Your Bond Fund Could Be Riskier Than It Looks

To understand a bond portfolio's risks, look beyond volatility-based metrics.

With credit spreads narrowing and returns across bond sectors converging so far in 2017, it's a good time for bond fund investors to question whether they're getting paid enough to take risk.

The most commonly used metric for measuring an investment's risk is the volatility of its historical returns. Academics have developed various measures that "risk-adjust" returns, such as the Sharpe ratio and Information ratio, using volatility as a proxy for risk. Such metrics attempt to gauge whether investors have been adequately compensated for the risks taken.

But how informative are volatility-based performance metrics? During long stretches, volatility can be useful in highlighting certain types of risk. For instance, in periods of economic weakness, high-yield bonds have experienced elevated defaults accompanied by sharp sell-offs. Local-currency emerging-markets bonds have traditionally experienced heightened levels of volatility because of fluctuations in emerging-markets currencies relative to the dollar. Long-duration Treasuries, which are highly sensitive to small changes in Treasury yields, have been similarly volatile.

But we don't necessarily need volatility to tell us these sectors are risky. Looking at a fund's credit quality (or other fundamental measures of default risk), currency, and duration exposures would give us the same information about those specific risks.

Historical volatility is also only as helpful as the time period you choose and the specific events that occurred in it--which may not be similar to the risky events to come. For example, the trailing five-year period through July 31, 2017, includes only one stressful period for high-yield corporates: June 2015 through February 2016. That was mainly confined to energy and metals and mining firms.

Overall, the post-crisis environment of low yields, low defaults, and a drawn-out, tepid economic expansion has rewarded high-yield corporates more than all other bond sectors. The Bank of America Merrill Lynch U.S. High Yield Master II Index gained 6.9% annualized during this stretch versus the Bloomberg Barclays U.S. Aggregate Bond Index's 2.2%. The high-yield index's Sharpe ratio of 1.2, which takes the index's excess returns and divides it by the standard deviation of those excess returns, also outranks other sectors, including the Aggregate Index's 0.7 Sharpe ratio. That's Modern Portfolio Theory shorthand for "investors were sufficiently rewarded" for taking high-yield corporate credit risk during this period.

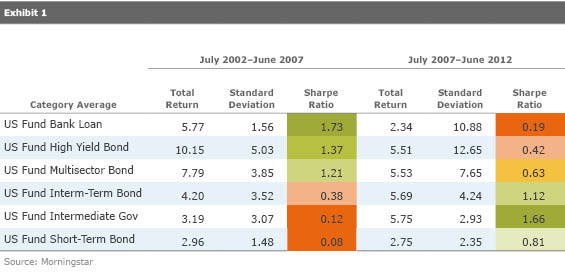

But as time periods shift, old events drop out, and new ones enter, volatility-adjusted metrics can change. For a simple illustration of how quickly and dramatically the fortunes of different bond sectors can shift, look at the five years leading up to the financial crisis and the five years that follow.

In mid-2007, just as a lengthy stretch of strong performance for credit-sensitive high-yield bond and bank-loan funds began to show the first signs of reversing, these Morningstar Categories' average Sharpe ratios far outpaced other types of bond funds. But in the five years that followed, high-yield bond and bank-loan funds went from the best- to the worst-performing funds in volatility-adjusted terms. Noting the historically stretched valuations on lower-quality corporate bonds in mid-2007 would have been more useful in warning investors about the risks ahead.

But even if the time period is long enough, and stressful events occur with enough regularity, judging whether investors have been paid to take risk is much more complicated than that. Oaktree Capital's Howard Marks has written critically about using volatility as a substitute for risk, calling risk "subjective, hidden, and unquantifiable…even in retrospect." What if, instead of rebounding in February 2016, oil prices had continued to plunge, or just settled at a much lower floor, pushing more high-yield bond issuers into financial distress? Was this scenario more or less likely than what actually occurred? Risk isn't just what happened (volatility); it's what could have happened but didn't.

In addition, there are plenty of instances where risks pass undetected by performance statistics until it's too late. As we noted in 2008, that was the case for funds that invested in subprime-backed mortgage bonds prior to 2007. Volatility-based metrics signaled that these funds were safe--until they no longer were. Before the financial crisis, many thought AAA rated subprime mortgage bonds were among the more-liquid sectors around, but that changed quickly as those securities lost their investment-grade ratings and there were suddenly way more investors looking to sell them and few looking to buy. Liquidity risk, which is difficult to measure and constantly changing, can be especially difficult to catch by looking at realized volatility, but it is nevertheless a critical consideration for investors in vehicles that offer daily liquidity. Today, large portfolio exposures to small issues and esoteric securities that aren't frequently traded, such as certain asset-backed sectors, can raise liquidity concerns, even if that risk hasn't shown up in a fund's performance metrics.

Given the strong multiyear run for riskier sectors, it's more important than ever to remember that observed volatility alone won't warn you about the risks to come. Bond managers who have been willing to underperform lately, both in absolute and risk-adjusted terms, rather than follow the crowd into riskier territory, may be set up to succeed in the future.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)