Will Actively Managed ETPs Meet Their Potential?

Several fund companies have submitted proposals with the SEC to launch actively managed ETPs that skirt daily portfolio transparency.

A version of this article was published in the January 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

In the beginning, exchange-traded product providers dedicated their product development efforts to covering the core of investors’ portfolios, bringing to market plain-vanilla, broadly diversified, market-cap-weighted ETPs. Having blanketed nearly every major asset class and style with passive products and stretched traditional notions of “passive” by adding a raft of strategic-beta ETPs to the menu, actively managed strategies seem to be the next logical frontier. Here I’ll discuss the potential active ETPs hold for investors and asset managers and some of the key obstacles that may prevent this category from ever fulfilling its prospects.

Long Potential Asset managers are keen to offer active strategies in an ETP format for several reasons. First, ETPs' in-kind creation and redemption process allows managers to offload positions without generating taxable capital gains. This mechanism could help shield fundholders from capital gains distributions, which have detracted significantly from many active funds' aftertax returns. Second, the costs associated with creating and redeeming ETP shares are initially borne by authorized participants, or APs, in the primary market. APs subsequently recoup these costs by collecting the bid-ask spread as they match buyers and sellers in the secondary market. Thus, portfolio trading costs are effectively externalized: They are incurred by investors buying and selling ETP shares. This insulates loyal shareholders from the costs that result from the coming and going of short-term investors, which are often absorbed by ongoing shareholders in traditional mutual funds. This feature can also help keep a fund fully invested, as it would not need to hold cash to meet fundholder redemptions. This could remove what has historically been an impediment to upside participation for some funds in bull markets.

Of course, investors also stand to benefit from gaining access to active strategies though an ETP by the improved tax efficiency and cost savings outlined above. Additionally, the hurdle to invest in a strategy may be lowered: Investors can purchase ETPs in an amount as low as a single share. Many funds have investment minimums that are much higher. Also, because ETPs are traded on exchanges, any investor with a brokerage account will likely have access to them.

Of course, broader distribution would also benefit these funds’ sponsors. Delivering active strategies via an exchange-traded vehicle opens a new distribution pipeline at de minimis incremental cost--particularly for existing strategies. This new pipeline would make managers’ strategies more broadly available to a greater number of investors, who for their part wouldn’t have to absorb the cost of traditional mutual fund baggage like loads, 12b-1 fees, or sub-transfer-agency fees.

Improved tax efficiency, lower costs, and broader distribution could potentially mitigate what have been significant headwinds for active managers and investors in their funds.

Short Interest Assets under management in active ETPs are a drop in the bucket compared with those in passive ETPs and actively managed mutual funds. The first U.S.-listed ETF, SPDR S&P 500 ETF SPY, was launched in 1993. Bear Stearns launched the first actively managed ETP in March 2008. By the end of 2016, investors had poured more than $2.5 trillion into passively managed ETPs but only $28.9 billion into actively managed ETPs. That's just 1% of ETP assets.

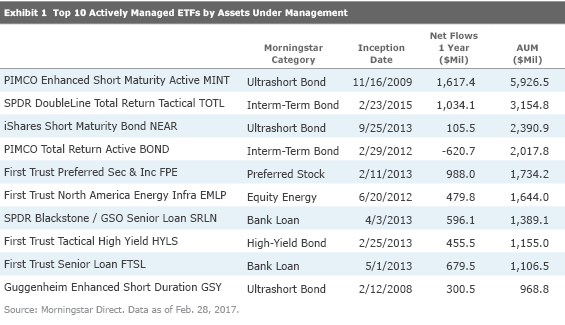

Actively managed ETPs’ limited success hasn’t been for a lack of effort. More than 225 actively managed ETPs have been launched since 2008, but almost one fourth have subsequently been shuttered. And the pace of new launches has accelerated. During the past three years, more than 130 actively managed ETPs have been launched. This represents more than 15% of the total number of ETPs launched during this period. Despite the rapid growth in the number of new funds, a small handful of active ETPs dominate the landscape. As measured by assets, the top 10 funds hold more than two thirds of all assets in active ETPs. Nine out of the 10 largest active ETPs are fixed-income funds.

As the data in Exhibit 1 demonstrate, actively managed fixed-income ETPs have had far more success than their equity-focused counterparts. The lone equity fund in the top 10 is a master limited partnership fund, which is not your traditional stock-pickers’ equity portfolio. At the end of 2016, fixed-income funds held more than 75% of actively managed ETP assets. Equity funds held just 10%.

What's the Hang Up? From the point of view of many portfolio managers, transparency is a concern. Mutual funds must disclose their holdings quarterly with a 60-day lag. The SEC requires actively managed exchange-traded funds to broadcast their holdings daily. This helps APs and market makers to keep these funds' market prices in line with the value of their underlying portfolios. Many equity managers fear if they frequently circulate their new buys and sells publicly without a lag, their strategies may be front-run or replicated outright, diminishing any edge they might possess. Daily transparency isn't nearly as great a concern among bond-fund managers. Copycatting fixed-income managers' trades is exponentially more difficult and costly as most trades occur over the counter and there are many more issues to choose from.

Where There Is a Will ... Several ETP sponsors and other enterprising innovators have proposed alternative fund structures that seek to preserve ETPs' benefits while circumventing the SEC's demands for daily transparency. To date, only one of them has passed muster with regulators.

In November 2014, the SEC approved the first nontransparent actively managed ETP structure: Eaton Vance’s exchange-traded managed funds, dubbed NextShares. Instead of trading in absolute dollar terms like an ETF or stock, ETMFs have a novel net-asset-value-based trading mechanism. ETMF shares trade throughout the day. Investors in ETMF shares pay a premium (when buying) or receive a discount (when selling) to the funds’ NAV, which is calculated at the end of the trading day (as is the case with traditional mutual funds). The SEC approved this approach because shares transact at prices that directly reference the fund’s NAV.

As is the case with ETFs, only APs may create or destroy ETMF shares. Each trading day, the ETMF provides a list of the securities that it will accept from APs to create new shares. This list doesn’t contain every position in the fund’s portfolio nor their precise weighting in the portfolio. As such, portfolio managers can exclude securities that they plan to trade so as not to broadcast their moves to the market. Through the end of 2016, Eaton Vance had signed preliminary agreements with 15 investment advisors to deliver their strategies through NextShares. At the end of 2016, three firms--including Eaton Vance--had launched NextShares, but none has gathered meaningful assets.

Another kind of nontransparent ETP that has been run up the flagpole involves the fund sponsor establishing a blind trust. The ETP’s custodian would serve as the trustee and an intermediary between the fund and the AP. The fund would transfer securities to the blind trust, and the AP would control a separate account within the blind trust and instruct the trustee to either liquidate or manage the shares transferred on its behalf. The fund could thus achieve a level of tax efficiency without tipping the fund manager’s hand, as APs wouldn’t know the makeup of the fund’s portfolio. The SEC has denied this workaround, as it may limit APs’ ability to keep these funds’ market prices in line with their NAV.

Another proposed approach being reviewed by the SEC involves the ETP sponsor providing, in lieu of the fund’s daily holdings, a robust data set that may include a daily trading basket of representative ETPs that have low tracking error and high correlation to the active ETP and/or performance metrics. This would in theory allow APs and market makers to effectively manage the risk they assume in quoting prices for these funds without daily portfolio transparency. Both proposals hinge on sidestepping the need for daily disclosure.

While the SEC has only approved one nontransparent active ETP structure, it has become marginally more accommodating in its approach to approving fully transparent active ETFs. In 2012, it lifted its ban on the use of derivatives in actively managed ETFs. And in July 2016, the agency approved generic listing standards for active ETFs. (Generic listing requirements for passive funds were already in place.) But the SEC’s one-size-fits-all solution has several limitations, including daily portfolio transparency and limited derivatives use. Generally speaking, this generic standard hasn’t met asset managers’ needs and uptake has been limited.

Even if one of these new less-transparent (a more appropriate term than nontransparent, as they would be every bit as transparent as mutual funds) fund structures alleviates the concerns of active stock-pickers, a larger issue remains: Investor demand for actively managed stock funds is waning. Asset flows away from actively managed equity funds toward less-expensive funds of all stripes, index mutual funds and ETFs in particular, has been well-documented. Furthermore, strategic-beta funds are also encroaching on active managers’ territory. While the ETP format could yield real benefits for fund sponsors and their investors, active stock selection is currently out of style.

Taking the Under It remains to be seen whether actively managed ETPs live up to their potential. Obstacles in the way include regulators, exchanges, platforms--effectively the entire fund production and distribution ecosystem. There's also the important question of investor demand to address. If asset managers build it, will they come? The prevailing movement out of active funds and into passive ones makes new fund formats seem like a last-ditch effort on the part of active managers. Also, ETPs aren't evolving in isolation. The dozens of new mutual fund T shares that fund companies have filed for are an example of forces that could further level the field between ETPs and traditional mutual funds. But even if actively managed ETPs fall short of their promise, they're helping to push crucial conversations about how to drive innovation in the packaging and distribution of investment strategies to improve investor outcomes

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)