'Bogleheads' Test Retirement Readiness

We simplify and amp up a portfolio's growth potential while maintaining its focus on ultra-low-cost investments.

Jeff is a "Boglehead."

Like the investors who believe in Vanguard founder Jack Bogle's philosophy of ultra-low-cost, index-based investing, Jeff, 58, and wife Jennifer, 56, have populated their portfolio with broad-market index funds and a handful of very inexpensive active funds from Vanguard. Thanks to their attention to costs and emphasis on index products, the asset-weighted expense ratio of their $990,000 portfolio is a slim 0.11% per year, just a fraction of the 1.07% expense ratio of a hypothetical portfolio with similar weightings and average expense ratios.

And like many Bogleheads, Jeff espouses a hands-off, low-maintenance approach. In the "investment philosophy" section of his investment policy statement, he asserts, "Market-timing and performance-chasing are losing strategies."

But this couple's financial situation hasn't always been on cruise control. In his initial letter to me, Jeff wrote "Like most people, we have made some mistakes along the way. Some have been self-inflicted, others just a casualty of poor timing." The couple started a business in the early 2000s, but the financial crisis forced its closure.

"The Great Recession was a wake-up call for us," Jeff wrote. He began consulting in the health-care industry and Jennifer returned to her first career as a hospital administrator. The couple also went on a strict budget, making a habit out of saving more than a third of their $100,000 annual income even while helping to fund college for their two sons, age 23 and 20. (The younger son is just finishing up his studies.) They've paid off their mortgage and are debt-free.

With those financial successes under their belts, Jeff and Jennifer are beginning to think about their retirements. Both would like to retire at age 63--Jeff in 2020 and Jennifer in 2022. They'll rely on a combination of their pensions, Social Security, and their portfolio to meet their in-retirement income needs. They'd also like to leave some assets to their heirs. "Our hope is that some portion of our assets will remain and represent a meaningful inheritance to our children."

Funding health-care costs between their early retirement dates and the date when they're Medicare-eligible is top of mind for this couple, too, as are long-term care expenses. Although Jeff says his health is good overall, he has a long-term medical condition that could make long-term care insurance unavailable or, at a minimum, unaffordable.

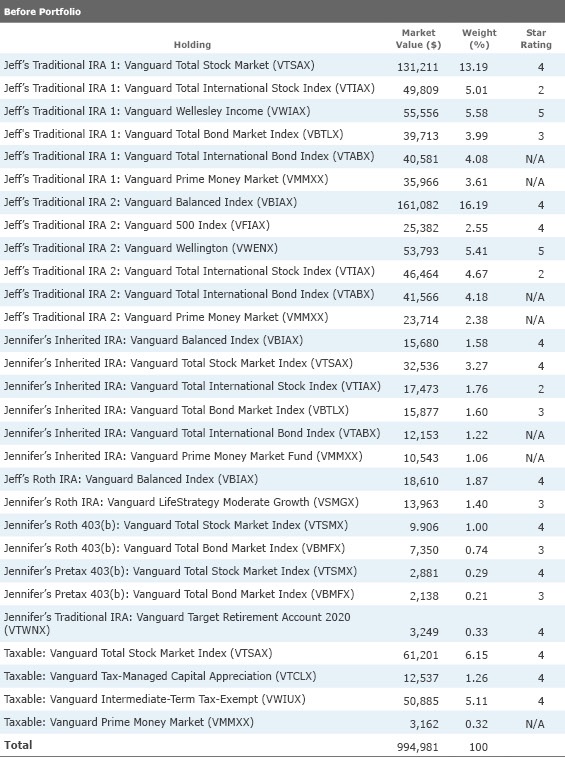

The Before Portfolio Given their emphasis on index funds, Jeff and Jennifer have tight control over their portfolio's asset-class exposures; an X-Ray of their portfolio shows their holdings to be right in line with their target 57% equity/43% bond and cash allocation.

Like most people closing in on retirement, they hold assets in a few silos. Jeff's two rollover IRAs represent the largest kitty, accounting for roughly 70% of their total portfolio. Those accounts consist primarily of broad-market equity and bond index funds, as well as two fine allocation funds,

Jennifer also has an IRA she inherited from her mother, from which she must take out annual minimum distributions on a schedule determined by her life expectancy. Her holdings in her inherited IRA are similar to those in Jeff's IRA, including a heavy emphasis on broad-market index funds. Because she doesn't need the money, she's deploying her inherited IRA withdrawals into a taxable account. Jeff and Jennifer have wisely chosen some tax-efficient assets to populate that portion of their portfolio: an equity index fund, a tax-managed equity fund, and a municipal bond fund.

Additionally, Jeff and Jennifer have been funding Roth IRAs annually, and Jennifer also holds both pretax and Roth 403(b) accounts with her current employer as well as a small traditional IRA. These accounts are a small component of their overall portfolio, however.

The After Portfolio Jeff wrote that he is targeting a 7% return for their portfolio between now and age 65, which is seven years away for him, and nine years away for Jennifer. That appreciation, combined with their anticipated portfolio additions between now and then, would bring their total portfolio value to $1.5 million at that time.

That target sounds too aggressive to me, however, given their portfolio's starting 57% equity/43% bond and cash split, meager bond yields (a good predictor of bond returns over the next decade), and not-cheap equity valuations. After a strong equity market for five-plus years, it's prudent to embed more modest return expectations into their planning.

The good news, however, is that even if Jeff and Jennifer's portfolio flatlines or even declines in value between now and when they eventually do retire, a combination of Social Security and their pensions should help make their retirements do-able. At their full retirement ages, their Social Security benefits and pension payments will exceed their current spending rate of $67,000 per year. Thus, they're in the enviable position of having a workable retirement-income plan for the bulk of their retirements without substantial assistance from their portfolio.

That said, they will be leaning on their portfolio to fulfill a few key goals. Because they'll plump up their pension and Social Security benefits substantially if they wait at least until their full retirement ages (65 for Jeff's pension and 66 for Social Security), they'll need their portfolio to provide their living expenses--including health-care outlays--in their early retirement, pre-Medicare, pre-Social Security years. They'll also rely on their portfolio to achieve their "fun" goals for retirement, especially travel. Finally, they may need their portfolio to cover their eventual long-term care costs, should they arise. If assets are left over, they will pass to their sons.

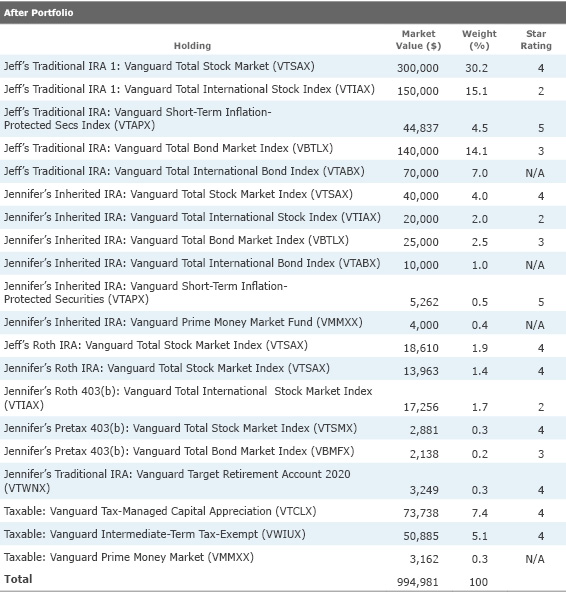

With retirement fewer than 10 years away, it's not too early for them to assess whether their portfolio successfully balances their need for early-retirement withdrawals with their need for long-term growth. Their 57% equity/43% bond mix looks reasonable; if anything, they could hold an even greater share of their total portfolio in equities, given that their retirement-income withdrawals will be limited in duration. My "after" portfolio includes a slightly higher equity weighting--65% of assets--and a higher weighting in foreign stocks--19% of the total portfolio, versus 13% in the original.

My after portfolio includes some additional adjustments around the margins. To help protect their purchasing power from their fixed-income holdings, I added in some Treasury Inflation-Protected Securities exposure--in this case

Additionally, the couple can take steps to streamline their portfolios and reduce redundancies. One of the first is to consolidate Jeff's two IRAs--rolled over from the 401(k) plans of former employers--into a single IRA. Jennifer should also consider rolling over her small traditional IRA into her Roth IRA. She can do so either right away (the tax hit won't likely be enormous, at least in dollar terms) or after they retire and have more control over their taxable income.

And while all-in-one funds like

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)