Women Fund Managers Making Gains Among Passive Funds, Funds of Funds

Global study finds women have better odds of winning management roles in growing parts of the industry.

In a new global study that looks at fund managers by gender, Morningstar found that women are underrepresented in fund manager roles worldwide, but we found some areas where women are making some gains. Women are more likely to manage a passive fund rather than an active fund, and they're more likely to be chosen to run a fund of funds than a fund that buys and sells individual securities. Women are more likely to share management responsibilities with others, and women managers individually oversee a lower number of funds.

Our study looked initially at where women are managing funds by geography. From there, the goal of our modeling exercise was to determine if certain characteristics are more prevalent among women fund managers relative to men fund managers. To begin, we defined our dependent variable to be the manager's gender and then we deployed a logistic regression to our data. Our technique allowed us to measure gender among each independent variable, so our model told us the change in odds of the manager being a woman for a typical, one-unit increase in each variable. We controlled for factors such as region, fund age, and manager age so we could be certain that our results were not swayed because of regulatory regimes or because opportunities are skewed based on the fund's age or the tenure of a manager.

Women are less likely to manage active funds. One of the most statistically significant findings of our study is that a woman is more likely to manage a fund that closely tracks an index than manage a fund that is actively managed, meaning it deviates from the benchmark index. The odds of a woman managing a passive fund over an active fund in the same asset class is 1.36:1. For a fixed-income fund, her odds of being named a passive fund manager over active are 1.23:1. And a woman's odds of running a passive allocation fund versus an active fund are the highest: 1.41:1.

At first glance, we could assume that women are benefiting from a growth area for the industry. One might argue that women are earning jobs as passive fund managers because more passive funds are being launched, and it appears easier for a woman to earn a newly created position than unseat the existing manager of an established fund. Our study's construction, however, suggests that women's odds are improving beyond industry growth. In our model, we controlled for both the age of the fund and the manager's experience level. We also ran our study each month to capture as much of the industry shift to passive management as possible. Put another way, the controls allow us to determine whether a woman's odds of managing a passive fund have increased or decreased absent of industry trends, and we find that women still are far more likely to manage passive funds than active funds.

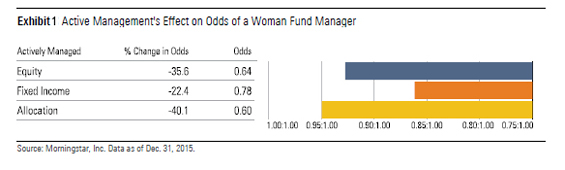

Conversely, our study found that women have lower odds of managing an active fund, which is a longer-established portion of the mutual fund industry. We do not suggest, however, that women are moving from active to passive management. Women--and men, for that matter--need different skills to manage active versus passive funds. With active funds, the manager aims to deliver higher returns than the fund's benchmark index by assembling a group of securities--or portfolios of securities. Active managers are responsible for every investment decision. With passive portfolios, the fund manager's objective is to deliver returns that match the benchmark and ensure that the owned securities meet the outlined investment criteria.

Our analysis cannot tease out whether women are being disproportionately offered passive-management roles or if they are actively choosing to do so. Regardless, the data tells us that the average woman fund manager is less likely to be involved in active management.

Women are managing funds of funds at an increasing rate. Since the start of our study, across asset classes, women fund managers have had increasing odds of being named a fund-of-funds manager. As the name suggests, funds of funds' holdings are not individual securities, but other funds. For equity funds of funds, the relative likelihoods for women increased to 1.49:1 from 0.96:1 over the course of our study. Women were far less likely to run a fixed-income fund of funds at the beginning of the measurement period, but a woman's odds of being named portfolio manager improved significantly to 0.96:1 from 0.52:1. The best odds of a woman being named portfolio manager of a fund of funds rests with allocation offerings. The odds fluctuated, starting at 1.35:1 and ending at 1.30:1.

These results--combined with our earlier findings about passive funds--suggest women are less likely to manage portfolios that center on individual security selection and more likely to allocate assets, select managers, or implement indexing strategies.

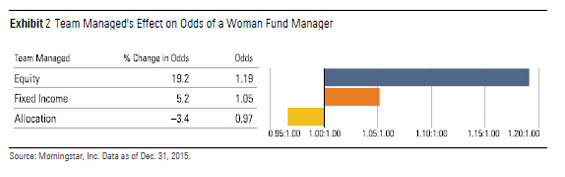

Women are more likely to be a member of a management team than a solo manager. Initially, this trend toward women being named to team-managed funds was one of the most discouraging correlations: Women are more likely than men to share management responsibility than to run a fund solo.

A team-management assignment may seem less appealing on the surface, but academic research suggests that women may prefer to work in teams. A 2011 study by Healy & Pate found that generally "women prefer to compete in teams, whereas men prefer to compete as individuals." They suggested that the formation of teams may help reduce representative gender gaps. Their analysis specifically looked at the role of teams within competitive environments. Given the fund industry's unchanging emphasis on performance relative to peers, it is reasonable to expect that women may prefer to work on team-managed funds over the long term. For this study, we control for different levels of competition within categories and the impact on the team-managed funds in those peer groups using the Herfindahl-Hirschman Index, which is a measure of market competition.

Fortunately for women, team-managed funds are in vogue. When our study began in January 2008, the percentage of team-managed funds was 39.7%, but by December 2015, that percentage rose to 45.1%. Since we update the model each month, monthly growth is reflected in our output. When we look at the relative likelihoods of women being named to a team-managed fund through time, we see minimal shifts in how men and women are named to fund-management teams. If the same rate of opportunities were available to men and women, the odds would be 1:1. This was the case for the better part of the study for fixed-income and allocation funds. In late 2013, however, the two asset classes diverged. Women are still more likely to be hired in a team for fixed-income, but the opposite effect occurs for allocation funds. Among equity funds, women had higher odds of being named to a team than as a solo manager. The odds of her being named to a team-managed fund are 1.19:1.

Ideally, the typical woman fund manager would have the same likelihood of running a fund solo as a typical male fund manager. However, Healy & Pate's research suggests the rise of team-managed funds may be a sign of propitious environments for women in the fund industry.

Women are less likely to manage multiple funds at once. We found that in cases where a woman manages one fund, her odds of managing a second fund are lower. Her odds get lower still with each additional fund. Specifically, after the first management assignment, a woman's odds of a second assignment go down to 0.94:1, 0.60:1, and 0.99:1, for equity, fixed-income, and allocation funds, respectively. Regardless of asset class, we saw this trend hold up. Women are named on fewer funds than men. This finding may suggest that women are less likely to be investment-policy leaders or viewed by their firm as star managers who can attract assets to offerings based on their reputations.

/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)

/s3.amazonaws.com/arc-authors/morningstar/895d7187-cd0c-437c-9fe4-63a22a4ba47c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/895d7187-cd0c-437c-9fe4-63a22a4ba47c.jpg)