Ultimate Stock-Pickers: Top 10 High-Conviction and New-Money Purchases

Top equity-fund managers made few high-conviction purchase in the third quarter, continuing a nine-quarter trend.

By Greggory Warren, CFA | Senior Stock Analyst

When we relaunched the Ultimate Stock-Pickers concept in April 2009, our primary goal was to uncover investment ideas that not only reflected the most recent transactions of some of the top investment managers in the business but were timely enough for investors to get some value from them. By cross-checking the most current valuation work and opinions of Morningstar's cadre of stock analysts against the actions of some of the best equity managers in the industry, we hoped to uncover a few good ideas each quarter. With more than 85% of our Ultimate Stock-Pickers having reported their holdings for the third quarter of 2015, and the market correction during the period affording many of them with an opportunity to put capital to work, we've got a pretty good sense of what stocks they have been buying during the past several months.

When looking at our Ultimate Stock-Pickers' purchases, we focus on both high-conviction and new-money buys. We think of high-conviction purchases as instances where managers have made meaningful additions to their existing holdings (or make significant new-money purchases), focusing on the impact that these transactions have on their overall portfolios. We do, however, remain cognizant of the fact that the decision to purchase any of the securities we are highlighting could have been made as early as the start of July, with the prices paid by our top managers much different from today's trading levels. As such, it is important for investors to assess the current attractiveness of any security mentioned here by checking it against some of the key valuation metrics—like the Morningstar Rating for Stocks and the price/fair value estimate ratio—that are generated regularly by our stock analysts' research efforts. It is even more critical for investors to look to these metrics when the market is being as volatile as it has been lately.

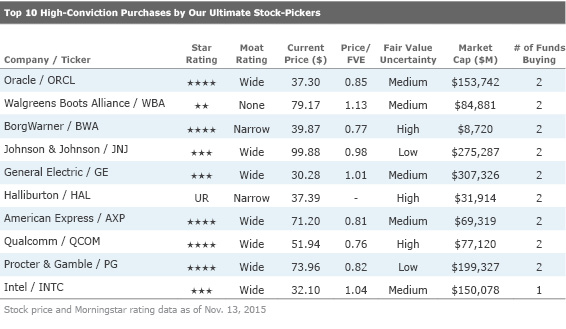

Our early read on the buying activity during the third quarter and first part of the fourth quarter has once again revealed a far smaller number of situations where our top managers have been buying individual stocks with conviction, or putting money to work in new names, than we've seen in past periods. This now marks the ninth straight calendar quarter where our top managers have generated incredibly low levels of buying activity. Of the conviction buying that did take place, most of it focused on high-quality names with defendable economic moats—exemplified by the number of wide- and narrow-moat names in the top 10 list of high-conviction purchases (as well as when the list is expanded to the top 25). The conviction buying was also far more focused on firms with low and medium uncertainty ratings, a signal to us that our top managers are sticking with established holdings where they feel they have more visibility into results over the near to medium term when putting more money to work.

One of the more noteworthy transactions that we saw during the third quarter, which did not make the early lists of purchases by our Ultimate Stock-Pickers was the outright

(PCP) by wide-moat-rated

- source: Morningstar Analysts

With regards to the top 10 high-conviction purchases, the trend of lower portfolio turnover among our top managers continues to result in fewer overlapping conviction purchases. While the

saw the lowest level of conviction buying during the past nine calendar quarters, with the number of stocks being purchased with conviction by two of our Ultimate Stock-Pickers dropping down to three (with the remainder being generated by single managers), the third quarter was a slight improvement. Even so, just three of the top 10 high-conviction purchases—no-moat

- source: Morningstar Analysts

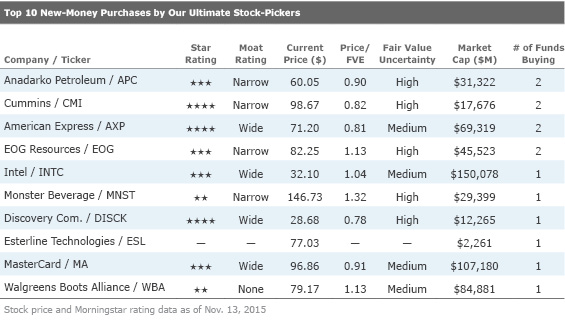

Technology and consumer stocks seemed to be of more interest to our top managers during the period, with the rest of the top 10 high-conviction purchases spread out among the remaining sectors. While the list of top 10 new-money buys had as many consumer names on it as the list of high-conviction purchases, it was far less concentrated on technology names. That said, the list of new-money purchases did have a couple of energy—narrow-moat-rated

With regards to Walgreens Boots Alliance, the firm was a meaningful new-money purchase for the managers at

Stefano Pessina has replaced Wasson as CEO and is largely viewed by many shareholders as a very competent retailer, given his earlier turnaround of the Alliance Boots business. That said, Lekraj believes that Walgreens faces a pressured operating environment, given the rapidly growing pricing power of pharmacy customers. Walgreens derives a significant majority of prescription revenue from third-party payers, largely the major pharmacy benefit managers. Large PBMs are able to aggregate an enormous amount of claim volume and leverage this into powerful pricing negotiating power. This dynamic puts enormous pressure on retail pharmacies, and it is challenging for these players to push back on pricing demands from customers. While around two thirds of Walgreens' revenue is derived from the sale of prescription drugs, Lekraj feels that firm is analogous to a mix of convenience and mass retail store, with management continuing to focus on pushing front-of-the-store (nonpharmaceutical) products to drive revenue and profitability. This strategy puts the firm in even more direct competition with mass grocers and retailers—sectors where profits and outsized returns on invested capital are hard to come by—and demonstrates Walgreens' weaker position along the pharmaceutical supply chain.

Lekraj views the firm's purchase of Rite Aid a moderate positive from an operational perspective, as the deal will expand Walgreens' geographic footprint into regions of the U.S. where it had a minimal or no presence previously; allow it to increase its drug purchasing power in order to offset some of the pricing pressure it has received from drug manufacturers; help the firm establish the most robust retail pharmacy network, giving it slightly more power when negotiating reimbursement rates with PBMs; and provide it with a material presence in the PBM space, with Rite Aid's midtier PBM EnvisionRx. But he goes on to note that Rite Aid, which had pursued a roll-up strategy before the 2008-09 financial crisis, which left it with a significant amount of debt on its balance sheet, has underinvested in many of its stores and overall infrastructure, leaving Walgreens to pick up the tab for necessary investments. He also notes that any new Walgreens/Rite Aid pharmacy will still face increasing competition from many mass and regional retailer/grocer establishments, which have collectively established significant pharmacy operations of their own. With the stock trading at a 13% premium to his $70 per share fair value estimate, Lekraj does not believe that there is much value there for investors in the near term.

Looking more closely at wide-moat-rated American Express, the stock was a meaningful new-money purchase for the managers at both FPA Crescent and

Sinegal does, however, note that this model has come under pressure more recently as competitors have targeted its cardholder base with ever-increasing levels of rewards and services, while charging merchants lower fees than American Express does. The company's image of exclusivity also took a bit of a hit earlier this year when

As for the other name that showed up on both lists, wide-moat-rated Intel was a meaningful new-money purchase for the managers at

While the overall portfolio composition didn't change much during the quarter, we do have two new holdings. The first is PayPal, which the Fund received as the result of a spin-out from its former parent company, eBay. We think the newly independent PayPal has terrific growth prospects, as the company works hard to become more relevant to merchants and consumers. We also think that eBay will benefit from the spin-out, since management now can focus all of its attention on improving its online marketplace, and not be distracted by the payments business.

The second new addition to the Fund is Intel, the well-known maker of semiconductors. We bought Intel in July after it had dropped 20% on a year-to-date basis. This weakness resulted in an attractive price-to-earnings (PE) multiple of 13x and a generous 3.3% dividend yield. While Intel is best known for chips designed for personal computers, we're more interested in its data center group (DCG) business, which now represents over 50% of earnings. The proliferation of data-hungry applications offered by Google, Facebook, Uber, Alibaba and others has placed unprecedented demands on data centers. Intel's DCG chips enable data centers to satisfy these demands in a fast and energy-efficient manner. Over the long-term, we expect Intel's DCG earnings growth to more than offset any softness related to its mature PC business.

While we were buying Intel, we were selling one of its competitors, Qualcomm. This latter stock was a long-term investment that didn't live up to our expectations, despite the company's enviable competitive position and strong secular tailwinds. We sold Qualcomm because we think the company's best days are probably behind them. So far, the Intel-for-Qualcomm swap has been a good move, as Intel is up modestly from our average cost, and Qualcomm has gone down since we sold it.

Morningstar analyst Abhinav Davuluri believes that Intel continues to be positioned well within the industry despite the shift toward mobile devices, which has propelled wide-moat rated

With the folks at Parnassus more focused on Intel's DCG business, Davuluri notes that weak enterprise spending has been the lone blemish in what has otherwise been a sterling year for DCG growth. While the company's long-term growth rate for the group is 15%, he notes that segment growth is likely to be in the low double digits this quarter because of weaker cloud demand (with customers tending not to do larger purchases in the fourth quarter of any calendar year as they don't want to disrupt their services during this period). That said, a seemingly forgotten segment of the firm's DCG growth is Intel's nonvolatile-memory business, which we believe will be a key aspect of the firm's DCG growth.

Davuluri notes that more than 80% of the memory currently sold by Intel is enterprise solid-state drives that go into data centers. By allowing customers to move up the stack, he feels that Intel can increase its presence in data centers, which should ultimately increase switching costs for the firm's processors as well. With the stock trading at a slight premium to his $31 per share fair value estimate, he encourages investors to hold out for prices closer to what the managers at Parnassus saw during the third quarter before committing too much capital to the name.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up at: http://news.morningstar.com/USPNet/emailSubmit4Update.html.

Disclosure: Greggory Warren has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)