Is the Golden Era of Dividend Growth Over?

Several factors are conspiring to thwart dividend growth, explains Morningstar DividendInvestor editor Josh Peters.

This article was published in the June 2016 issue of Morningstar DividendInvestor. Download a complimentary copy of DividendInvestor here.

It's provocative and possibly dangerous to call an end to an era, but I'm going to give it a try: The golden age of dividend growth is over.

Maybe you didn't even know that there had been a golden age of dividend growth, but I trace its start to 2003, when tech bellwether

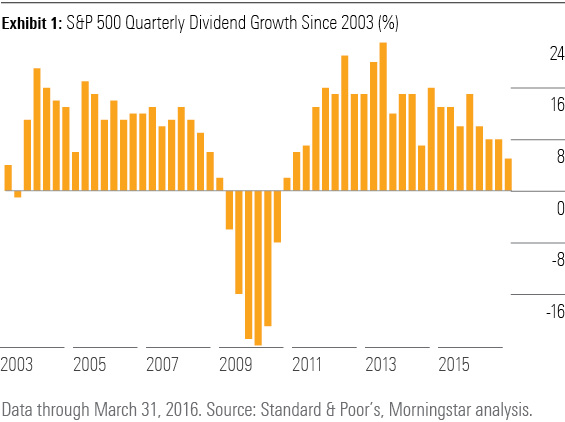

History illustrates just how golden this golden age has been. There was that nasty stretch from the fourth quarter of 2008 to the first quarter of 2010 in which dividend payments shriveled at the fastest pace since the Great Depression. The nadir came in the third quarter of 2009, with dividends down 24.1% year over year. Some of that decline reflected dividends that had been raised too much in the preceding boom, particularly in the banking industry. The plunge also made it easier for double-digit growth to return as corporate profits and dividends recovered; only in the third quarter of 2012 did the S&P's quarterly dividend payment reach a new high.

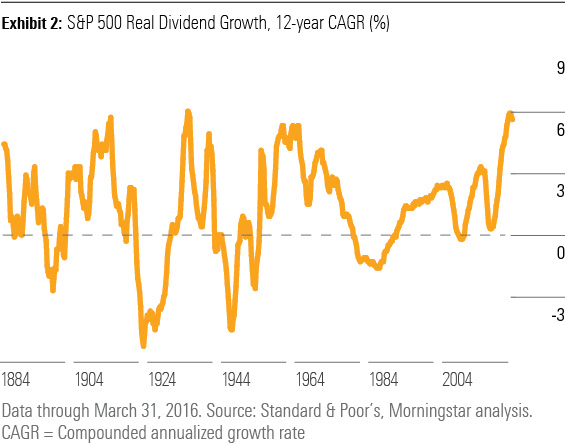

But even with the horrors of 2008–09 in our data, the 12-year growth rate in dividends (adjusted for inflation) has averaged an extraordinary 5.9% a year, edging out even the growth experienced in the post-World War II boom.

Why is the golden age over? It's not just that dividend growth has already slumped, though it clearly has. In the first quarter of 2016, S&P 500 dividends per share rose only 4.6%, the weakest advance in nearly six years. The energy sector can be blamed for much of the weakness, including cuts by

Dividend Select stalwart

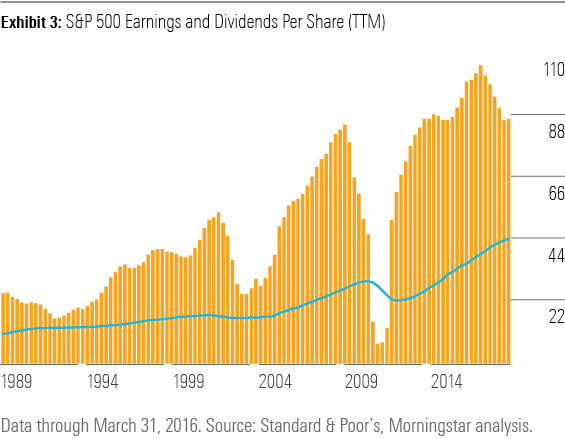

Similar forces are at work in the market at large. The price level of the S&P 500 may be within 3% of its all-time high, but trailing-12-months earnings per share, computed under generally accepted accounting principles, have dropped 18% since peaking in the third quarter of 2014. In the same span, dividends per S&P share have risen 14%.

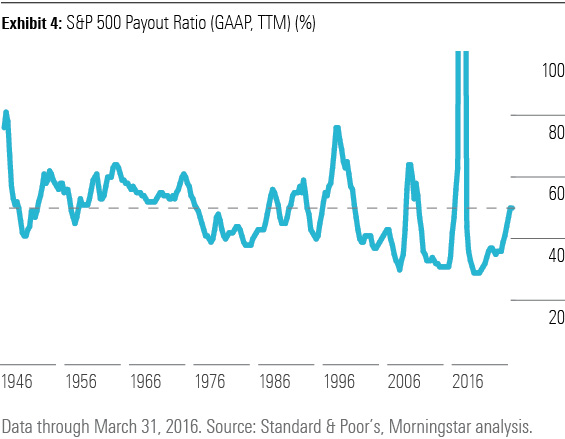

This combination of rising dividends and falling profits has created a situation that at one time I didn't believe I'd ever see outside a recession: a historically normal payout ratio for the U.S. stock market. For the entire run of DividendInvestor, I've been complaining about low yields and payout ratios. The median payout ratio for the post-World War II period is 50%, but since the tech bubble, this metric has scraped new low: just 29% at the 2011 nadir. But with the numerator (dividends) of the payout ratio continuing to rise since third-quarter 2014 and the denominator (earnings) falling, a big shift took place in a hurry. In the four quarters through the first quarter of 2016, the payout ratio of the S&P 500 has reached the 50% mark: normal at last!

I strongly suspect that payout ratios will now constrain the rate of dividend growth--not just for individual stocks here or there like P&G, but for the market as a whole. There's simply a lot less catching up to do. For example, there are a lot fewer firms that don't pay dividends at all than there used to be. At the beginning of 2003, only 351 of the S&P's 500 members paid dividends. Today, 418 do, accounting for 88% of the profits Wall Street estimates for 2016.

Facebook FB could move the needle by joining the dividend parade (inconceivable as this might be), but

Also, and perhaps more important, most of the top payers of dividends today already look about as generous as they ought to be. Of the $411 billion of annualized dividends I estimate for the S&P 500, half is paid by just 37 firms. Some could legitimately afford to pay more without starving their businesses for growth capital or paying too much to be sustained through the next economic downturn, but I can call out only a few (

Finally, there is the matter of corporate earnings growth, the ultimate wellspring of dividend increases. Forget about the next couple of quarters: Consensus earnings estimates for the back half of 2016 are as preposterously high as ever. What can we expect for actual corporate earnings growth over the long run?

The past is not a perfect predictor of the future, but it's a reasonable starting point. In the past 70 years, real earnings per share for the S&P 500 have grown at just 2.8% annually. To this we might add another 2 percentage points for inflation, on an assumption that the Federal Reserve eventually gets the inflation rate it wants. This lifts long-term EPS growth to the neighborhood of 5% in nominal terms.

Then there's the question of share repurchases, which are a major theoretical contributor toward EPS growth--perhaps 3 percentage points in the past 12 months alone. However, the practical, enduring benefit of widespread share repurchases is debatable. Much of the buyback spending merely offsets shares being issued to executives and employees, the full economic cost of which is not captured under current accounting rules (but--surprise--is fully deductible for tax purposes). Buybacks are also procyclical in a value-destroying fashion: Companies buy in gobs of shares when cash is plentiful and stock prices are high, but in tough times, at least some of those shares wind up being sold to replenish capital at low prices. Perhaps buybacks are worth 1 or 2 percentage points of growth in addition to the historical average.

However, unfavorable demographics alone might knock a percentage point off this figure, as retiring baby boomers trim their spending. Weak productivity growth is another problem; so is the nascent downtrend from a peak in corporate profit margins. A lot of buybacks have been financed by borrowing rather than excess free cash flow, highlighting the unsustainability of recent repurchases.

Furthermore, for most of market history, corporations increased their earnings per share by investing retained earnings in expansion. Why should we assume that earnings not paid out as dividends will earn higher returns through buybacks--let alone at today's lofty valuations--than old-fashioned investments in property, plant, equipment, and inventories would have? I'm not sure we should credit the future EPS growth profile of the S&P 500 with any credit for buybacks at all, in which case even 5% might be an optimistic figure. (I plan to investigate this line of thought in further detail in the months ahead.)

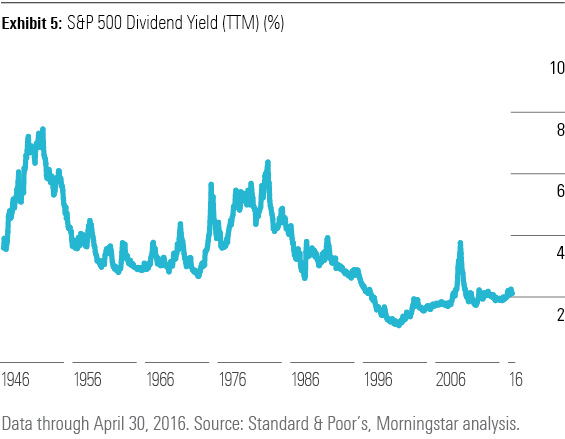

The saddest part of this story is that the rise in payout ratios has not been accompanied by much improvement in dividend yields. A historically normal dividend growth rate of 5% would be fine in the context of a 4% dividend yield, which was the S&P 500 average from 1945 through 1995. But with today's market yield barely above 2%, a reversion to normal dividend growth spells weak total returns for years to come.

I'm not the only one to notice that dividend growth is slowing, but I'm surprised by the conclusions other people have drawn. Far from making dividends less attractive or less relevant, slower dividend growth makes dividends--specifically large ones that provide rich dividend yields--that much more important!

This isn't to say we won't be affected by the slowdown in dividend growth: We already have been. Adjusted for changes in our portfolio and income reinvestment, we enjoyed dividend growth averaging 8.4% a year from 2011 to 2013--not nearly as much as the S&P, but very good considering we were collecting double the market's yield. As our companies had generous dividends already and therefore less room to sustain rapid dividend growth amid headwinds for profits, our growth rate slipped to 5.5% in 2014 and 2015. Today, I figure we're running at or just below the 5% mark.

But dividend growth is uncertain and cyclical; dividend income--though not guaranteed--is a far more reliable driver of returns. By creating a portfolio with almost double the dividend yield of the market, we're much closer to meeting our long-term goals in a slow-growth environment than the average investor.

/d10o6nnig0wrdw.cloudfront.net/05-08-2024/t_f17f0449d3314a27b966dcee5d39a6cb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)