4 Cheap Stocks Among Recent Economic Moat Changes

We've cut or boosted the economic moat ratings and trends for more than a dozen companies, and these four firms look undervalued.

Most stock investors will tell you their goal is to buy stocks when they're cheap. But cheap stocks come in a few flavors, and not all of them are appetizing. Take "cigar butt" stocks, for instance: They appear cheap today and could turn a profit in the short term because they often have a few "puffs" left in them. But ultimately, they are low-quality businesses with deteriorating fundamentals. A real investing coup is finding a bargain-basement price on shares of a company that is well-positioned to increase profitability for years, or even decades.

The reality, though, is that's often easier said than done. High-quality stocks don't go on sale all that often. But sometimes the market sells off indiscriminately, or investors overreact to short-term headwinds facing a company or industry, which can create attractive entry points. It's worth identifying which companies are poised for superior long-term profitability and keeping them on a watchlist so you're in a good position to scoop them up when an opportunity presents itself.

Understanding and Using Economic Moats Morningstar equity analysts make it easy to identify high-quality businesses. We believe that these five attributes imbue companies with economic moats, or structural advantages that protect their profits from competition and allow them to earn high returns on capital for many years. By assigning a Morningstar Economic Moat Rating to companies, we attempt to quantify the size or sustainability of an advantage. A company with competitive advantages that we expect to last more than 20 years has a wide moat; one that can fend off its rivals for 10 years has a narrow moat; while a firm with either no advantage or one that we think will quickly dissipate has no moat.

Our moat methodology considers both quantitative and qualitative factors, including analyzing the company's financial statements, talking to its managers, visiting the firm's operations when relevant, and reading industry publications.

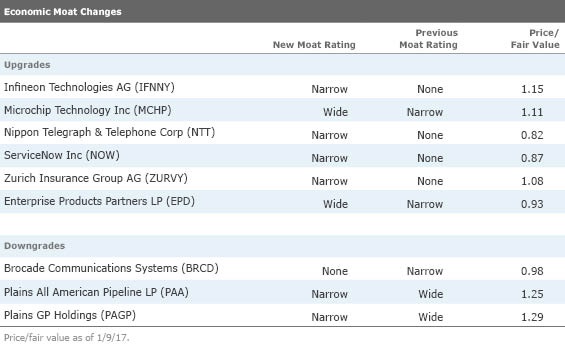

But this fundamental analysis is not a one-and-done affair. Sometimes our continued research and due diligence leads us to upgrade or downgrade a company's moat rating if we see evidence that the company's competitive advantage is either strengthening or eroding.

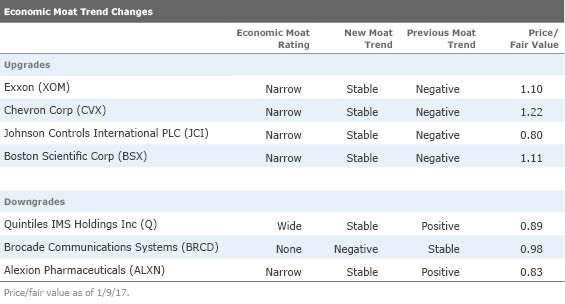

There is another component that works alongside the economic moat rating, and that's the moat trend. The moat trend rating describes how a company's competitive position is changing over time. It can be positive, indicating the competitive position is strengthening; negative, indicating the competitive position is weakening; or stable.

(Premium members can see a company's moat trend on the beta version of Morningstar.com by clicking on a company's quote page and scrolling down to the Morningstar's Analysis section. Click here to see Exxon Mobil's, for example.)

Recent Economic Moat and Moat Trend Changes Here is a roundup of economic moat and moat trend upgrades and downgrades to our coverage during the third quarter of 2016. We also highlight some undervalued stocks.

Senior equity analyst Dan Baker recently upgraded Nippon Telegraph & Telephone's economic moat to narrow from none. Baker notes that NTT derives around two thirds of its value and earnings from its stake in narrow-moat rated mobile operator NTT DoCoMo. In addition, there have been some changes over the past few years that now lead Baker to believe that NTT's return on invested capital will come in above its weighted average cost of capital in our forecast period, after many years of trailing it. Namely, Baker believes NTT benefits from an efficient scale moat source, with much of its fixed line network highly unlikely to be overbuilt and little likelihood of successful new entry into the three-player mobile market.

Previously rated no moat, equity analyst Rodney Nelson upgraded ServiceNow's moat rating to narrow in December. "Rapid ascent in the IT service management market has unlocked opportunities for the firm to upsell customers to stickier products around IT operations management and other enterprise service management products," Nelson said. "Thus, we believe ServiceNow has established a meaningful level of customer switching costs that connote a narrow economic moat."

Equity analyst Brian Bernard assigns Johnson Controls a narrow economic moat. Bernard notes that the market has long viewed Johnson Controls as an automotive parts company; on average, it has generated 66% of sales from automakers and aftermarket partners over the past 10 years. However, Bernard believes the company's competitive advantage is strengthening after the recent spin-off of its automotive seating business, Adient, and its merger with Tyco International. "The Adient spin-off and Tyco merger result in a more profitable and less cyclical business, one with much less exposure to the volatility of the automotive original equipment manufacturer market, or OEM, and more exposure to higher-margin, recurring service revenue," Bernard said.

Alexion's patent-protected portfolio of ultra-rare disease drugs, along with its clinical development targeting additional indications in areas of high unmet need, forms the foundation of our narrow economic moat rating, writes equity analyst Kelsey Tsai. One of Alexion's drugs, Soliris, has very high annual cost and lifelong usage, which have turned the drug into a blockbuster product. "Patients face dire prognoses without the treatment, and payers are willing to reimburse the drug, given the limited patient population," Tsai said. She anticipates that Soliris' expansion into other autoimmune diseases will be a catalyst for the firm over the next five years. However, the growing pipeline of competitors in the complement-mediated disease space leads us to lower our moat trend to stable from positive.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)