It's Groundhog Day (Again) for the U.S. Fund Industry

Vanguard, BlackRock, and plain-vanilla indexes dominate the sales charts.

Deja Vu Ask 100 people to name a film about a man caught in time, doomed to repeat his day, and 98 of them would immediately respond, "Groundhog Day." (The rest of us would cite "Source Code," an underrated, Chicago-based thriller.)

Ask them what industry is stuck in a similar situation, and you'd receive a whole lot of blank looks. But "mutual funds" would be a good answer.

The pattern emerged during the early 2000s, expanded with 2008's stock market crash, and has settled into what appears to be inevitability. Two companies, Vanguard and BlackRock, consistently dominate fund sales. (By "fund," I mean both open-end mutual funds and their younger cousins, exchange-traded funds.) Among the hundreds of companies that collectively run 30,000 share classes, the real action occurs at a handful of major index funds, run by two sponsors.

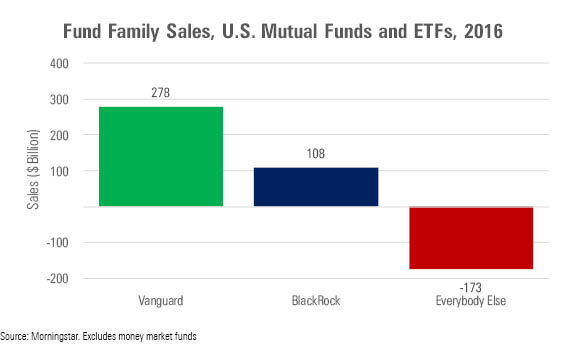

Two Families Let's start with the 2016 fund-family results.

Of course, that "Everybody Else" bar involves some sleight of hand. It's not that every fund company besides Vanguard and BlackRock suffered net redemptions. Included in the Everybody Else category were many companies that enjoyed positive sales. However, with $55 billion, State Street landed far behind the two leaders. Only three additional firms, DFA, Schwab, and AQR, passed the $10 billion mark. The 2016 marketplace can fairly be called a duopoly.

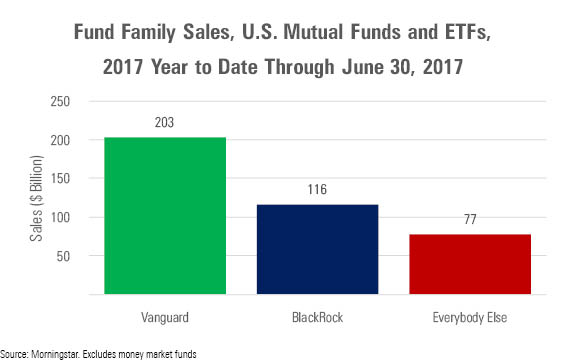

So can the first six months of 2017.

At first glance, Everybody Else looks to be doing much better. It has rallied from being deeply negative during 2016 to receiving almost $80 billion during the first half of this year. That is indeed better. However, the challengers aren't closing the market-share gap. Even as they have improved, so have the market's leaders. Vanguard is on track to take in $400 billion for the full year. That's 40% above what it accomplished in 2016. BlackRock has already surpassed last year's totals. While the poor became richer, the rich became much much richer.

That $77 billion total for Everybody Else doesn't hide any major items, either. Rather, that amount is spread thinly and widely among the field. With State Street dropping dramatically from its 2016 sales, the year-to-date leader outside the big two is PIMCO, at just under $14 billion. Even more so than last year, third place is distant.

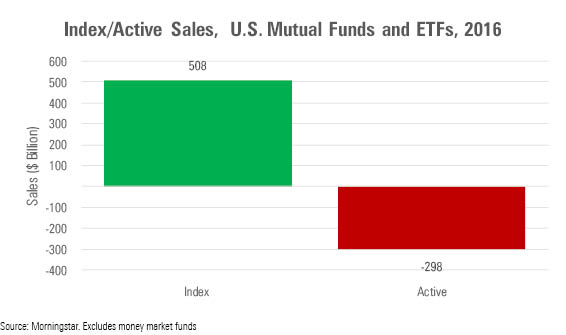

Indexes, Indexes, Indexes Unsurprisingly, the sales breakdown between indexed and actively run assets echoes the fund-family charts. Although Vanguard does manage $900 billion worth of actively managed funds (not including funds of funds, as that would be double counting), it too has been unable to buck investors' preference for indexing. In recent years, its actively run funds have had roughly flat sales. BlackRock's net sales, too, have been dominated by index funds. With sales for the two giants being almost entirely index funds, and most of the action in the other fund companies being for active funds, the 2016 index/active chart has a familiar look about it.

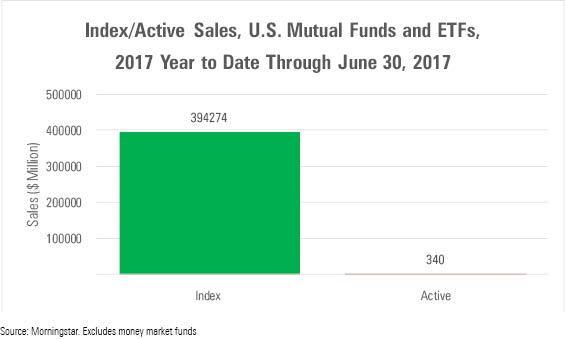

As does the year-to-date total.

Although its tale is somewhat more pessimistic than that of the fund-family results, because unlike the 2017 fund-family figures, which were pleasantly positive (if not quite as resoundingly triumphant as those of the big two), active-fund net sales in 2017 have been flat. There aren't serious challengers to either Vanguard or BlackRock, but among the semiserious ones, they too tend to be index-fund providers.

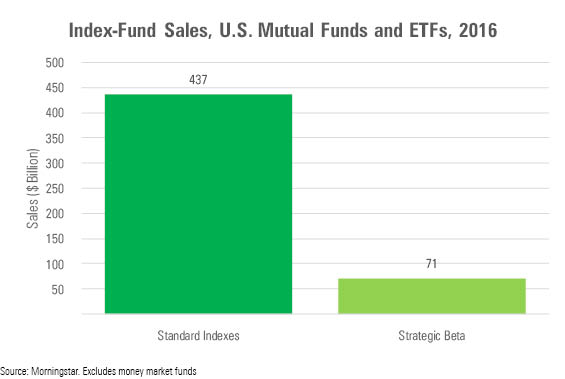

More Vanilla, Please Much attention has been given to strategic-beta funds ("strategic beta" by Morningstar's nomenclature and, I am pleased to report, increasingly by the industry itself as well; "smart beta" to those who prefer marketing terms). Several observers, including this columnist at times, have touted the more-exotic indexes that are created for strategic-beta funds as representing the next generation of indexing. Until now, goes the theory, investors have contented themselves with plain-vanilla indexes, but now they may avail themselves of more-creative options.

If the revolution is occurring, it is happening slowly. Morningstar estimates that conventional index funds outsold strategic-beta funds by a 6-to-1 margin in 2016.

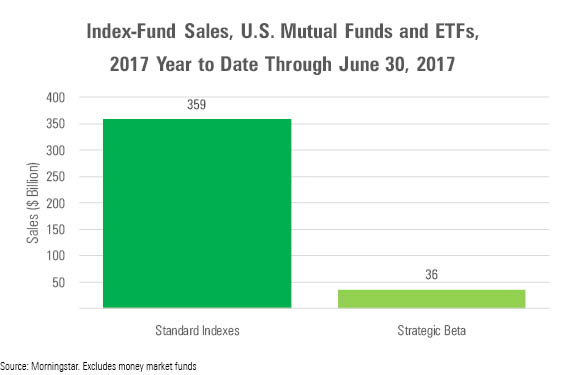

This year, in a setback for the revolution, the ratio has climbed to 10 to 1.

What's more, these figures are kind to the cause of strategic beta, because Morningstar assigns to that group style-based "growth" and "value" indexes. Such an approach is not incorrect--the line separating conventional indexes from strategic-beta indexes can be drawn in many places--but it is, to be sure, an aggressive definition. Most sources would place growth and value funds among conventional indexes, thereby lowering the sales estimates for strategic beta.

Far be it from this columnist to break the spell of repetition. Upon reviewing the numbers for the first half of 2017, I have nothing better to offer than what I have previously written, when this columnist first began in 2013, and every year thereafter. At some point the current fund-sales trend must surely end. When that will occur, I have no idea. It does not appear on the horizon. Thus, in the absence of new information, it's wisest to assume that next year will, once again, resemble this past year.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)