More Evidence of Solid Performance From Sustainable Funds

Investors in funds that incorporate environmental, social, and governance factors into their process appear not to suffer a performance penalty.

The most frequently asked questions about sustainable investing still have to do with performance. In theory, when investors limit their investment universe for moral or ethical reasons, they risk underperformance because they are not selecting the most efficient set of investments.

That's perfectly normal, as Meir Statman argues in his recent book, "Finance for Normal People: How Investors and Markets Behave." Individual investors--aka "normal people" in Statman's terms--choose less-efficient portfolios for all kinds of reasons.

Those who choose a less-efficient portfolio for ethical reasons receive expressive and emotional benefits that can offset the utilitarian costs of not receiving the highest possible return at the lower level of risk offered on an efficient frontier. I think it can also make them better investors--more engaged, patient, and focused on the long term.

More recently, as the field has become focused on incorporating environmental, social, and corporate governance, or ESG, considerations into the investment process, performance expectations have changed. More institutional investors and asset managers today believe that integrating ESG in an effective way can help reduce risk and point to overlooked investment opportunities, resulting in a positive impact on performance.

Last fall, I reviewed the academic literature on the performance of sustainable/responsible portfolios and mutual funds. I found that, on the whole, it suggested no performance penalty--even though much of the research focused on older funds that primarily relied on exclusionary screening. I also found that the more recent literature on sustainability and its financial impact on individual companies pointed more decisively to a positive relationship. This suggests to me that, as more sustainable funds focus on ESG incorporation rather than just exclusionary screening, their performance will become even more competitive over time.

Against that backdrop, let's take a look at the performance of the current crop of U.S.-based sustainable funds. I am using my list of mutual funds and exchange-traded funds that have an intentional focus on sustainable investing. These are funds that, by prospectus, describe an explicit focus on sustainable investing, ESG, or related themes. I excluded funds that use only a limited set of negative screens (such as tobacco, alcohol, and gambling) and purely faith-based funds because neither of these types of funds has an explicit focus on incorporating ESG into their investment processes. Based on my criteria, as of midyear, there were 187 open-end mutual funds and ETFs in the United States that practice sustainable investing. Of these, 141 are open-end funds and 46 are ETFs. Many are relatively young: 76 have not yet reached their three-year anniversaries. Thirty-five funds were launched in 2016 and another dozen in the first half of 2017. Overall, these funds cover 36 different Morningstar Categories.

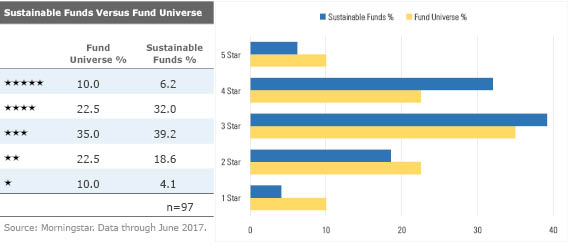

The Morningstar Rating for funds (or the star rating) measures a fund's risk-adjusted performance, including up to 10 years of a fund's history, relative to its category. The star rating is distributed normally within each category. Because sustainable funds are not a category unto themselves but rather are assigned a category based on their underlying portfolio characteristics (that is, style, size, country, duration, and credit quality), they sit alongside conventional funds in their categories. If we observe that the overall star rating distribution of sustainable funds is on par with that of the universe as a whole (that is, normally distributed), then we would have additional evidence that there is no performance penalty associated with sustainable funds.

Exhibit 1 shows the Morningstar Ratings for sustainable investing funds. In addition to the 76 that have not reached their three-year anniversaries, 14 ETF sector funds do not have star ratings because they are in the catch-all "miscellaneous sector" category, leaving 97 sustainable funds with star ratings. I used the oldest share class of each fund in this analysis.

The distribution of star ratings among sustainable investing funds skews in a positive direction, suggesting better risk-adjusted performance relative to the overall universe. The funds cluster more toward the middle (2, 3, and 4 stars) than does the overall universe, but 38.2% of sustainable funds have either 4 or 5 stars while only 22.7% have 1 or 2 stars. Based on the expected distributions, those numbers should be equal at approximately 33%. The positive skew holds for U.S. Morningstar Style Box categories, non-U.S. stock categories, and bond categories.

We can't say too much about the performance of the newer sustainable investing funds, but judging from their (non-risk-adjusted) returns so far, they appear to be holding their own relative to the older funds and relative to their category peers. On average, the returns of newer funds--defined as those less than three years old--place in the top halves of their categories for the year to date, the trailing year, and trailing two years (through June). They also, on average, have category ranks for those periods equal to or better than those of the older group of sustainable funds. Exhibit 2 also shows that sustainable funds overall are holding their own for the year to date, with an overall average category rank of 49.

Anything can happen between now and when these younger funds reach their three-year anniversaries in the next couple of years, but my expectation is that they will not hurt the risk-adjusted performance profile of already established sustainable funds--they may even improve it. The current positive skew in the star ratings of sustainable investing funds is another piece of evidence countering the underperformance myth. There is, of course, a range of manager skill and fund quality that investors still must discern when selecting sustainable funds. But the evidence suggests that those interested in investing in sustainable funds can receive competitive performance while also addressing their sustainability concerns.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)