Sustainable Funds Outperformed During the Early-February Market Swoon

Nearly two thirds of equity funds outperformed their categories.

Sustainable funds have experienced lower volatility so far in the recent market downturn. I took a look at how sustainable funds performed during the first nine days of February. That’s a short time period, but the S&P 500 tumbled 7.15% during those seven market days.

My universe consisted of funds I identified in my recent Sustainable Funds U.S. Landscape Report as funds that, by prospectus, state that they incorporate environmental, social, and governance criteria into their investment process or indicate that they pursue a sustainability-related theme, or seek measurable sustainable impact alongside financial return. The group includes 221 open-end funds and exchange-traded funds in the United States that have Morningstar Category rankings. (Several others are in the miscellaneous sector category, for which Morningstar does not calculate category rankings.)

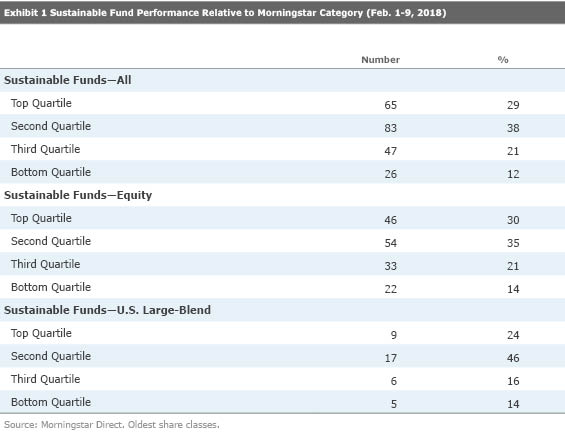

From Feb. 1 through Feb. 9, two thirds of all sustainable funds available in the U.S. finished in the top half of their respective categories. Granted, that stat includes all sustainable funds, not just equity funds, so I broke out the equity funds and found much the same thing. Among equity funds, 65% outperformed their peers, with more than twice as many finishing in their category’s top quartile than in the bottom quartile. Thirty percent of equity funds finished in their category’s top quartile, while only 14% finished in their category’s bottom quartile. Among the 37 sustainable offerings in the U.S. large-blend category, 26 finished the period in the category’s top half. Not only that, but 30 of the 37 funds in the group outperformed the S&P 500.

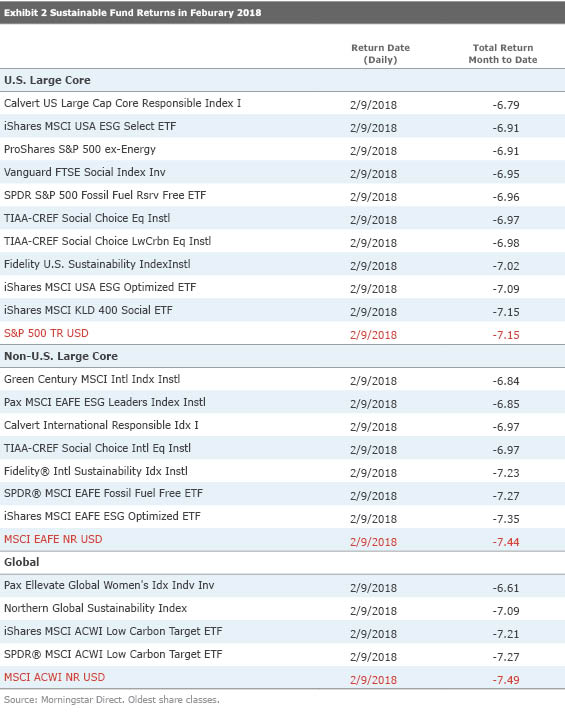

Speaking of the S&P 500, I didn’t find a single broad-market sustainable index fund or quasi-index fund that underperformed from Feb. 1 through Feb. 9. The list includes 10 large-blend sustainable index funds that either matched or outperformed the S&P 500, seven foreign large-blend sustainable index funds that outperformed MSCI EAFE Index, and four world large-cap sustainable index funds that outperformed MSCI ACWI Index.

Broadening the analysis to all funds using the Morningstar Sustainability Rating generated similar, but more modest, results. The better the fund’s globe rating, the better the companies it holds performed on material ESG issues, and the better the fund performed during early February. On average across six large-cap U.S. and non-U.S. equity categories, funds with 4- or 5-globe ratings lost 6.98% from Feb. 1 through Feb. 9, while those with 1- or 2-globe ratings lost 7.19%.

The gap was similar for large-value and foreign large-blend, larger for world large-cap, and was the largest for diversified emerging markets, where 1- and 2-globe funds lost 0.84% more, on average, than 4- and 5-globe funds. For large-growth, the gap was only 0.09%. Only in large-blend did the relationship not hold. In that category, funds with 1- or 2-globe ratings lost 0.06% less than those with 4- or 5-globe ratings. Nonetheless, large-blend is the category in which intentional sustainable funds did especially well.

While sustainable funds pursue a range of investment strategies, a common element among them is that the consideration of ESG factors leads to a preference for companies that manage material environmental and social issues effectively and have strong corporate governance practices. These tend to be higher-quality companies that hold up better during market turbulence.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)