For Vanguard, Every Year Is a Record

At least this time, there is some consolation for the others.

Making History Vanguard is Major League Baseball in the 1990s: the steroids era. One year Roger Maris's home-run record goes, the next year that record is beaten, the following year somebody gets 70. What is possible is constantly redefined.

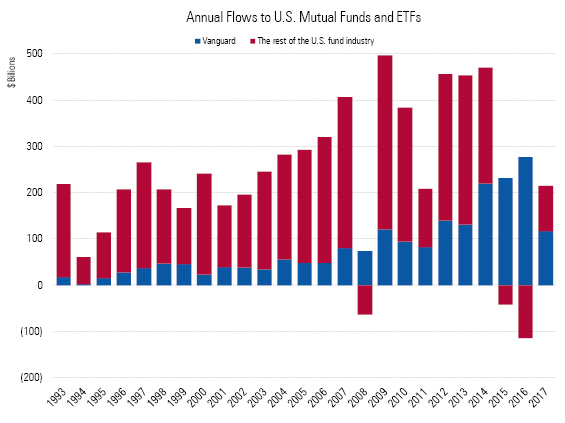

In 2014, the company became the first to attract more than $200 billion of net new flows into its U.S.-based mutual funds and exchange-traded funds—$219 billion, to be precise. The next year, it bumped that to $230 billion, then to $277 billion in 2016. This year it will obliterate that mark. Indeed, unless the trend changes dramatically, Vanguard will hit 100 home runs for the season.

The good news for Vanguard’s rivals—to the extent that the news may be called good and they may be termed rivals—is that for the first time in three years, they are also gaining assets. Not most of them, to be sure. The supertanker continues to take on water. However, for the first time in three years, Vanguard is not attracting more than 100% of the industry’s inflows. There is a breath of hope for the others.

Singing the Blues Here's the picture, with Vanguard in blue and the rest of the U.S. fund industry in red (no political commentary intended).

source: Morningstar

It's not so impressive at first glance. The 2017 bar closely resembles 2011’s. But of course, this is April, at which point the enormity of Vanguard’s accomplishment begins to loom. Morningstar estimated $116 billion for Vanguard’s first-quarter flows; Vanguard reported $121 billion. (The preliminary differences will be reconciled as the final numbers are reported.) Either way, that suggests that Vanguard’s full-year figures will be more than $400 billion, as there isn’t much seasonality to the company’s sales. One hundred home runs indeed.

The company thrived across the board. Stock funds, bond funds. Domestic funds, international funds. Taxable funds, municipal-bond funds. Unlike other fund companies, Vanguard relies neither on a handful of star funds nor on a reputation for running one asset class. Vanguard alone in the industry has built a true brand, and that brand extends across all investment types.

A Mile Wide

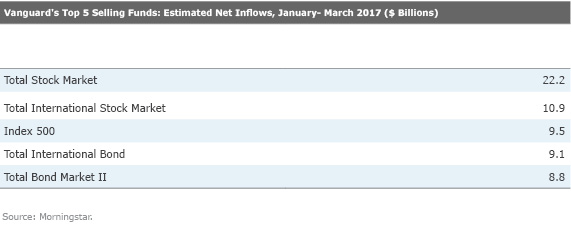

However, there is a theme to Vanguard’s top sellers: breadth. Four of the company’s five most-popular funds during this year’s first quarter have “total” in their names. Those four are Vanguard’s most broadly diversified index offerings, and the fifth,

That makes sense. There is sound logic behind that catchy phrase of core-and-explore. By placing their assets into the two mental buckets of “core” and “explore,” investors improve their chances to avoid making avoidable mistakes. The labeling makes them likelier to be patient with their core assets, which are the bulk of their assets, and to channel their trading instincts to the explore investments. Best to play rough with the less-valuable toys.

Vanguard did not invent the term of core-and-explore, but it more than any other company has benefited from the usage. Thinking about funds as “core” changes their desired traits, in a fashion that plays to Vanguard’s strengths. Back in the day, an investor’s first fund would usually be a “growth” stock fund. Can Vanguard grow capital better than the next firm? Unclear. But Vanguard certainly can lay claim to running superior core funds. No frills, low costs, few surprises—those attributes underlie core funds, and they underlie Vanguard’s brand.

The Rest of the Pack Where has the rest of the industry found its sales opportunities? Is it playing Vanguard's game, by bringing assets into predictable core funds, or is it succeeding through more-exotic fare—perhaps more daring, or specialized, than what Vanguard is willing to offer? The answer is both. That said, the first-quarter best-seller list is dominated by core funds.

Eight of the 10 winners are index ETFs. True, there are some semispecialized funds in that group—an emerging-markets fund, as well as mid- and small-company U.S. stock funds. However, those are about as tame as explore funds get (if indeed they can be called explore funds at all); Vanguard has essentially identical offerings. The remaining two competitors,

Further down the list, more explore funds appear, which is the nature of the beast. The leading funds from a few major providers will gobble up most of the core inflows, thereby vaulting to the top of the charts. In contrast, investors purchase a very wide variety of explore funds, spanning asset classes, geographies, and investment strategies, from a large number of companies. Those assets can sum to a substantial amount—as suggested in this year’s asset flows to the red bar—but they do not often cluster within a single fund.

Whither Now? Some have posited that the practice of indexing will become too prevalent, which will lead to peculiar market behavior that will end up penalizing index funds. That could be—in fact, it will be if a sufficiently high percentage of assets are indexed, so that there is not enough actively invested money to set efficient security prices. However, by any measure, we are far short of that event, and will be for the foreseeable future. The financial markets will need to be much more indexed than they are today for active management not to have a significant voice.

Thus, I find myself in the same position as in each of the past few years: unable to foresee Vanguard’s decline. It is foolish to think that today’s norm will be tomorrow’s, and that current leaders will be the future’s winners. Change happens. However, it is even more foolish to hazard a guess when none can be forthcoming. The contest remains Vanguard’s, for as far as the eye can see.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)