Strategic Beta Is Active Management

The same questions must be answered.

It's Indexing, but It's Not Passive Some call the approach "smart beta," others say "factor investing." Morningstar's preferred term is "strategic beta." Whatever the label, the tactic of buying securities that have a particular feature or group of features--such as trading at a low price/book ratio, or having high price momentum over the past 12 months--has become very popular. Those who buy such funds believe that they own better betas. Their funds will beat the market.

That, of course, is the promise of active management. Strategic-beta investing is active management. Because they are typically offered through exchange-traded funds that mimic indexes, strategic-beta funds tend to be thought of as passive investments. They are not. They implement active decisions, with the promise of delivering outperformance, and should be evaluated accordingly.

For both strategic-beta investors and traditional active managers, there are three key questions:

1) Why?

2) Still?

3) How?

Why? The strategic-beta strategy must be supported by reason. There must be some credible explanation why that particular beta--or collection of betas--is superior. The justification could be economically based and rational, or it could be behavioral. Or it could be both.

Value stocks, for example, are said to carry higher risks than their standard deviations would suggest, because they are particularly vulnerable to economic recessions. Therefore, they compensate with higher returns. They also are supported on behavioral grounds, with the argument that they deliver better performance because they are psychologically difficult to hold. Who wants to own ugly companies that sell on the cheap?

I've discussed this subject elsewhere, so I won't spend more time on it in this column. Suffice it to say that for strategic beta, as with other forms of active management, everything flows from why. If there is no satisfactory answer to that question, then those pretty back-tested numbers likely came by accident. The data were mined until they yielded something shiny and yellow--but fool's gold it was.

Still? Assume that a strategic beta can be defended. One can understand why it delivered good investment results in the past. That explanation is a necessary condition for the strategy's future success.

It is not, however, a sufficient condition.

For one, the economics may have changed. Consider the aforementioned case of value stocks, which (according to some) carry a return premium that compensates for their tendency to crater along with the general economy. Perhaps that occurred because the value-stock indexes held many cyclical companies, such as chemicals, autos, and financials. If the composition of the value universe were to change, such that utilities and energy companies were to dominate, then that argument might no longer hold.

The point is, each strategic beta is correlated with many other factors. As those correlations change over time, which they inevitably do, the performance premiums will also shift. The economics behind each strategic beta are not static.

Nor, of course, are investor beliefs.

Despite the best efforts of investment bloggers and business-school professors, behavioral biases are unlikely to change. We can lecture incessantly about buying when blood is running in the streets, but when the blood actually is running, most investors are likely to flee. (Including some of us who lecture.) In my view, strategic betas that depend upon behavioral explanations are unlikely to lose their entire justifications.

Unfortunately, because of increased investor awareness, they could become so popular that their behavioral support no longer matters. If most investors "know" that value stocks offer a free lunch by beating growth stocks while (under normal market conditions) being less volatile, and value-style ETFs and mutual funds attract hundreds of billions of dollars more than growth-style investments, the prices on value securities may be pushed up so that value no longer can have a higher future return. Even if the behavioral pattern persists.

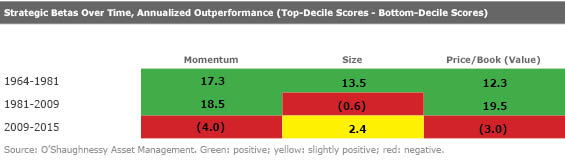

That may be what has happened to value stocks during the past few years. (Or perhaps not; in this column, I offer another explanation.) This chart below, derived from a fine article by Patrick O'Shaughnessy of O'Shaughnessy Asset Management, shows how three strategic betas have fared during the past half century. Buying value stocks and those with price momentum fared well until the post-2008 era. Owning smaller-company stocks was less successful, as that tactic petered out after the 1970s, just as the first academic recognition arrived.

Things change. Sometimes, a great deal.

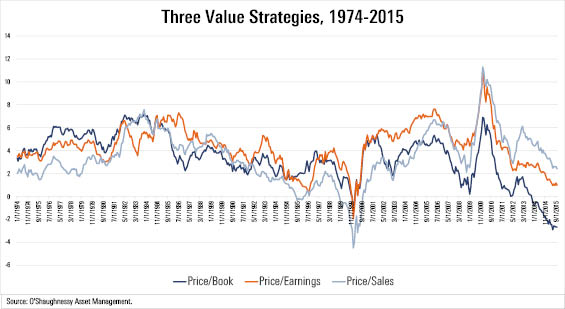

How? In another article, "Three Value Investors Meet in a Bar," O'Shaughnessy demonstrates that even if one correctly answers the first two questions, by determining 1) the source of extra performance for a strategic beta and 2) to what extent that source continues to persist, there remains the issue of how to implement that beta. There are many ways of identifying a particular investment factor.

To illustrate the thesis, O'Shaughnessy charts the 35-year results for three flavors of value investing: a) price/book, b) price/earnings, and c) price/sales. In all three cases, his hypothetical fund purchases the cheapest 10% of U.S. stocks that have market capitalizations of greater than $200 million (in today's dollars) and equal-weights the portfolio. Thus, the universe is the same, the implementation is the same, and the strategic beta to be exploited is the same. The only difference lies in the detail of how to define value.

The results, however, are far from being the same. Below are the rolling 10-year figures for the three approaches:

As O'Shaughnessy notes, the best-known value-investing tactic, that of identifying value stocks by price/book ratios (as done by Ken French and Eugene Fama in their academic papers, for example), has generally lagged behind the other two approaches. Represented by the dark blue line, its rolling returns have been strongly positive for most of the 35-year period, but often below the other two lines, and during the most recent 10 years (as shown in this column's first chart) it has slid into the red.

Thus, investors who wish to purchase a "passive" ETF that holds value stocks, to reap the assumed benefits of the value factor, have a real and important decision to make about the investment details. By no means will one value-stock ETF match the performance of another, even if they sound alike and fish in the same investment pond. The same holds for other strategic betas as well.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)