Reality Check

Certainty is an expectation that we can’t deliver.

There is a false sense of precision in the financial advice industry that has me worried.

I see it showing up in a bunch of ways:

- Asset-allocation suggestions that run out to two decimal places.

- Life expectancy projects that show up in months.

- Advisors telling clients they're 97.4573% confident clients will meet their retirement goals after using Monte Carlo calculators

It’s not the tools’ fault. It’s us.

We are so dead set on the idea that our value must come from providing certainty that we will go to some pretty dramatic lengths to deliver it— in theory.

But certainty is a myth.

That’s a problem because humans (you and I included) want certainty more than just about anything else. We want someone to tell us what’s going to happen next. When will the rain come? Where will the buffalo be next season? What will the market do next quarter?

We’ve built an entire industry on the idea that we can come down from the mountaintop with our version of stone tablets and give the people what they want. We have bigger computers, more research staff, and larger budgets. We’ve designed an industry to sell certainty.

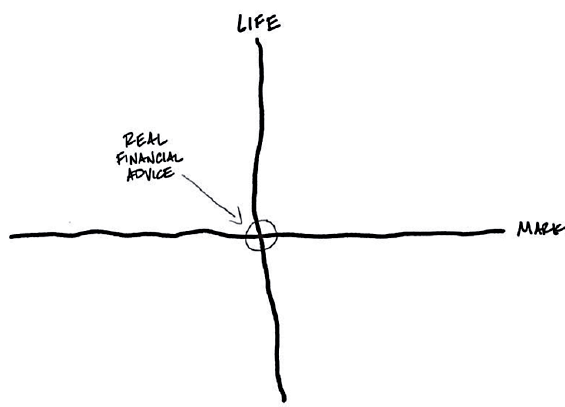

But the reality is that our clients’ lives and the markets’ movements come with irreducible uncertainty. The business we’re in lives at the intersection of those two uncertain paths. When we promise or imply certainty through things like algorithms or investment policy committees, we’re just exacerbating the problem.

People know we’re making stuff up.

They know that the things we call forecasts or assumptions are nothing but guesses. And the more we pretend these forecasts or assumptions are something other than guesses, the more we’re complicit in the game that results in unfilled promises.

Certainty is an expectation that we simply can’t deliver.

But here’s a secret: We don’t have to.

I’ve paid attention to some of the best leaders in our industry, and they’ve stopped playing the game. They made transparency a priority (crazy!) and are honest, sometimes brutally so, about the idea that they didn’t know exactly what will happen.

I know that when I made the switch and started using the word “guess” during client conversations, people relaxed. People felt less pressure, and as a result, they felt they could relax. It emphasized they were in safe company, and we were working through a process. As a result, they valued my advice more, not less, because it was reality-based.

May I make a humble suggestion?

Real financial advice doesn’t need to defend outdated ideas. Instead, we should embrace our role of being guides in a changing world. We have plenty of tools and experience to help us help our clients deal with what we find together. That’s what real human beings want. That’s what our clients want. They want a trusted advisor to guide them through uncertainty rather than sell them the false promise of certainty.

That’s a job we as an industry can do. The question facing all of us is whether we’re willing to let go of the outdated promises we made the cornerstone of financial advice, and embrace reality instead.

This article originally appeared in the December/January 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)