Inside the Morningstar Style Box for Alternatives

A look at where liquid alternative funds fall in the alternatives style box and what it means for investors.

We recently introduced the Morningstar Style Box for alternative funds, a new research framework for evaluating liquid alternatives investments that’s available to Morningstar Direct clients at the end of October and will be on the Morningstar website in early 2018.

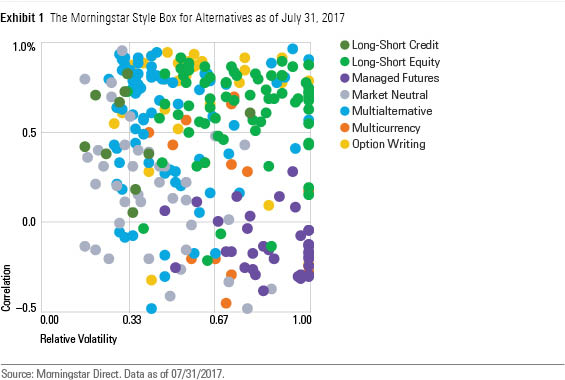

We first introduced this style box last year in an article that showed how its main components of correlation and volatility can help investors quickly and intuitively gauge a fund's diversification potential. Alternative strategies come in many different varieties, and funds within the same Morningstar Category that pursue very similar strategies can still have very different diversification characteristics.

In this follow-up, we illustrate these features by examining funds that fall into the four corners of the alternatives style box. This article will focus on two corners of the box, and tomorrow we will tackle the other two. For reference, the exhibit below shows where all liquid alt funds fall in the alternatives style box as of July 2017.

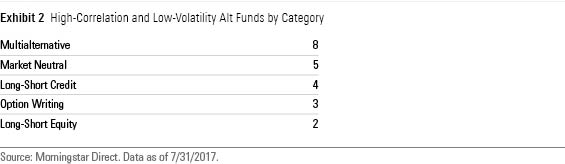

Alternative Funds With High Correlation and Low Relative Volatility In the top left region of the alternatives style box, one finds funds that have a high correlation to global equities (above 0.50 during the trailing three years) and a low relative volatility (less than 33% the volatility of global stocks when measured by monthly standard deviation during the trailing three years). Exhibit 2 shows the breakdown of funds by category as of July 2017.

Highly correlated, less-volatile alternative funds are often considered a partial stand-in for fixed income, which has a similar risk/reward profile. For the measurement period in this example, the Bloomberg Barclays U.S. Aggregate Bond Index had 27% of the relative volatility of global equities, for instance.

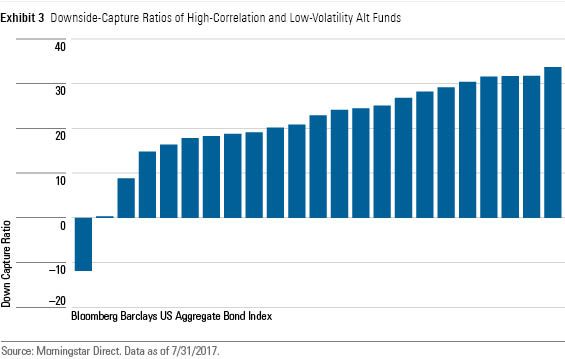

These funds' high correlation to equities should give investors pause, as it indicates performance tends to be influenced by the direction of global stocks. In a market where stocks are falling, these strategies are likely to fall as well, albeit by less given their lower relative volatility. Still, investors who have turned to these funds in lieu of fixed income amid concern about rising interest rates should keep in mind that they could disappoint in an equity market sell-off, during which it's not uncommon for bonds to rally. In such a scenario, they'd probably be better off in bond funds.

During the three-year period ended July 31, for example, the average high-correlation/low-volatility alternative fund captured 22% of the global equity benchmark's downside, with the distribution of downside-capture ratios shown in Exhibit 3, but bonds tended to deliver gains: The Aggregate Index gained 12% during those down periods over the same span.

These funds may still appeal to more-conservative investors, though even they should be mindful of how they'll mesh with other holdings as part of a broader portfolio. For investors willing to take the plunge, there are a handful of funds with these characteristics that we do recommend, as shown in Exhibit 4.

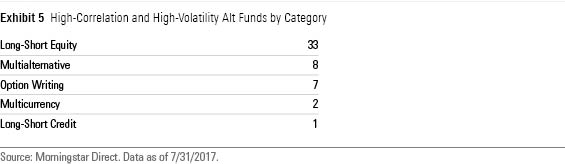

Alternative Funds With High Correlation and High Relative Volatility In the top right portion of the alternatives style box, one finds liquid alternative funds that are highly correlated with global equities and also relatively volatile. These funds hail predominantly from the long-short equity category. To be included in the category, a fund must consistently have a beta to equities between 0.3 and 0.8 (for categorization purposes, in the United States the S&P 500 is typically used as the benchmark) and gross short exposure of at least 20%. Given their high relative volatility and net long exposure to equities, these funds tend to be considered a substitute for other growth assets, like long-only equities.

Long-short equity strategies boast several potential benefits that can recommend them. For instance, adding a long-short equity strategy to a diversified portfolio can lower overall portfolio volatility without sacrificing a significant portion of the equity market’s upside. In addition, short-selling can give managers an opportunity to add excess returns in ways long-only funds cannot.

Morningstar analysts recommend only one fund that falls in the high-correlation, high-volatility region of the alternatives style box as of July 31.

Investors should treat the due diligence of long-short equity funds as they would any active equity manager. The fund’s returns are going to be driven by management’s ability to identify stocks that are both undervalued and overvalued. Some long-short equity funds do add an element of market-timing by varying net exposure levels depending on the manager’s view of the broader equity market. These more-tactical equity managers can be more easily identified by how their alternatives style box position changes over time.

Conclusion These examples cover a short period of time, and the results shouldn't be expected to hold in every market environment. Still, we believe the factors that investors should consider as part of their due-diligence process when evaluating an alternative strategy are unlikely to change regardless of whether the process starts today, tomorrow, or several years from now. Paying attention to how a strategy has been correlated to equity markets over time and in specific market periods, like 2015's volatile third quarter, and what kind of volatility it has exhibited relative to equities, could help investors better set expectations for alternatives. As liquid alternative funds continue to develop track records, we'll be able to examine how these factors change over different market environments. For now, investors should still consider these factors as part of the evaluation process.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)