The New, Bigger Chubb Is the Best P&C Insurance Buy

The combination of two moaty franchises will create a large-cap outperformer.

However, we are a little skeptical that the expected level of synergies will be fully realized. We don't believe that any meaningful synergies can be obtained in New Chubb's largest expense items, loss and loss adjustment expense (claims) and policy acquisition costs. Claims tend to be a completely linear cost item, and we would not expect claims as a percentage of premiums to fall materially. While there could be some possibilities to improve claims experience through fuller databases and better analytics, both companies are already essentially best in class in this area, which would seem to leave little room for material improvement. Further, Old Chubb and ACE primarily use independent agents and brokers to source business, and policy acquisition costs primarily relate to commissions paid. As a result, these costs are primarily variable, and we don't believe there are any meaningful scale benefits in this area either. That leaves administrative expenses as the only cost item that can benefit from increased scale and be materially reduced. In this light, the expected synergies of $650 million are equal to about 20% of pro forma administrative expense; this estimate looks quite aggressive, especially considering there is not a lot of overlap in the combined domestic operations. ACE primarily serves large corporate customers domestically, while Old Chubb focuses on middle-market companies and high-net-worth individuals.

But we do believe some meaningful synergies can be realized. Beyond the corporate-level synergies available in any deal (reducing two management teams to one, and so on), we think the most attractive area for synergies will come from international operations. While both companies (particularly ACE) have meaningful international presences, their operations are relatively small on an absolute basis. We think the combination will allow these operations to reach a more efficient size. With 40% of New Chubb's revenue coming from outside the United States, eliminating duplicate international costs could add up to meaningful savings, and we project that the company can achieve $450 million in annual synergies. At this reduced level, the deal looks about fairly priced. Also, we estimate this level of synergies would boost return on equity by about 80 basis points, providing a reasonable strategic rationale for the combination.

Combination Creates Best-in-Class Large-Cap Diversified Insurer While we like that the deal looks fairly valued and there are meaningful cost benefits involved, from a long-term perspective we are most enthusiastic about the fact that the combination will create a moaty international insurer with exposure across most insurance lines for the first time.

In our view, while moats are possible in some areas, insurance is at its heart a commodity industry in which it's difficult to achieve sustainable excess returns. Competition among companies is fierce, and participants can rapidly slash prices or undercut competitors to gain market share. Furthermore, insurance is one of the few industries in which the cost of goods sold (claims) is not known for many years, which provides incentives for companies to sacrifice long-term profitability to boost near-term growth. In this light, we think large, highly diversified insurance operations will tend to be mediocre performers, as any strengths they might enjoy in some areas will be diffused elsewhere. As a result, our narrow-moat-rated insurers tend to be smaller insurers focused on specific areas. We think the New Chubb will be an exception to this rule, as the underlying businesses of both companies are moaty, in our view.

Insurers have two potential sources of income: investment income and underwriting profits. Combined, these two streams determine the return on equity a company generates. The relative level of investment income for insurers depends on hard-to-predict capital market movements and is largely out of the company's control, and higher investment returns typically reflect higher risk-taking as opposed to investing acumen. We do not believe any insurance company has a sustainable competitive advantage when it comes to investing float (Warren Buffett and Berkshire Hathaway are the one exception to this rule). As a result, we focus exclusively on underwriting profitability to separate out quality companies in the sector.

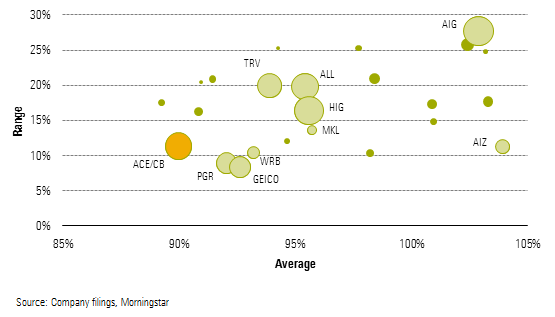

For P&C insurers, underwriting profitability is measured through the combined ratio, which is essentially a reversed underwriting operating margin. A ratio below 100% indicates an underwriting profit. Underwriting profits are not easy to come by, with the industry averaging a combined ratio of 99% over the past 10 years. Therefore, in our opinion, companies with a combined ratio materially below 100% on a sustained basis deserve consideration for a moat.

On this basis, the new Chubb looks quite moaty. In the accompanying chart, we show the average level and range of combined ratio for P&C insurers over the past 10 years (the size of the bubble relates the level of premium underwritten). While the average level is the primary yardstick ,we think considering the range is useful to consider as well, as some lines are more volatile than others, and a more consistent underwriting result provides greater confidence that the level can be maintained. As can be seen, based on a pro forma combination of Old Chubb's and ACE's underwriting results, the company looks to be one of the moatiest names in the industry, generating attractive and relatively consistent underwriting results over the past decade.

Average Combined Ratio for Domestic P&C Insurers, 2005-14

New Chubb offers the widest industry exposure of any narrow-moat insurer we cover. Progressive PGR is focused on personal lines, exclusively on auto insurance. W.R. Berkley WRB focuses strictly on commercial insurance, with a strong emphasis on casualty lines. Travelers TRV comes the closest to New Chubb's mix, but we view its personal lines operations as dilutive to its moat in commercial lines.

Looking further at geographic footprint, ACE has the largest international presence by a fairly wide margin. Further, we like that its international P&C operations are largely strategic in nature, as an international presence is necessary to maintain its moat in large-corporate commercial business and, to a lesser extent, in its high-net-worth personal lines. We think New Chubb best fits the bill for investors looking for a core insurance holding, as it is the only insurer to combine moaty operations and a wide industry presence.

Strategy Changes, but New Chubb Still in Good Hands ACE and Chubb represent two contrasting approaches to insurance stewardship. While Chubb has generally been content to operate in existing niches, ACE is considerably more aggressive and has expanded through acquisition into a number of new areas. Generally, we prefer Old Chubb's approach and award the company an Exemplary stewardship rating while awarding ACE a Standard rating.

For insurance companies, we place a greater emphasis on stewardship and think the quality of stewardship is of roughly equal importance to that of the moat. We believe this for a few reasons. First, insurance is unusual in that the largest cost (claims) must be discovered over time. This cost uncertainty creates leeway for management teams to underestimate claims costs and deliver nasty surprises to investors down the road. Further, insurers are exposed to investment risk through the large investment portfolios they carry. Finally, the balance sheet leverage inherent to the insurance business model can magnify the potential impact of underwriting or investment mistakes. As such, we think taking a close look at stewardship is necessary, as Old Chubb's impressive record could easily be undone if the franchise were put in less capable hands.

Both CEOs have managed to drive stock returns that have outpaced the S&P 500. Chubb's John Finnegan outperforms on the basis of return on equity, which we view as the most important metric, while ACE's Evan Greenberg outperforms on the basis of growth. The growth differential is largely due to acquisitions, as Finnegan has made no major acquisitions and Greenberg has been active on this front. If we look at tangible ROE, the result is basically a draw. In our view, this reflects well on Greenberg, as his acquisitions don't appear to have diluted the moat of ACE's underlying business, and suggests he knows how to run acquired operations effectively. His interest in Old Chubb further demonstrates that he appreciates the value of moaty franchises when evaluating targets. We intend to maintain our Standard stewardship rating for the New Chubb, but we maintain a generally positive view on management going forward and have few concerns that the record of Old Chubb will deteriorate under its new management team.

While Greenberg has highlighted the potential growth opportunities as a rationale for the combination, we think organic growth opportunities for large insurers like New Chubb are very limited, given the fully mature nature of the industry, although the company's sizable international operations raise its growth prospects a bit. Still, absent considerable acquisition activity, we would expect New Chubb's growth rate to more closely resemble the growth of Old Chubb.

There has been significant speculation that this merger will kick off a wave of consolidation. We don't agree with this idea. Historically, large mergers among P&C insurers have been fairly rare, and in our view, informational asymmetry (sellers know much more about the quality of their books than buyers) and highly variable cost structures (which limit the benefits of scale and potential synergies) remain as serious roadblocks to large-scale M&A activity. Looking more closely at stewardship highlights the unique set of circumstance that led to this deal. We believe ACE's interest in Chubb consisted at least in part in its view that the Chubb brand was not being exploited fully under Finnegan's watch. On Chubb's side, we think the impending retirement of a proven manager like Finnegan in 2016 made Old Chubb more amenable to offers. Chubb's record and demonstrated underwriting discipline reduced the risks of informational asymmetry, and the unique fit between the two franchises opened up the possibility of material synergies. We think this situation will be difficult to replicate and don't expect to see more deals of this size.

Outlook for P&C Insurance Is Solid Management has made comments that the merger will reduce the company's exposure to the insurance cycle, and while we agree that the increased diversification will probably reduce volatility a bit, we don't believe New Chubb will be immune to the ups and downs of the industry. The insurance industry can go through long periods of subpar or above-average profitability. In our view, even long-term investors looking at the space shouldn't ignore the near-term outlook. The most recent pricing cycle has taken about 15 years to run a full course, highlighting the length of pricing cycles in the industry.

We believe investors often make the mistake of focusing strictly on pricing to formulate their outlook for the P&C insurance industry, as historical results suggest that overall profitability levels are the key driver of insurance stock returns. In recent years, pricing increases have restored profitability in the P&C domestic insurance market despite lower interest rates and investment income. More recently, pricing has softened somewhat. While we are not optimistic that pricing increases will continue, we think the profitability picture is biased to the upside. Looking at the trends in pricing and profitability, peak levels of profitability have typically lagged peak increases in pricing. In our view, this is due to the time it takes for price increases and improved rate adequacy to filter through insurers' books.

Further, a gradually rising interest rate environment would be a net positive for P&C insurers, in our view, given the relatively tight spread between rates and inflation. Overall, we think the current environment is conducive to investing in high-quality names. Our baseline assumption is a modest improvement from already solid levels. However, historical results suggest momentum in pricing changes, with increases carrying on longer than justified by fundamental drivers. This phenomenon creates potential for a truly hard P&C market in the coming years.

The domestic market will be the main driver of New Chubb's results, but with 40% of premiums coming from outside the U.S., international markets will play a material role as well. To this end, we like that international operations are diffuse, with Europe, Asia, and Latin America each accounting for 10%-15% of premiums. As a result, we think the company is insulated from weakness in any specific country outside the U.S.

Market Underestimates New Chubb's Potential We believe investors primarily rely on price/book multiples to value insurers, and we would agree that this is the most appropriate multiple, although the measure requires some tweaks and proper consideration for the quality of the franchise. In our view, while the New Chubb doesn't necessarily look that attractively valued at first glance, a deeper look shows that might be best long-term opportunity in the industry at the moment.

When using a price/book multiple to value insurers, we like to make a couple of adjustments. First, we prefer excluding goodwill from book value and ROE calculations, as this represents a sunk cost from previous acquisitions and distorts the underlying performance of the franchise. Second, we remove unrealized investment gains and losses (typically included in accumulated other comprehensive income). These gains and losses are typically the result of shifts in interest rates (for instance, a corporate bond that was purchased when yields were 5% would increase in value if the market rate on comparable bonds fell to 4%). Insurers cannot effectively realize these gains, as they would have to reinvest the sale proceeds into lower-yielding debt.

The appropriate multiple obviously depends on the returns the franchise can generate going forward. Although New Chubb trades at a higher multiple than most of its peers, that is appropriate given the relatively high returns it should generate. Considering this, New Chubb looks relatively undervalued, offering one of the best mixes of valuation and expected returns, although it is not a dramatic outlier.

Moving beyond the book multiple relative to expected ROE, we think New Chubb is the best idea for generalist investors looking for a core insurance holding, as it offers the best mix of industry exposure, franchise quality, and management. Its diversification by line and geography insulates the company from issues in particular areas. Further, the company maintains a meaningful competitive advantage across most of its lines, and we expect it to continue to outperform in terms of underwriting results. While we award the company a Standard stewardship rating, we are generally positive on management going forward, as Greenberg has proved to be a capable steward.

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)