What Impact Are Higher Rates Having on Housing?

Weak November housing data implies that higher rates may be a headwind for 2017 housing growth.

This week, there really wasn't much to write about in terms of economic news. Through Thursday, most markets were little changed, with the U.S. doing the worst, Europe about flat, and some healthy gains in emerging markets. Bond rates were down a little, driving bond prices up.

Most of this week's news was on housing, with some price data and pending home sales. Since we haven't had a housing review for a while, and because we didn't talk about all of last week's housing news, our focus this week will be on the slowing we are seeing in housing. Data is certainly not in a free-fall, but it's enough to limit 2017 GDP growth. We suspect higher interest rates are the primary cause of the housing industry's troubles.

Outside of housing the only real news was another widening trade gap for the month of November. With the dollar still strong and farm products no longer providing much help, exports declined and imports increased. Unfortunately, if the trade numbers continue on their current path, net exports could be a significant headwind to the fourth-quarter GDP calculation. Although most economists were anticipating this, the magnitude of the problem appears larger than expected, with the potential to take 1% or more off of fourth-quarter GDP. Expectations were for a more modest 0.25% negative net export contribution for the whole quarter. That could put fourth-quarter GDP growth under 2% unless we have a huge trade rebound in December.

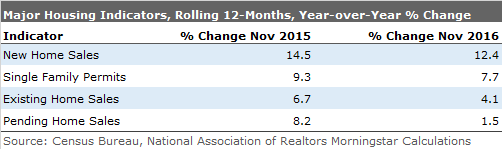

We have been tracking the housing industry statistic very closely to try to gauge the psychological impact of Donald Trump's election and sharply higher interest rates. The November data has been trickling in slowly. With our four key housing metrics now in for the month, there appears to be some modest deterioration in the data, especially on a year-over-year basis. On a rolling 12-month basis, growth rates are down from year-ago levels in all four cases: new homes, existing homes, the more forward-looking permits, and new home sales data.

The falloff is certainly no disaster, but it likely means that housing will have a hard time matching its longer-term contribution rate to GDP in 2017. With the consumer already under pressure, this is not great news.

The shorter-term month-to-month data hasn't looked so hot, either, with both single-family housing permits down along with pending home sales. Existing-home sales eked out a small monthly gain while new home sales showed some nice growth in November.

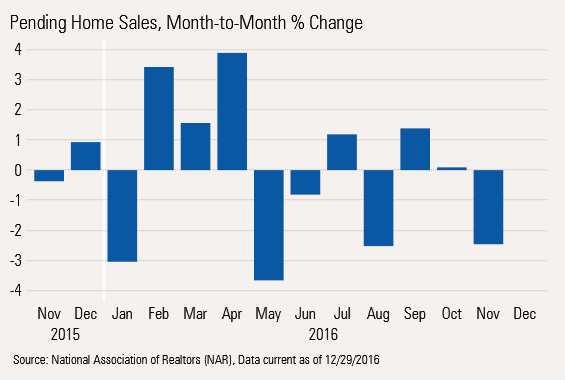

One troubling sign this week was softness in the pending homes data, as shown below.

This great leading indicator has had a rough time the past two months and hasn't had any great months since spring. These numbers are seasonally adjusted, already accounting for the fact that spring is normally a strong time for home sales.

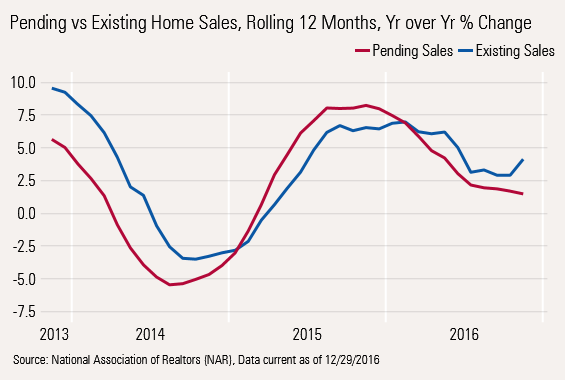

Still the year-over-year, rolling 12-month data looks even worse. That data, shown by the red line below, suggest the market for existing homes continues to weaken under the burdens of low inventories, high prices, and now higher interest rates.

It's interesting to note that the blue line above, representing existing-home sales, has fared better. It appears that buyers are rushing to close sales quickly on already-signed deals to avoid higher interest rates. We believe that is the primary reason the two lines have diverged recently.

Unfortunately, there will likely be payback in the months ahead, and existing-home sales growth may fall below the 1.5% pending home sales rate. Pending home sales are a very good future indicator of existing-home sales. A signed contract normally precedes a closing by 30-60 days.

Much higher mortgage rates are not helping, and could prove to be an even bigger headwind for December and beyond. The current 4.32% mortgage rate compares with just 3.42% at the end of September. On a 250,000 loan, the monthly payment would be $1,240 per month now versus $1,111 a year ago. That is a hard-to-stomach 11.2% increase in just three months' time. We would like to believe that long-term rates could top out, or least pause here as longer-term rates have jumped far higher than short-term rates, suggesting that even if short-term rates move higher, the long-term rates, such as mortgages, may not follow.

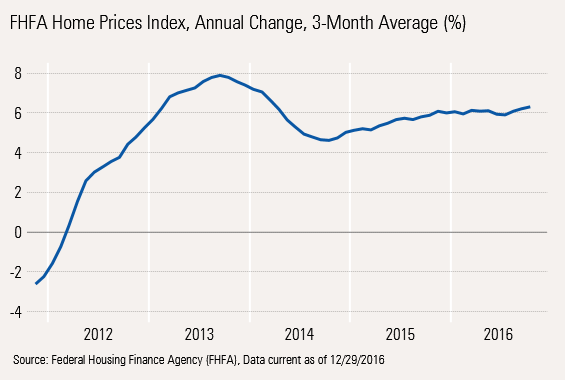

Unfortunately, accelerating home prices will not help matters. According to the FHFA, home prices increased 0.4% (4.8% annualized) in October, compared with September. That was mercifully lower than the 6.2% year-over-year increase, but still high enough to cause problems.

Also, the year-over-year rate keeps creeping up. We hope that the current 6.2% rate represents a top, but that can't be guaranteed. With inventories still low and demographics favoring the housing industry, seeing a top in this data might be a bit of wishful thinking. On the other hand, higher interest rates might put a stop to the increases. Only time will tell.

The year-over-year regional data has begun to converge. It's no longer the situation that it was at the beginning of the recovery, when almost all of the big increases were on the West Coast (though it still leads the way). Growth rates are now between 8.3% (Mountain) and 3.3% (Mid-Atlantic). Besides these two regions, five regions are at about 5% growth. The South Atlantic Region, at 7.6%, has now joined the Mountain and Pacific regions on the leader board (8.3% and 8.0%).

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)