Parnassus Investments: A Leader in Sustainable Investing

This firm's ESG offerings are worth a look.

Jerry Dodson founded Parnassus Investments in 1984 as a responsible investing firm. Since then, Parnassus has grown to $26.5 billion in assets under management—more than twice that of the next-largest sustainability-focused asset manager—and has become an unequivocal leader in sustainable investing. The firm’s strong investment culture and disciplined approach distinguish it from peers, even those without sustainable investing mandates. In fact, of its four funds that receive Morningstar Analyst Ratings, three are Morningstar Medalists—including Silver-rated

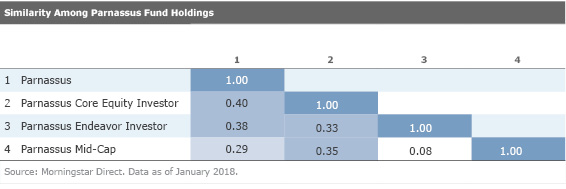

A Strong Investment Culture From 1984 to 2001, Dodson was the sole manager for each of the firm's funds, and he was initially the only listed manager for each fund it has since launched. But he has handed off much of his responsibility and is now a manager for just two. Still, he has kept the investment team lean at 13 members, consisting of nine managers; one analyst focused on fundamental research; and three analysts focused on environmental, social, and governance (or ESG) research. The team will also add two analysts this upcoming summer to bolster its fundamental research efforts. On the face of it, the number of analysts may seem small. The investment team's modest size likely limits the breadth of its research, but it meets this challenge with significant collaboration among its managers, who run focused, low-turnover portfolios. In fact, the similarity among the January 2018 holdings of the firm's four U.S. equity funds illustrates this combined effort, as shown in the table below. For example, the most similar portfolios are large-blend siblings Parnassus and Parnassus Core Equity, which have a common-holdings score of 40% (this metric accounts for both the number of stocks held in common and their respective portfolio weights).

Because each member is an integral part of this tight-knit team, the firm thoroughly vets incoming analysts. Like other firms, it has a competitive summer internship program. But Parnassus’ internship program is a rite of passage for investment professionals. Except for Jerry Dodson and Samantha Palm, manager for

The Parnassus Approach The team executes a consistent high-conviction, long-term-oriented approach at each of its equity funds. The approach is straightforward: The team targets high-quality companies—characterized by sustainable competitive advantages, increasingly relevant products or services, and exemplary management—and aims to purchase them when they're out of favor with the market. Often, when the managers identify a good business, they first place it on a watchlist, then wait to buy at a more attractive valuation. Because the managers prefer quality firms battling temporary headwinds over mediocre firms trading at fire-sale prices, the firm's funds tend to land in the blend section of the Morningstar Style Box. When the managers buy a stock, they're willing to allocate a significant stake and tend to hold on for the long term. Indeed, each fund holds between just 30 and 40 names, and portfolio turnover at each fund has trended below that of its typical Morningstar Category peer.

ESG analysis is integral to the investment process, as well, and portfolio companies must have ethical business practices. The team’s ESG screens are like others; it avoids companies deriving significant revenue from alcohol, tobacco, weapons, nuclear power, or gambling, or those with ties to Sudan. But its ESG analysis extends further than these exclusionary screens, and it emphasizes positive ESG criteria. The team performs a qualitative assessment of potential investments, evaluating each firm’s corporate governance and business ethics, employee benefits and corporate culture, stakeholder relations, products, customers, supply chain, and environmental impact. These considerations align with Parnassus’ preference for responsible companies, but also help the team uncover business risks or opportunities that fundamental analysis may overlook. For example, companies with poor environmental practices may suffer costly fines or brand damage; meanwhile, environmentally friendly practices may promote a positive corporate image. This can directly affect a company’s bottom line, so integrating it into the team’s fundamental research provides a more complete understanding of potential investments.

For the most part, Parnassus has delivered strong results. Indeed, over the trailing 10 years ending February 2018—which represents close to a full market cycle—all four of the firm’s U.S. equity funds have finished in the top quintile of their respective Morningstar Categories. While the firm’s expertise lies in mid- and large-cap domestic equities, it has experimented in other asset classes with less success. Parnassus merged away its small-blend fund, Parnassus Small-Cap PARSX, in 2015. It will also liquidate its Diversified Pacific/Asia fund,

So, there are certainly areas in which the firm can improve, but all things considered, investors looking for solid ESG options can do well by turning to Parnassus.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)