4 Health Savings Accounts With Low Fees

Look out for three common HSA expenses: underlying fund fees, maintenance fees, and investment fees.

In our inaugural report evaluating health savings account plans, we looked at 10 of the largest plans through two separate lenses: as a spending vehicle to cover current medical costs, and as an investment vehicle to save for future medical expenses.

When evaluating HSAs as spending vehicles, we focused primarily on the maintenance fees charged by each plan. When analyzing plans from an investment-vehicle standpoint, we focused on their investment menus and considered three main components to determine an overall assessment: menu design, quality of investments, and price.

We also considered past performance of the funds, though we placed little emphasis on that as we don't believe performance is predictive of future results. One plan would not share its investment menu with us, so we excluded it from the investment-vehicle evaluations.

This article takes an in-depth look at how we evaluated the total cost borne by HSA plan participants who use the plan as an investment vehicle. Ideally, HSA plans offer investment options with attractive expense ratios relative to retail mutual funds while limiting other fees, such as maintenance and investment fees.

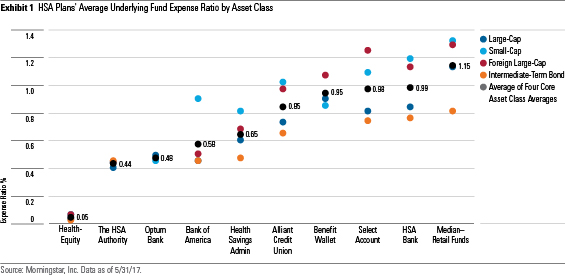

Underlying Fund Fees To evaluate the cost of investing in an HSA plan, we began by assessing underlying fund fees. To make an apples-to-apples comparison across plans, we calculated the average expense ratio of each plan's underlying funds in four broad asset classes: large cap, small cap, foreign large cap, and intermediate-term bond. Exhibit 1 shows the results. We included the median fee charged by similarly managed retail mutual funds to put the expense ratios into perspective. To calculate the average retail fund fee, we used primarily A share classes, which tend to be the most widely owned share classes among retail investors.

With average expense ratios across the four broad asset classes ranging from 0.05% to 0.99%, the plans' underlying fund fees compare favorably versus retail mutual fund peers'. However, HSA plans tack on additional fees that investors must take into consideration.

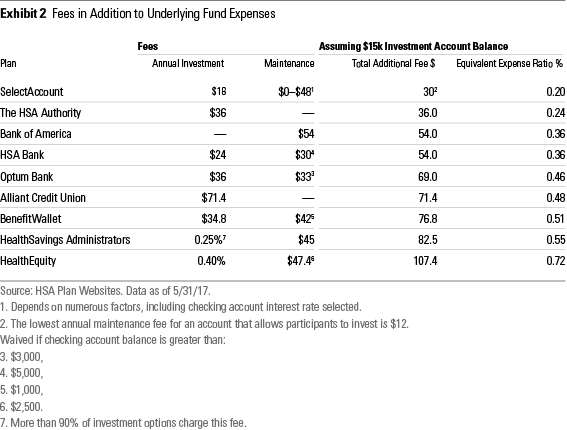

Maintenance and Investment Fees Most plans charge maintenance fees to cover general administrative costs. Moreover, the majority of plans charge an investment fee to participants who invest in the mutual fund lineup. Maintenance and investment fees are typically dollar-based fees. To incorporate these expenses into our analysis, we converted dollar-based fees to percentage terms, assuming an account balance of $15,000, which was the average balance in HSA accounts that had investment assets as of year-end 2016, according to Devenir Research's 2016 Year-End HSA Market Statistics & Trends. Exhibit 2 shows the additional fees charged by each plan, as well as the equivalent expense ratio assuming a $15,000 balance.

Some plans waive maintenance fees if the checking account balance exceeds a certain threshold. However, we didn't waive the maintenance fee in any circumstance. Assuming investors intend to maximize their account value, they would prefer to invest as much money as possible rather than transferring money to the checking account to avoid fees.

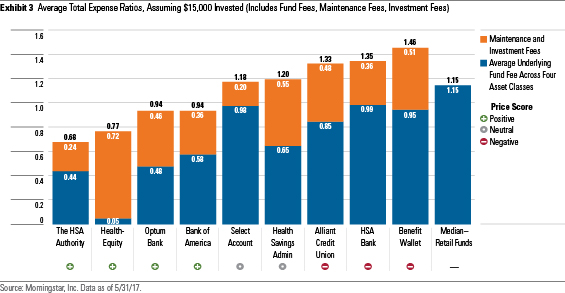

All-In Cost to Invest We layered each plan's additional fee, in percentage terms (as calculated in Exhibit 2), onto the average underlying fund expense ratio across the four asset classes (as calculated in Exhibit 1) to determine an average total expense ratio for each plan. To assess whether these prices represent a good value proposition, we compared plans' average total expense ratios with the median fees charged by similarly managed retail mutual funds. As shown in Exhibit 3, plans with below-average fees versus retail mutual fund peers earn positive price scores, those with middling expense ratios receive neutral price scores, and plans with high expenses garner negative price scores.

Positive The HSA Authority, Optum Bank, HealthEquity, and Bank of America boast below-average fees relative to retail mutual funds, earning those plans positive price scores. The plans have gained a cost advantage by offering low-cost index strategies. In fact, these four plans use index options more heavily than the five other plans that we evaluated. HealthEquity has unusually cheap underlying fund fees, as it uses strictly index funds offered by Vanguard in the four core asset classes. Passive strategies represent 65% of the plan's fund choices, which is significantly more than all other providers. The plan tacks on more fees than any other provider we evaluated, charging a maintenance fee of $47.40 per year plus an investment fee of 40 basis points. Still, thanks to extremely low underlying fund fees, the plan's total expenses land well below the median charged by retail mutual funds. The HSA Authority, Optum Bank, and Bank of America offer a mix of active and passive strategies within the core asset classes. The plans' underlying fund fees across the four areas range from 0.44% to 0.58%. The HSA Authority charges $36 a year in dollar-based fees, translating to an expense ratio of 0.24% assuming a $15,000 investment, which is lower than most plans. Bank of America charges $54 in annual fees, and Optum charges $69. The plans' expenses look less attractive than the other two plans with positive price ratings, but overall, the options are still priced below average versus the median retail fund.

Negative Alliant Credit Union, HSA Bank, and BenefitWallet look unattractive from a fee standpoint, earning those plans negative price scores. HSA Bank and BenefitWallet have higher underlying fund fees than most of the other plans included in this analysis, with average expense ratios of 0.99% and 0.95%, respectively, across the four asset classes. Alliant Credit Union's underlying fund fees look more reasonable, at 0.85%. Nonetheless, all three plans charge hefty dollar-based fees. Each plan layers on between $54 and $77 a year in maintenance and investment fees (HSA Bank and BenefitWallet waive $30 and $42 if the investor's checking account balance exceeds $5,000 and $1,000, respectively). That's equivalent to an additional 0.36% and 0.51% on top of underlying fund expenses, assuming a $15,000 investment, which is a tough hurdle for active managers to consistently overcome.

BenefitWallet's average underlying fund fee skews upward because the plan does not have an intermediate-term bond fund, which typically costs less than equity funds. Nonetheless, even after adjusting for that, the plan remains expensive versus retail mutual funds after considering underlying fund fees, investment fees, and maintenance fees. The $42 maintenance fee can be waived if an investor's checking account balance exceeds $1,000; waiving that fee would make the plan fairly priced versus retail funds. Nonetheless, it would be better if the firm reduced this fee or waived it regardless of the checking account balance.

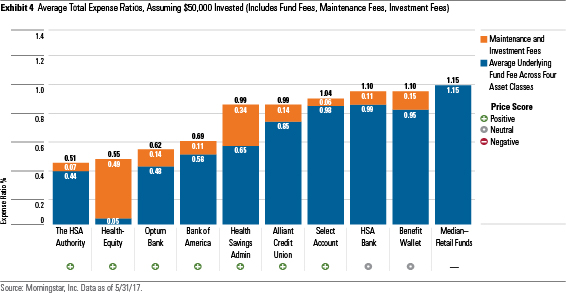

Greater Account Balances Make Fees Comparatively Less We assumed a $15,000 investment account balance to determine price scores, because that's the average total assets for HSA accountholders with investment assets. However, keeping a greater account balance changes how plans stack up relative to one another on a fee basis, as it reduces the relative impact of additional dollar-based expenses. Exhibit 4 shows that, with a few exceptions, underlying fund fees become the most important consideration for investors with large accounts. Using the same method employed in Exhibit 3 to calculate average total expense ratios, but assuming a $50,000 HSA investment account balance, all the plans' average total expense ratios fall below the median fee charged by retail mutual fund peers. The HSA Authority and HealthEquity remain among the most attractive from a fee standpoint. Although the average total expense ratios reduced for all plans, plans that charge predominantly fixed expense ratios as opposed to dollar-based fees became comparatively less attractive, as their total expense ratios decrease more gradually than other plans' as account assets grow. For instance, SelectAccount slipped in rank because it has one of the highest average underlying fund fees and the lowest dollar-based fee. BenefitWallet and HSA Bank still have the highest fees, with average total expenses equal to about 1.10%. Compared with retail mutual funds, that's not low enough to merit a positive price score, so they would receive neutral scores if we assumed a $50,000 investment.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)