Our Favorite World-Bond Funds

Investors need to carefully consider various currency, interest-rate, credit/default, and geopolitical risks before jumping into this steadily growing category.

The U.S. world-bond category has been growing at a steady clip in recent years, and this trend continued through 2015, albeit at a slower pace. The category more than doubled in size to $200 billion between 2010 and 2015, notching some of the biggest relative inflows within the taxable-bond space. (Only nontraditional bonds and emerging-markets bonds saw a faster rate of growth during that stretch.) While world-bond funds make sense for their diversification potential, it is also important to consider their various currency, interest-rate, credit/default, and geopolitical risks. Here we outline the key risks and return drivers of funds in this Morningstar Category and highlight a few of our favorites.

Key Risks Currency: World-bond funds tend to follow one of three currency management approaches: unhedged, tactically hedged, and U.S.-dollar-hedged. Non-U.S. currency exposure is the most significant risk to consider as currency movements have the most significant impact on risk/return profiles. This risk affects unhedged funds the most acutely, followed by funds that use tactical currency approaches. When the U.S. dollar strengthens, losses from overseas currencies can result in weak or negative returns for unhedged bond funds. That's been clear with the dollar's recent surge: From January 2013 through December 2015, the U.S.-dollar-hedged Barclays Global Aggregate and its ex-U.S. counterpart posted gains on the order of 3%-4% annualized, whereas the unhedged versions of the benchmarks registered annualized losses between 2% and 4%.

Interest rate: Most world-bond funds focus largely on sovereign debt, which makes them quite susceptible to interest-rate risk. The durations of prominent benchmarks including the Barclays Global Aggregate have run a bit longer than the Barclays U.S. Aggregate Bond Index in recent years. That said, some pockets of the asset class are more closely tied to changes in U.S. rates than others. Emerging-markets debt denominated in U.S. dollars (also dubbed "hard currency debt") is a credit-risk asset that offers a yield pickup over U.S. Treasuries in exchange for emerging-markets country risk (political, regulatory, or macroeconomic). Investors in these issues are shielded from foreign-currency risk, but a rise in U.S. interest rates tends to hurt hard-currency bond prices. When rates rise in the United States and the dollar strengthens, investors often sell hard-currency debt, while weaker emerging-markets currencies result in a greater debt load for hard-currency issuers.

Credit/default: The potential for corporate defaults and restructurings is another consideration. According to S&P, corporate default rates for investment-grade and junk-rated entities remain below long-term averages globally, and defaults remain most highly concentrated in the U.S. However, issuers from certain developed markets, including Australia, Japan, and New Zealand, and emerging-markets countries saw an uptick in default rates from 2013 to 2014. Investors in higher-yielding corporates outside of the U.S. also face differences in bankruptcy laws, which could lead to poorer recoveries in the event of a default. This risk is further amplified for world-bond funds that invest in emerging-markets corporates. Beyond corporate credit risk, emerging-markets countries have also seen periodic sovereign-debt restructurings (Ukraine and Argentina are two of the most recent examples).

Geopolitical: Country fundamentals can change quickly with turnover in political regimes, and geopolitical risk looms large, particularly in emerging-markets countries. For instance, the troubles between Ukraine and Russia have whipsawed their bond prices and currencies since early 2014.

Given the aforementioned risks, the level of emerging-markets and high-yield exposure is another important consideration when selecting a world-bond fund.

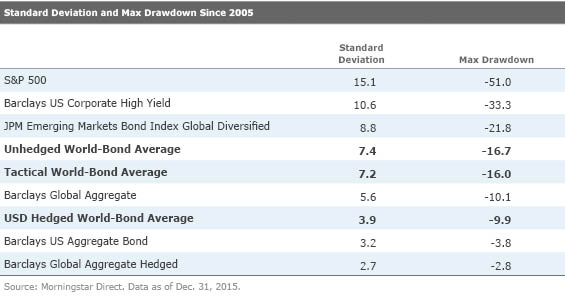

The following table compares the standard deviations and maximum drawdown (peak-to-trough loss) of several indexes and the three world-bond groups over the past decade through December 2015. A relatively small group of world-bond funds have records dating back 15 or 20 years, but a similar pattern holds for the indexes over the past 20 years.

World-bond funds generally aren’t subject to the same swift sell-offs or elevated levels of volatility as dedicated emerging-markets bond funds or high-yield offerings because the former generally sport higher overall credit quality and better liquidity. Still, the unhedged funds and Barclays Global Aggregate were roughly twice as volatile as the Barclays U.S. Aggregate over the period, and the same has been true over longer time frames, so they should be approached carefully. Meanwhile, hedged world-bond funds were half as volatile as unhedged and tactical funds, which take on currency risk.

Some of Our Favorite World-Bond Funds

Templeton Global Bond

TPINX

Templeton Global Total Return

TGTRX

These funds fall at the aggressive end of the world-bond category, making significant currency bets relative to the funds’ underlying bond exposures. It is also worth highlighting emerging-markets exposure in these funds given the volatility this asset class adds. The Templeton funds devote the most assets to the developing world, with that stake accounting for around half of the bond exposure and two thirds of the currency exposure. Longtime manager Michael Hasenstab and his team of portfolio managers and analysts have put their contrarian approach to good use, generating a topnotch long-term record at Templeton Global Bond and an impressive, if slightly shorter, record at Templeton Global Total Return.

Legg Mason Brandywine Global Opportunities Bond

GOBIX

The Brandywine fund sports a bit less emerging-markets exposure, but allocations still run higher than the norm for world-bond funds, at 30%-40% of assets. Also, this fund doesn’t engage in such dramatic bets against currencies, but it is still quite active, leaving certain currencies unhedged and fully or partially hedging others back to the U.S. dollar. Over time, its experienced team has shown that a valuation-driven approach and savvy country and currency selection can deliver strong results relative to peers and commonly used global bond indexes.

PIMCO Global Bond

PIGLX

PIMCO Foreign Bond

PFUIX

Among unhedged world-bond funds, PIMCO Global Bond (Unhedged) and PIMCO Foreign Bond (Unhedged) invest broadly across sectors (government, corporate, securitized, inflation-linked) and regions. As of September 2015, the funds had between 10% and 15% stakes in emerging-markets debt, though these stakes have gone as high as 40% of assets. The management team does make some minor currency adjustments to these funds, including downplaying emerging-markets currencies over the past year. But as their names suggest, the funds are meant to provide exposure to non-U.S. currencies and will commonly sport significant exposures to the euro, yen, and pound, which dominate the benchmark.

PIMCO offers the same strategies in U.S. dollar-hedged versions,

DFGBX

DFA Two-Year Global Fixed-Income

DFGFX

Also in the U.S. dollar-hedged camp are DFA Five-Year Global Fixed-Income and DFA Two-Year Global Fixed-Income, which are among the most conservative world-bond funds in the entire category. Not only do they remove currency risk from the equation but they also invest only in high-quality developed-markets government and corporate debt. Even though these funds have trailed the hedged group average and the commonly used Barclays Global Aggregate over time, they’ve done an admirable job versus their much more conservative benchmarks, the Citi World Government Bond Index 1-5 Year and Citi World Government Bond Index 1-2 Year.

Whether investors opt to take on foreign-currency exposure or not, we encourage them to use these funds strategically rather than as a play to boost short-term returns or to try to time currency movements. Investors should also carefully examine their existing bond portfolios before considering an allocation to a world-bond fund because non-U.S. debt has become more prominent in core-bond and multisector-bond funds. A typical fund in that category has a midteens stake in overseas bonds, and many of them devote 30%-40% of assets to these securities. Even most core-bond funds sport at least a single-digit stake in overseas debt, and some have stakes in the 20% range.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)