Don't Focus on Dividends Alone

Dividends can be enticing, but focusing narrowly on them can lead to trouble.

The article was published in the July issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

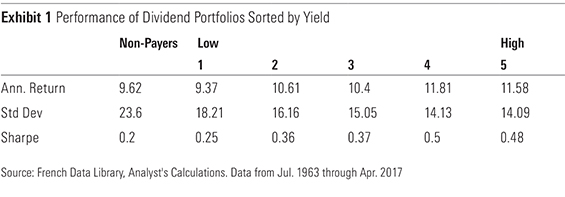

Dividends aren’t as important as they might appear. True, dividend payments can impose discipline on managers, making it harder for them to squander shareholders’ money on low-return pet projects. And yes, high-yielding stocks have outpaced their lower-yielding counterparts over the long term, as shown in Exhibit 1. But there does not appear to be a causal relationship between dividends and returns.

Instead, this performance pattern can be explained by high dividend payers’ tendency to trade at lower valuations and exhibit less sensitivity to the business cycle than less-generous dividend payers. These characteristics have historically been associated with more-attractive performance independent of dividend policy. So dividends don’t tell the whole story. Focusing too narrowly on them can lead to trouble.

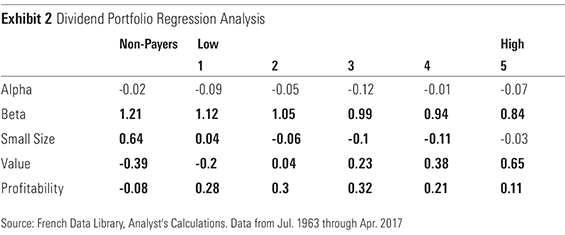

Exhibit 2 shows the results of a regression analysis that attempts to explain the returns of six portfolios of stocks formed on dividend yield with the market risk premium, size, value, and profitability factors from the French Data Library. After controlling for these factors, the high-dividend portfolios didn’t perform better than the low-dividend-paying portfolios. But they were less volatile and exhibited lower sensitivity to the market risk premium (market beta). This inverse relationship between dividend yield and market sensitivity likely arises because the market often punishes firms that cut their dividends. So firms wouldn’t commit to high payments unless their managers were confident in their ability to honor them over a full market cycle. Managers of firms with more-stable cash flows (and lower market betas) are likely more comfortable paying higher dividends. Firms that don’t pay dividends tend to be less mature and have more-volatile cash flows.

The positive relationship between high dividend yields and low valuations isn’t surprising. Mechanically, lower valuations translate into higher yields among dividend-paying stocks. Firms that pay out a larger share of their earnings as dividends tend to reinvest less to fuel future growth. Lower growth, on average, leads to lower valuations.

It may be intuitive to presume that stocks with higher dividend yields tend to be more profitable than those that have lower yields, but that's true only up to a point. Non-dividend-paying stocks exhibited lower sensitivity to the profitability factor than dividend payers, but the two highest-yielding portfolios had less exposure to that factor than their lower-yielding counterparts. That’s consistent with other portfolios that exhibit pronounced value tilts, as investors typically pay less for less-profitable firms. Investors who narrowly focus on yield may ultimately sacrifice profitability and increase risk.

Dangers of Yield-Chasing

History is strewn with examples of high-dividend-yielding stocks forced to cut their dividends amid deteriorating fundamentals, including

These risks are most pronounced in funds that aggressively reach for yield, sacrificing diversification or ignoring fundamentals like profitability. For example,

This posture has made this strategy considerably more volatile than the Russell 1000 Value Index and opened it up to greater downside risk. For example, between Oct. 8, 2007, and March 9, 2009, the fund’s index would have cumulatively lost 79.5%, 19.7 percentage points more than the Russell 1000 Value Index. Even though back-tested data suggests that the fund’s index would have beat the Russell 1000 Value Index by 1.3 percentage points annually from the end of June 2003 through May 2017, that isn’t much compensation for the risk it takes.

It isn’t necessary to avoid the highest-yielding stocks altogether or apply demanding screens for quality to stay out of trouble. Rather, a broadly diversified, market-cap-weighted portfolio of high-dividend-paying stocks, like

Dividend Growth While most broadly diversified dividend-income strategies are essentially value strategies with slightly lower-than-average market risk, dividend growth strategies are more quality-oriented and defensive. They tend to favor highly profitable firms with durable competitive advantages. Consistent dividend growth is usually a good sign. It suggests that the firm is growing profitably, more insulated from the business cycle than most, and that managers are confident in their firm's prospects and committed to shareholder-friendly policies. But like dividend yield, past dividend growth does not tell the full story. It isn't sustainable if it grows faster than (cash) earnings and doesn't provide a good indication of how earnings will grow in the future. Even if it did, growth alone is not predictive of better stock performance, as growth expectations are usually reflected in stock prices. So, while dividend growth is a sensible strategy, it isn't perfect.

Take

Gold-rated

These adjustments helped VIG avoid Bank of America and

However, that rate of dividend growth is probably unsustainable, as earnings payout ratios have climbed across the board. At the end of 2006, VIG’s holdings were expected to pay out 29% of their earnings as dividends during the next year. By May 2017, that figure climbed to 43%. Dividends can’t grow faster than earnings indefinitely.

Recognizing that the past isn’t prologue, Bronze-rated

The resulting portfolio has a similar tilt toward highly profitable stocks with wide Morningstar Economic Moat Ratings, signifying durable competitive advantages to VIG. But its holdings have not had to demonstrate the same consistency across the business cycle, so it may not hold up quite as well during market downturns. It has been a bit more sensitive to market fluctuations over the trailing three years through May 2017. Despite this potential drawback, the fund’s focus on the fundamental drivers of dividend growth is laudable. It would be even better to combine this approach with the type of demanding dividend growth screen VIG applies. That said, VIG may already be doing that behind the scenes.

Look Beyond Dividends Dividend income and growth strategies both have merit, but dividends alone don't drive stock returns, and focusing on them in isolation can increase risk. To keep risk in check, dividend income investors should look for strategies that are well-diversified, like VYM, or that screen for quality, including profitability. Similarly, dividend growth portfolios can be good defensive strategies, but past dividend growth isn't always sustainable. It is best to look for strategies that demand a record of consistent dividend growth and the potential to sustain that growth. VIG takes steps in that direction, but the specifics on this fund's process are lacking.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)