25 Funds Investors Are Dumping

The reasons include investors' shifting preference for lower costs, the rise of target-date funds, and good ol' performance-chasing.

Investors continue to dump higher-priced funds in favor of lower-priced fare--not only in U.S. stock categories, but in foreign-stock and bond categories, too.

That's one takeaway from the results of our recent survey of individual funds that investors are selling. (Next week we'll cover the top funds they've been buying.) A similar theme was revealed in our research paper on U.S. fund fees, which showed investors paid lower fund expenses in 2016 than ever before, not because fund fees in aggregate have fallen but because investors have voted with their feet in favor of lower-cost funds.

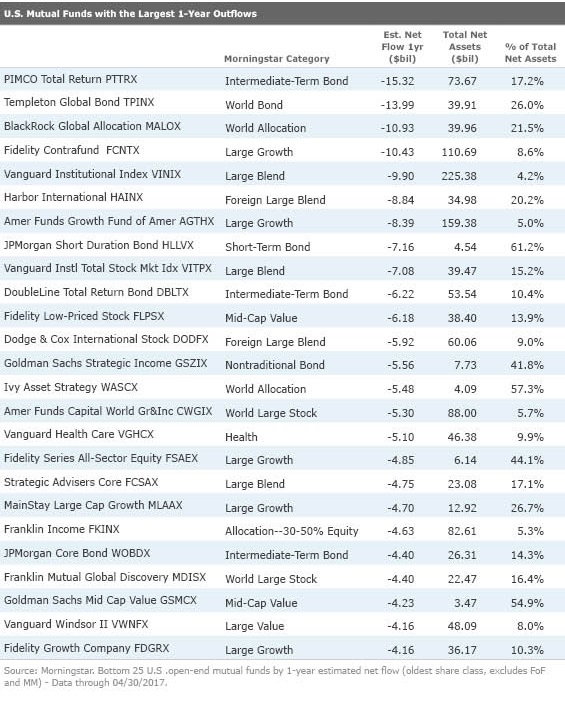

With the help of Morningstar senior research analyst Annette Larson, we took a look at the 25 funds that had seen the biggest redemptions in absolute dollar terms in the one-year period through April 30, 2017. Although we screened for the largest redemptions in dollar terms, this year we added a percentage of total assets data point, which helps put the flows in better perspective. Inflows and outflows to giant funds tend to tip the scales on a dollar-weighted basis even when the flows are a relatively small percentage of the fund's assets. For instance, two share classes of the mammoth Vanguard 500 Index fund--VINIX and VFINX--are on the list of top inflows and outflows over the one-year period; the story here is not really one of investor conviction, it's more about fund distribution and sales channels.

Eight out of 10 funds with the highest estimated net redemptions were actively managed funds, in a wide array of categories. By contrast, seven of the top 10 most heavily purchased funds were index funds (we will publish the full list next week).

And finally, investors continue to chase performance. In many cases, the funds that are seeing redemptions have had disappointing returns over the short term, the long term, or both.

What Gives in Large Growth?

Funds in the large-growth category were especially heavily redeemed--accounting for one fifth of the top 25 most-dumped funds over the past year. This is a bit of a head-scratcher, as the large-growth category has been one of the strongest-performing categories over the trailing three- and five-year periods. Two large growth funds with particularly large outflows have pretty strong records, too:

Silver-rated Contrafund's $10 billion outflow is 8.6% of its total assets under management. The reasons for this are not obvious, as the fund has been a decent performer on an absolute and relative basis over both short- and long-term periods. We can only speculate on the reasons. Contrafund is included in a lot of 401(k) plans, so the redemptions could be a result of investors' increased preference for target-date and passive products, said director of manager research Russ Kinnel.

Bronze-rated Growth Fund of America has also been a strong performer; it's hard to find an obvious reason investors would throw in the towel on this fund. But a close inspection reveals that investors are dumping the pricier share classes of Growth Fund of America. Looking at fund flows into Growth Fund of America's different share classes reveals that the A shares had the heaviest net redemptions at $6.8 billion, while the low-priced, no-load F3, F2, and R6 are actually gathering assets, with inflows of $1.6, $1.5 and $1.3 billion in assets, respectively. (These share classes are available only through qualified retirement plans such as 401(k)s.) Investors' preference for target-date funds is likely responsible for at least some of the outflows, too.

Familiar Themes in Fixed Income

The most heavily redeemed fund for the third year running was Silver-rated

Disappointing relative short-term performance is probably the major story at both Neutral-rated

By contrast, the list of 25 open-end funds with the heaviest inflows reveals investors flooded into passive bond funds Silver-rated

There are probably several trends at work here. One is performance-chasing: Prudential Total Return Bond landed in the category's top quintile in 2016 and is at the top of the charts again for the year to date. PIMCO Income has had stellar returns on an absolute and relative basis compared with its multisector-bond category, and its risk-adjusted returns over both short and long periods outleg the average fund in the intermediate bond-category by a considerable margin.

Two other themes are likely at play: the migration to passive funds, and the rising popularity of target-date funds. Although taxable bond funds have been one of the few asset classes in which inflows to active funds have continued to outpace those into passive funds, fixed-income index funds have seen strong inflows, stemming in part from target-date funds' increasing popularity. (Some bond index funds, such as Vanguard Total Bond Index fund, are used as underlying holdings in target-date funds.)

Investors Turn to Indexing in International Categories

Though Gold-rated

"[Templeton Global Bond] struggled for the first three quarters of 2016 before snapping back in a big way in the last quarter," explains associate director of fixed-income manager research Karin Anderson. "The problems stemmed from a combination of heavy emerging-markets local currency exposure, near-zero duration, and weakness from the U.S. dollar (the fund has shorts on the euro and yen because the team thinks the U.S. dollar will appreciate against them). Not all these things were working against the fund at the same time, but at certain times two of these three strategies weren't working."

As Templeton Global Bond shed 26% of its assets, new money poured into an index fund in the world-bond category--

Two funds in the foreign large-blend category,

Investors fleeing Gold-rated Harbor International may be reacting to the fund's subpar five-year return relative to the foreign large-blend category, says senior analyst Kevin McDevitt.

"It may also reflect lingering concern about the current team since founding manager Hakan Castegren's death in October 2010," he said.

As for Gold-rated Dodge & Cox International, a very disappointing showing in 2015 when the fund lost 11.4% and landed in the category's basement has marred its otherwise strong record.

As Harbor International and Dodge & Cox International shed billions in assets, foreign large-blend category peer

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)