cash in Berkshire's coffers (as of the end of 2017) into an asset with higher earnings potential.

It may seem like there's nothing Buffett and Berkshire can't do with all that money. But the truth is, Berkshire is limited to only "one or more huge acquisitions" with the cash, as he says. The conglomerate's days of being nimble enough to take advantage of small-cap, fast-growing opportunities are behind it. It's a lot harder for a business to grow its earnings when its market cap is $480 billion, as Berkshire's is, than when it's $1 billion, for example. If Berkshire were take an interest a small-cap stock with rapidly growing earnings, that business wouldn't have a meaningful impact on Berkshire's overall earnings growth.

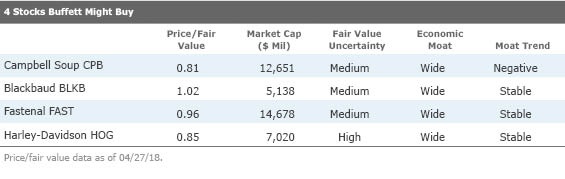

Individual investors, though, have opportunities available that Berkshire is probably too large to take an interest in. We screened mid- and small-cap stocks in our coverage using some of Buffett's famous investing criteria. We looked for stocks of firms with market capitalizations of less than $15 billion that had positive free cash flows and returns on equity of more than 10% in each of the past three years. As a proxy for quality, we screened for those with wide moat ratings. Within that subset, we homed in on four reasonably priced and fairly valued stocks.

Campbell Soup

Consumer sector director Erin Lash thinks Campbell has amassed a wide economic moat. The firm’s primary competitive advantages are its pre-eminent soup offering and its brand dominance, along with its favorable cost structure, which is attributable to its global distribution network. Campbell has generated returns on invested capital (including goodwill) of 18% on average, in excess of Lash’s 7% cost of capital estimate in the past 10 years. She expects the firm will continue generating excess returns over her 10-year forecast.

Blackbaud

Blackbaud provides end-to-end CRM and financial planning solutions for nonprofit organizations, corporate charitable organizations, and educational institutions. Senior equity analyst Rodney Nelson assigns Blackbaud a wide economic moat thanks to strong customer switching costs and intangible assets based on its broad suite of constituent relationship-management software and deep knowledge and expertise within the nonprofit fundraising industry. The company is rapidly migrating many of its legacy on-premises customers to cloud-based solutions, a shift that Nelson believes will ensure its leadership position for the long term.

Fastenal

Product distribution can be a tough business: Low barriers to entry combined with customer and supplier bargaining power can erode returns on invested capital. Despite these competitive pressures, industrial distributor Fastenal’s superior scale and ability to monetize its large network of customers and suppliers have allowed it to earn excess returns (20-year average return on invested capital is 24%), says equity analyst Brian Bernard. He expects Fastenal to maintain its competitive advantages over at least the next 20 years; he awards Fastenal a wide economic moat rating, supported by the firm’s scale-driven cost advantages, customer switching costs, and a network effect.

Harley-Davidson

Harley’s distribution channel and brand loyalty give the firm a wide economic moat, in senior equity analyst Jaime Katz’s view. The robust dealer network allows the company to have a broad reach with its products, Katz says, and the breadth of this distribution channel would be difficult and expensive to replicate quickly, particularly in North America and in certain international markets. Harley has garnered brand loyalty from the manufacturing of high-quality motorcycles for 115 years, and its record for product innovation and reliability over a long time frame is difficult to copy, she said.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)