Absolute-Return Funds Aren't Hitting Their Mark

Investors would have generally done better in portfolios of passive investments than in target-return funds.

We recently released a study of the generally disappointing results that much-hyped objectives-based investments have delivered to investors. A summary of the research can be found on Morningstar.com, and the full paper is on our corporate site. Today's article looks more closely at multiasset target-return funds, one of the fastest-growing subsets of objectives-based investments.

Target-return funds, also known as "absolute return" strategies, can vary quite widely in terms of the investment strategies they pursue and securities they buy. But, by and large, these different approaches coalesce around a single overarching goal: Earn positive returns regardless of market environment.

The pursuit of positive returns intuitively resonates on a few levels. From a behavioral finance perspective, it addresses investors' strong preference to avoid losses. From an objectives-based framework, it can be attractive to investors looking to hit a certain return level; a number of target-return funds, for instance, come with specific return objectives, such as cash plus 4% or Consumer Price Index plus 5%.

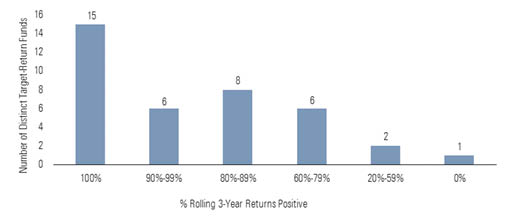

Target-Return Funds Deliver Positive Returns, and So Does the Index Target-return funds don't produce positive returns month after month in unerring fashion. This is no indictment, as it is probably not reasonable to expect that of virtually any strategy. So, instead, we evaluated the performance of target-return funds over rolling three-year periods. By that measure, they fare pretty well: Of the 38 distinct target-return funds with at least three years of returns, 15 delivered positive returns in all rolling three-year periods since inception. As shown by Exhibit 1, a good majority produced positive returns in more than 80% of rolling three-year periods.

Exhibit 1.

Number of funds that have positive three-year rolling returns, April 1, 2006, to March 31, 2016

- source: Morningstar Analysts

However, there's a catch: Comparable 30/70 and 50/50 blended indexes also had positive returns in every rolling three-year period in the past decade through March 31, 2016. We mainly compare target-return funds to a 30% equities, 70% fixed-income blended index because our holdings data show that they have an average net equity allocation of about 30%. However, as a number of the funds reside in the multialternative Morningstar Category, they often use derivatives, which may result in a different true equity exposure. Over the past three years, target-returns funds' average monthly returns had a 0.91 correlation with a 30/70 index. Their correlations were highest--at 0.95--with a 50% equities, 50% fixed-income index, so throughout this section we also compare the funds with a 50/50 index.1

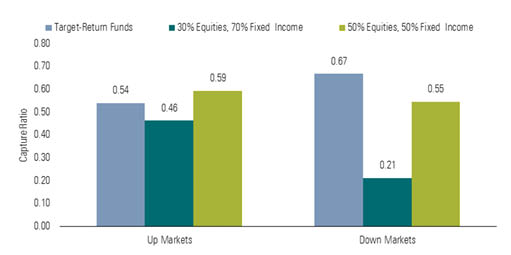

A few caveats apply to this comparison. First, while target-return funds' average performance may resemble these simply constructed index composites, they're very different approaches. Indeed, the target-return funds within the multialternative category employ alternative investment strategies, which are a far cry from the traditional stocks and bonds of the 30/70 or 50/50 composites. In addition, U.S. stocks have been very difficult to beat over the past decade, arguably making upside capture more important than downside avoidance. Yet, as shown in Exhibit 2, target-return funds appear to excel primarily at avoiding losses, and thus, one could argue, this has placed them at a stylistic disadvantage in recent years.

Exhibit 2. Target-Return Funds Protect on Downside, and So Does the Blended Index

Average monthly up- and down-market capture ratios versus the S&P 500, April 1, 2006, to March 31, 2016

- source: Morningstar Analysts

Nevertheless, even after accounting for these factors, target-return funds have turned in rather disappointing results. For one, the two blended indexes capture less of the S&P 500's dips than the typical target-return fund; each index lacks exposure to high-yield bond funds, which has helped. For another, in exchange for the downside protection they've afforded, target-return funds have sacrificed much of the upside.

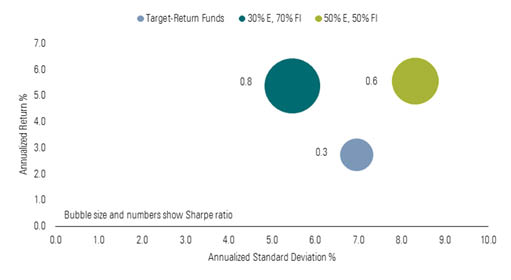

Those up- and downmarket capture patterns translate to consistently inferior 10-year and rolling three-year risk and return statistics compared with the blended index. Exhibit 3 charts target-return funds' overall risk and return statistics over the past 10 years from April 1, 2006, to March 31, 2016. During that time, the typical target-return fund had an annualized gain of 2.7%, while the 30/70 index returned 5.4% and the 50/50 index grew 5.6%. That 2.7-percentage-point return differential between the average target-return fund and the 30/70 index is still greater than the 1.77% average prospectus net expense ratio of each target-return fund's oldest share class.

Exhibit 3. Target-Return Funds Have Higher Standard Deviations, Lower Returns Than Blended Index

10-year annualized returns, standard deviations, and Sharpe ratios, April 1, 2006, to March 31, 2016

- source: Morningstar Analysts

Target-return funds' higher fees explain much of the performance shortfall but not the difference in volatility. In the past decade, target-return funds have an average annualized standard deviation of 7.0% compared with the 30/70 index's standard deviation of 5.5%. The funds were less volatile than the 50/50 index's 8.3% standard deviation, but that wasn't enough to make the funds come out ahead on a risk-adjusted basis, as measured by Sharpe ratios.

Attribution analysis of the rolling three-year periods over the past decade through March 2016 reveals that a combination of poor asset allocation and security selection explains the shortfall to the 30/70 index. Although target-return funds routinely allocate assets among a bevy of different asset classes and strategies, those moves have not bolstered returns.

Recommended Target-Return Funds Although target-return funds haven't delivered as a group, some funds have merit. Those funds are run by experienced teams with proven long-term and consistent records of beating their peers and indexes. To wit, two funds have earned medals under our Morningstar Analyst Rating, meaning we believe they are well poised to deliver strong risk-adjusted results compared with their peer groups and relevant indexes over a full market cycle.

GMO Benchmark-Free Allocation

GBMFX

This is one of about a dozen funds not within the multialternative category that falls within the target-return group. It qualifies for the group because it has an inflation plus 5% annual return target, with a 5% to 10% annualized standard deviation goal. Since its July 2003 inception through June 2016, its annualized 8.5% gain has readily met the return goal--CPI All Urban increased 2.1% during that period. It has done so with a standard deviation of 7.2%.

We downgraded the fund to Bronze from Silver in June 2016 because of a manager change and organizational stress at the firm. Comanager Sam Wilderman plans to leave GMO by December 2016, yet lead manager Ben Inker's continued presence still inspires our confidence in the fund. Inker will continue to maneuver GMO Benchmark-Free Allocation across almost two dozen asset classes, changing allocations based on an overarching firmwide view that valuations and profit margins eventually revert to their long-run averages. Over the past decade, the team has allocated roughly half the fund's assets to equities, with half of that portion invested in non-U.S. stocks. The fund compares well with a 50% MSCI ACWI/50% Barclays U.S. Aggregate Bond composite index, which gained an annualized 6.2% with an 8.1% standard deviation from the fund's July 2003 inception to June 2016. —Leo Acheson

This Bronze-rated fund targets a return of cash plus 5%. Since its December 2011 inception through June 2016, it has an annualized return of 3.1% and standard deviation of 4.1%. Adding back its net expense ratio of 1.34% gets the fund closer to meeting its return target (most objectives are typically on a gross-of-fees basis). It has had a globally diversified, average net equity exposure of about 20% since inception. A 20% MSCI ACWI/80% Barclays U.S. Aggregate Bond composite index gained 4.5% during the same time period, with a standard deviation of 3.2%. The fund was on a stronger trajectory prior to 2015's low-return environment. There's reason to believe that this global macro strategy's well-developed and risk-aware process can get it back on a stronger performance track in the future. Lead portfolio manager Guy Stern tactically invests in global stock, bond, and currency markets and draws from the best ideas of a more than 50-person global absolute return analyst team. —Jason Kephart

1 Within the blended indexes, non-U.S. equities represented 30% of the composite's total equity sleeve. We used the S&P 500 to represent U.S. equities, the MSCI ACWI ex USA Index for non-U.S. equities, and the Barclays U.S. Aggregate Bond Index for fixed income.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)