Sustainable Fund Choices Continued to Expand in 2017

2017 saw 39 new open-end funds and ETFs plus 17 existing funds that have adopted ESG.

The universe of sustainable investment funds in the United States continued to grow in 2017, making it easier than ever to invest for sustainability and impact.

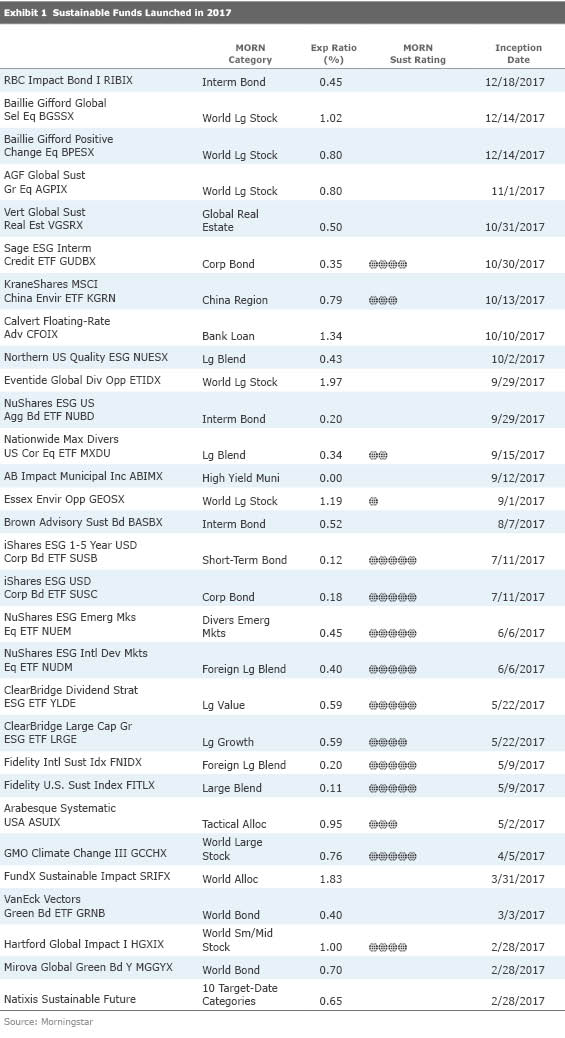

A total of 39 new open-end funds and exchange-traded funds launched during the year. That number includes the 10 funds in the first sustainable target-date series and 11 ETFs. By asset class, 17 are equity funds, 10 are bond funds, and 12 are allocation funds.

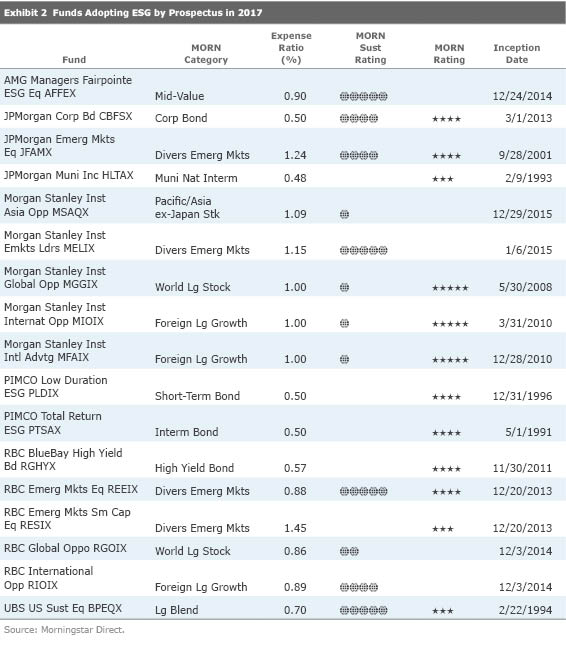

In addition to the newly launched funds, 17 existing funds were added to the sustainable-funds universe because they now incorporate environmental, social, and governance, or ESG, criteria and have made that explicit in the prospectuses they have issued this year. This group includes a number of global, international, and emerging-markets equity funds run by Morgan Stanley, JPMorgan, and RBC, as well as two PIMCO bond funds.

Here are some notable additions to the sustainable-investing funds list in 2017:

- Natixis Sustainable Future, a target-date series managed by Natixis subsidiaries Mirova, a sustainable investing shop based in France, Loomis Sayles, and Active Index Advisors, with the allocation glide path handled by Wilshire Associates;

- Fidelity U.S. Sustainability Index FITLX and Fidelity International Sustainability Index FNIDX, which mimic indexes in the MSCI ESG Leaders series;

- NuShares' ESG ETFs, from TIAA/Nuveen, including U.S. style-box funds, international developed- and emerging-markets funds, and an aggregate bond fund, which allow for easy model building and tactical allocation using ESG funds;

- Two new muni options with a focus on tax-free bonds that have social or environmental impact, the newly launched AB Impact Municipal Income ABIMX and JPMorgan Municipal Income HLTAX, which added its impact objective to its prospectus in February;

- Two green bond funds, Mirova Global Green Bond MGGYX and Van Eck Vectors Green Bond ETF GRNB, joining Calvert Green Bond CGBIX in the space;

- Vert Global Sustainable Real Estate VGSRX, subadvised by DFA;

The number of Morningstar Categories in which there are sustainable investment fund options has grown significantly. Investors can now find sustainable funds in 58 categories. While most are equity funds, and most of those focus on large-cap stocks, the group now includes 38 bond funds, 25 allocation funds, and two funds we classify as alternatives.

It is now easier than ever for investors to build portfolios of sustainable funds without sacrificing key asset classes or having to use conventional funds for allocations that don't have sustainable-fund options. At the same time, with 39 new funds in 2017, 34 in 2016, and 26 in 2015, a lot of sustainable funds still lack the minimum three-year track record many investors require. The 26 funds in the class of 2015 will reach their three-year anniversaries this year, and 16 of them have two-year returns that place in their categories' top half. Of course, a lot can happen in one year. But have patience, it won’t be long before investors have some more-seasoned choices.

In the meantime, if you are interested in investing in a newer fund, here are some things to look for:

- A low expense ratio;

- An experienced portfolio manager with a track record running sustainable institutional or separate-account strategies;

- An experienced portfolio manager with a track record running a similar conventional fund or strategy;

- An asset manager with asset-class and sustainable investing expertise;

- In the case of passive funds, the longer-term performance of the fund's index (although be aware that some indexes report back-tested performance).

Look for the number of sustainable-investing fund options to continue to grow in 2018 as well as the number of existing funds adopting ESG by prospectus.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)