Tax-Deferred Retirement-Saver Portfolios for Schwab Supermarket Investors

We combine Gold-rated active funds with Schwab’s low-cost index products.

Over the past few decades, grocery stores have increasingly aimed to serve as one-stop shops for busy consumers. The trend started with supermarkets bolting on pharmacies and selling toiletries; banks, coffee bars, and restaurants came next. In-grocery bars followed, with retailers hoping that consumers might be more likely to open their pocketbooks for pricey cheeses and takeaway foods if their cupholders contained a frosty pint of craft beer or glass of wine.

Over the same time frame, many financial firms have aimed to serve as one-stop shops, too, allowing investors to buy and sell their own house brand of mutual funds, stocks, and bonds, as well as mutual funds offered by third parties.

More than 20 years and two major bear markets later, investor preferences have changed. The dot-com bust quelled many individuals' appetites for buying and selling stocks, and investors' interest in actively managed products has also waned. Sensible, ultradiversified products like target-date vehicles and index funds have been gaining assets at the expense of almost everything else.

Schwab hasn’t ignored the winds of change. Over the past decade, the firm has built out its lineup of very low-cost, low-minimum index funds and exchange-traded funds. The presence of those ultra-low-cost choices makes the firm much easier to recommend as a one-stop investment shop than would otherwise be the case.

About the Portfolios

I’ve used Morningstar’s Lifetime Allocation Indexes to inform the portfolios’ asset allocations and the exposures to subasset classes. To populate the portfolios, I employed no-load, open mutual funds that received Morningstar Medalist ratings from Morningstar’s analyst team and that are available without a load or transaction fee on Schwab’s OneSource supermarket platform.

I also developed the portfolios without consideration for tax efficiency—that is, I assumed they would be held inside of a tax-sheltered wrapper of some kind, such as an IRA. Investors who intend to hold their portfolios inside of a taxable account would want to put a greater emphasis on tax efficiency, emphasizing index funds and ETFs on the equity side and municipal bonds for their fixed-income exposure.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and sub-allocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as Morningstar Medalists.

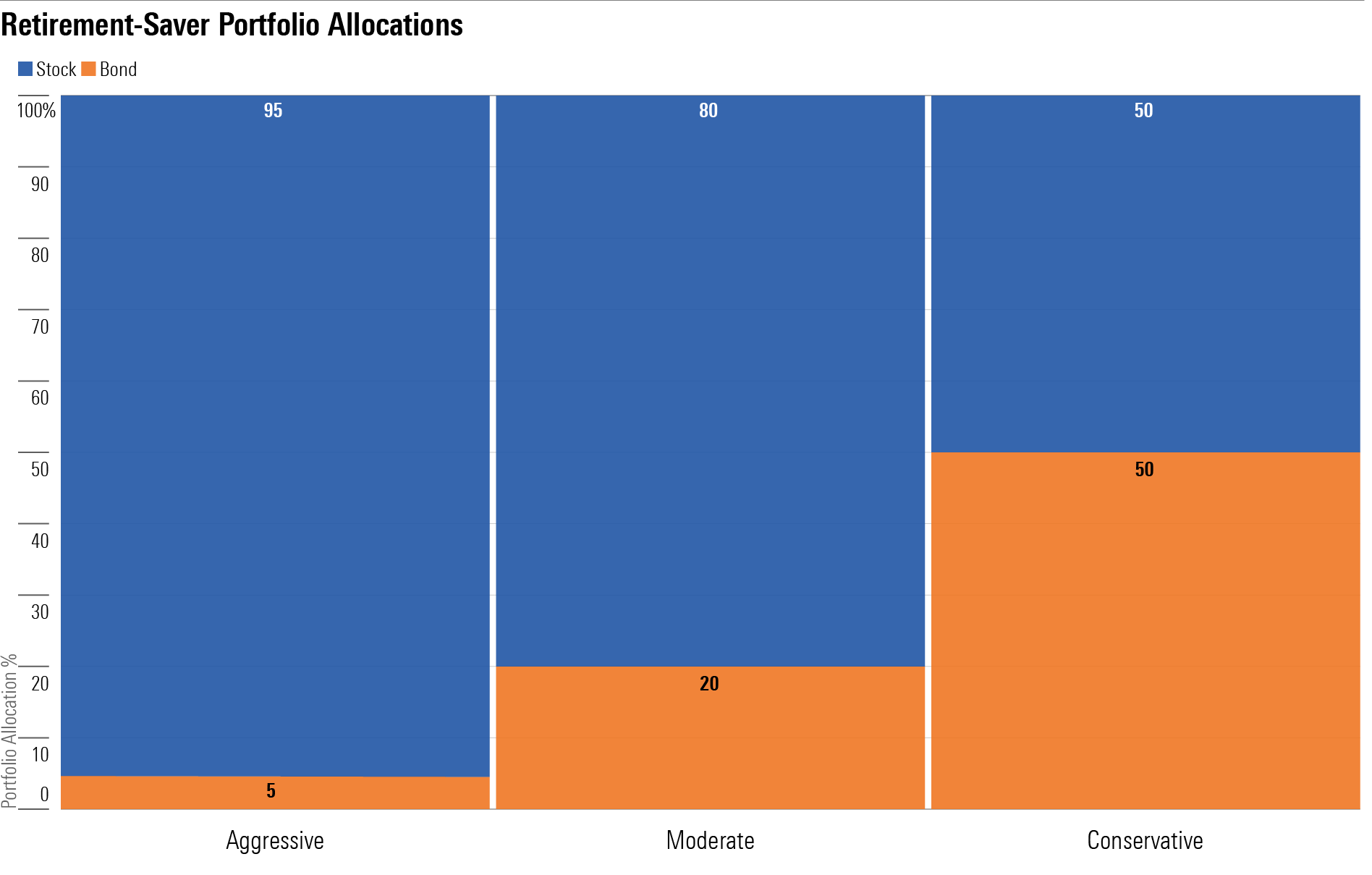

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Aggressive Tax-Deferred Retirement-Saver Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 20%: Oakmark Fund OAKMX

- 10%: Harbor Capital Appreciation HCAIX

- 25%: Schwab Total Stock Market Index SWTSX

- 40%: American Funds International Growth & Income IGIFX

- 5%: Metropolitan West Total Return Bond MWTRX

Moderate Tax-Deferred Retirement-Saver Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 18%: Oakmark Fund OAKMX

- 10%: Harbor Capital Appreciation HCAIX

- 20%: Schwab Total Stock Market Index SWTSX

- 32%: American Funds International Growth & Income IGIFX

- 20%: Metropolitan West Total Return Bond MWTRX

Conservative Tax-Deferred Retirement-Saver Portfolio for Schwab Supermarket Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)