March Ratings Activity Features a Flurry of Downgrades

Two prominent Gold-rated funds were downgraded.

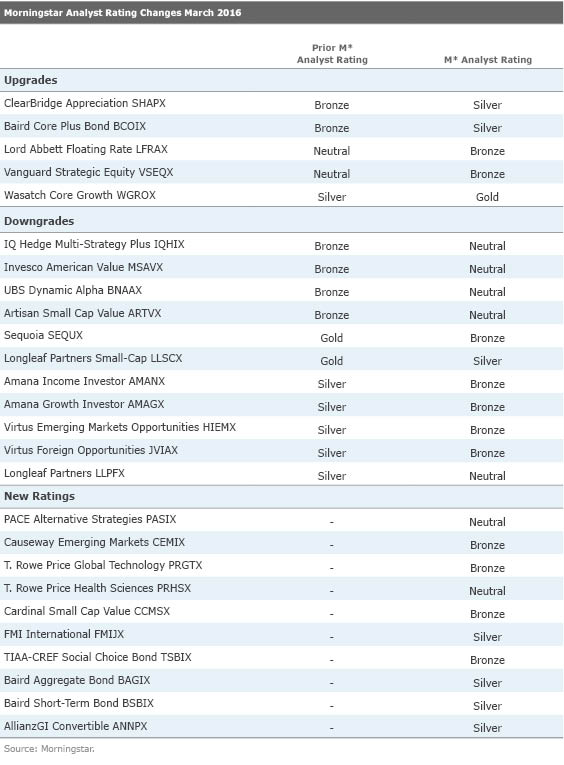

In March, Morningstar manager research upgraded the Morningstar Analyst Ratings of five funds and downgraded 11. Analysts also assigned 10 new fund ratings. The table below lists all the changes, and some notable ones are highlighted here.

Upgrades

Managers Scott Glasser and Michael Kagan have run the fund together since early 2010, and they focus on downside protection and modestly beating the S&P 500 benchmark with less risk. The managers want to be long-term owners of stocks where the potential upside outweighs the potential downside by a ratio of 3 to 1. Some of the fund’s largest holdings have been in the portfolio since as early as 1986, such as

Downgrades

This fund will perform well when energy prices rise or as other trends the managers forecast come to fruition. The managers remain insightful, their analyst team stable, and Southeastern’s strength as a parent impressive. But a fund that repeatedly makes serious errors among its heavily weighted holdings will struggle to outperform over time.

New Ratings

The fund has posted exceptional results since its inception approximately five years ago. Its 9.2% annualized gain from January 2011 through March 2016 beats 98% of its foreign large-blend peers. Currency tailwinds have benefited the fund, which fully hedges its non-U.S. currency exposure to the dollar.

Lead manager Pat English and team take a long-term, “business owner’s” approach to investing. They focus on non-U.S. firms that have strong recurring revenues, balance sheets, and returns on invested capital, with share prices trading at discounts to their intrinsic value estimates.

The resulting portfolio is concentrated and can hold more cash--currently about 20% of assets--than its typical peer. This approach has achieved a superb record with strong downside protection--a hallmark of FMI funds. Currency tailwinds won’t last forever, but this patient approach should deliver for long-term investors.

While

Mary Ellen Stanek helms a team of six named comanagers who average 32 years of industry experience. The team is rounded out with five additional senior portfolio managers and four analysts. The team invests in a mix of corporates, mortgages, and Treasuries, and it benchmarks itself against the Barclays U.S. Aggregate Index. Emphasis has been on higher-quality holdings, and the fund tends to have a higher allocation to A and BBB rated securities and a lower allocation to non-investment-grade or nonrated securities than its typical intermediate-term Morningstar Category peer.

Historical performance has been impressive. Over the trailing 10 years ended March 2016, the fund generated an annualized return of 5.2%, modestly ahead of the index and better than 77% of its peers.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)