Get Your Hands on Hanesbrands

Near-term sales headwinds have caused the market to unfairly punish this narrow-moat firm.

With significant weather headwinds, few new apparel trends, and poor inventory management resulting in heavy discounting across the board, apparel stocks had a very rough time. However, we think these short-term issues present long-term investors who can weather a couple of volatile quarters with an attractive opportunity to own stocks with long-lasting competitive advantages and significant growth opportunities.

We see

Top-Line Weakness Looks Macroeconomic, Not Company-Specific When we approach our long-term investment thesis, the most significant factor driving our comfort in future cash flows is the sustenance or advancement of the company's competitive advantage, or economic moat. Although short-term noise and macroeconomic cyclicality will affect overall performance in the apparel retail space, competitive advantages will allow companies with moats to weather these temporary storms, making their stocks good long-term investments at an appropriate valuation. Hanesbrands' top-line growth has come under pressure recently, but we believe this is driven by overall apparel market weakness and not a shift in competitive advantage.

First, U.S. retail sales data supports the belief that overall apparel retail sales are weak. In the first three months of 2016, clothing and accessories sales grew 2% while department store sales declined 4%. Second, although there are nuances in apparel product and strategic offerings, our coverage universe saw fourth-quarter 2015 comparable sales growth come in slower than the first three quarters, and expectations are for 2016 comparable sales to be weaker than the average annual projection over the next five years. Again, we believe this supports the notion that weak fourth-quarter 2015 and expected 2016 performance is an industrywide problem.

Finally, weakness in sales correlates very closely to lackluster performance at Hanesbrands' largest distributors, again showing that weakness is a retail problem, not a brand problem. Eighty percent of Hanesbrands' sales are in the United States, with 87% of sales done through wholesale channels. Forty-nine percent of sales are mass merchant. If we look at the three largest retailers of Hanesbrands (Wal-Mart with 23% of sales, Target with 15%, and Kohl's with 5%), we see that the weakness is channel-wide, not company-specific.

Brand Competitive Advantage Stronger in Innerwear Although we believe a brand intangible asset can be strong enough to command an economic moat, in most of apparel we typically view any competitive advantage as more transient, as there are no switching costs attached to it for the consumer. However, in the innerwear category, the power of brands appears stronger than in the rest of apparel, as consumers dislike trying on undergarments to find the correct fit and sizing of a different brand, giving the category a small switching cost. According to Sourcing Journal, nearly 80% of consumers say fit is very important to underwear purchase decisions, followed by comfort. Price ranks only fifth in the list of importance, showing that a brand that stands for quality and consistency has pricing power.

This compares favorably with the general apparel market. According to a Prosper Insights & Analytics April consumer survey, more than 80% of respondents usually or only buy clothing when it's on sale, showing the importance of pricing in general apparel purchases versus innerwear. Only 50% say that familiar labels are important in general apparel purchases.

Additionally, innerwear is a replenishment category, which we think makes it slightly less discretionary. According to Sourcing Journal, among consumers who have purchased underwear in the past year, 56% did so because they needed new pairs, 47% because old pairs were worn out, and only 37% because they wanted new and different underwear. Over time, shipments tend to match sell-through, and Hanesbrands has about six to nine months of visibility into input costs and can adjust pricing ahead of the costs flowing through. Therefore, the replenishment nature of the category yields margin stability. This margin consistency compares favorably with other apparel manufacturers that have less pricing power, less stringent manufacturing process control, and wider swings in demand.

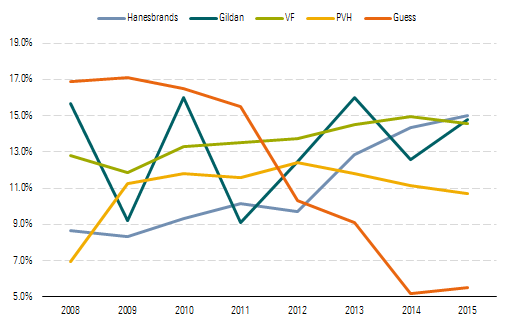

Hanesbrands Has a More Stable Operating Margin Than Many Other Apparel Manufacturers

Significant and Underappreciated Margin Expansion Opportunity We think three things will drive operating margin expansion. First, we think a second contributor to Hanesbrands' economic moat is the cost advantages the firm obtains through its scale and vertical integration. We see this as a very defensible and sustainable moat source. Hanesbrands produces about 2 billion units annually with roughly 80% manufactured internally. When it can internalize high-volume styles, we estimate that it saves as much as 15%-20% in costs. We see the company moving toward producing 90% internally over time. Also, with a focus on improving manufacturing processes, the company has generated $35 million-$40 million, on average annually, in efficiency gains. This is roughly 1% of 2015 revenue and can result in about 60 basis points of margin improvement annually.

Second is the Innovate to Elevate strategy. From 2013 to 2015, Hanesbrands spent about $177 million on design, research, and product development. The goal of the program is to identify relevant consumer insights and long-term megatrends that will affect the company's categories over the next 5-10 years. Examples of products launched include Tagless T's, ComfortBlend, ComfortFlex Fit, and X-Temp. We think customers are willing to pay up for these innovations. For example, in 2013, sales of ComfortBlend were up 125% year over year and were being sold at a 50% premium to core. X-Temp products were at a 75% price premium to core. We think this pricing premium will aid in gross margin expansion as innovative products are introduced and penetration increases for existing products. We expect a new Innovate to Elevate product for the core category as early as the back half of 2016.

Third, selling, general, and administrative expense can be leveraged. Although there has been some noise as synergies from acquisitions have trailed revenue recognition, the company expects SG&A to increase at about half the rate of sales. We agree that the manufacturing capabilities of Hanesbrands will allow for this. Over the past three years, SG&A has averaged roughly 22.8% of revenue. However, at closest competitor Gildan GIL, SG&A averaged 12.6% of sales for the same period. Although we agree that differences in product, manufacturing capabilities, and geographic distribution can account for some of this, it demonstrates to us that there is a reasonable amount of room for leverage.

Future Acquisitions Provide Unmodeled Upside Given the difficulty in projecting the size and timing of acquisitions, our model does not incorporate any further M&A activity. However, we note that acquisitions are core to Hanesbrands' growth strategy, and we see further action as likely. We think this growth strategy will build shareholder value as the company has historically paid a fair value for acquisitions, selected targets that are aligned with the core business, and delivered impressive synergies, given its scale and manufacturing capabilities. In fact, Hanesbrands has added $120 million in operating profit through acquisitions but then added an additional $170 million in operating profit through revenue, SG&A, and manufacturing synergies it achieved.

The company has four acquisition criteria. First, the target must be in a core category. Second, it should provide complementary growth opportunities in consumer segments, channels, or geographies. Third, there needs to be a high probability of cost synergies that leverage Hanesbrands' supply chain and SG&A. Finally, the goal is for the acquisition to be accretive in the first year, excluding integration costs.

We think the company has done an excellent job executing on this strategy. Hanesbrands spent $1.5 billion on Gear for Sports, Maidenform, DBApparel, and Knights Apparel. These companies have delivered $1.6 billion in revenue, over $250 million in annual operating profit after synergies, and low to mid-teens aftertax internal rates of return.

Hanesbrands also recently closed its purchase of Champion Europe for approximately EUR 200 million. With a valuation of 10 times 2016 EBITDA and expectations to deliver an aftertax internal rate of return in the low teens to midteens, we view the price as fair and the acquisition as quickly accretive. Over the next three years, we think revenue can grow to north of EUR 250 million and operating profit can increase from EUR 15 million to EUR 25 million.

In addition, Hanesbrands announced the acquisition of Pacific Brands for approximately $800 million. This deal brings the leading underwear brands in Australia and is expected to close in the third quarter. We think synergies from moving manufacturing in house (typically a 15%-20% cost savings) will be compounded by scale benefits for previous acquisitions as the production of basic core products is plugged into Southeast Asia. At a roughly 10 times EBITDA acquisition valuation and numerous synergies, we expect this acquisition to be immediately accretive to earnings and deliver an aftertax internal rate of return in the midteens. More important, we think this acquisition, right on the heels of the Champion Europe purchase, shows the strength of Hanesbrands' acquisition capabilities, the scalability of its manufacturing platform, and its international growth potential.

Valuation Is Attractive Over the next five years, we see Hanesbrands achieving 6% average annual revenue growth and 10% average annual operating income growth.

We think top-line growth will be driven by 2% growth in the innerwear segment (46% of the business), 3% growth in the activewear segment (25% of business), 7% growth in direct-to-consumer revenue (7% of business), and 5% growth in international (20% of business). We expect Champion Europe revenue will grow to EUR 250 million and operating profit to EUR 25 million over the next three years while Pacific Brands sees mid- to high-single-digit top-line growth and operating profit rising from $56 million to $100 million in three years.

The innerwear market is large and mature with replenishment products in a stable consumption pattern. Therefore, we think low-single-digit growth expectations are reasonable and will be primarily driven by price inflation and shifts toward more innovative, higher-priced product lines.

Unlike innerwear, the U.S. activewear market is growing at low-double-digit rates, benefiting from an increase in fitness awareness as well as the athleisure fashion trend. Although we see the athleisure trend as a part of the more cyclical fashion cycle, we think that increased fitness levels are here to stay and that this will drive above-apparel-market growth opportunities for the category. Furthermore, we think Hanesbrands has an opportunity to increase its penetration in the more innovative, higher-priced performance apparel market.

Although direct-to-consumer sales are currently a small percentage of revenue (about 7% in 2015), we think this is a high-growth opportunity for the company. Overall apparel sales online are growing at a high teens rate, and we estimate that online sales average about a 16%-18% penetration of total apparel sales in the apparel category. Hanesbrands is increasing its focus and investment on this channel. One of the largest online pure plays is now the company's seventh-largest domestic customer and represents over 1% of total sales.

Finally, we see international growth driven by both increased product and geographic penetration. We particularly see the revenue opportunity as providing a long runway for growth. Champion Europe is based in Italy, and the vast majority of its business is in Southern Europe (Italy and Greece). It also has a significant retail presence with 130 stores. Finally, its products tend toward heritage cotton basics. With this acquisition, we expect Hanesbrands to expand the wholesale business, penetrate Northern and Eastern Europe, and introduce a wider product line spanning various price points and including more modern lines, similar to the performance product.

Our discounted cash flow estimates also imply that operating margin will expand from 15.0% in 2015 to 18.0% by 2020. We think DBApparel can contribute $125 million in operating profit over the next three or four years and synergies will start in 2016. We think Knights will contribute $40 million in operating profit (up from roughly $22 million in 2015) over the next two to three years. Ultimately, we believe Hanesbrands can drive double-digit earnings per share growth over the next five years through existing acquisition synergies, supply chain efficiencies, and Innovate to Elevate. There could be further upside to our discounted cash flow analysis if the company continues to make accretive acquisitions.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)