Flows Into Foreign Equity Funds Remain Strong

Investor rebalancing is a contributor.

In the seven years since the 2008 financial crisis, correlations between U.S. equities and foreign equities have trended back to historical averages. Immediately following the crisis, the three-year correlations of U.S. equities and foreign equities hovered around 90% until 2013. More recently, correlations between U.S. equities and MSCI EAFE Index have fallen to around 70%, and correlations between U.S. equities and the MSCI Emerging Markets Index are now at around 45%. These trends help remind us that international equities do provide diversification.

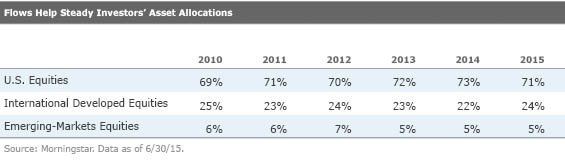

The standard asset allocation for a moderate-risk investor is a 60% equity/40% bond portfolio. Within the equity portion, the recommended weights, on average, are as follows: U.S. equities at 70%, international developed equities at 23%, and emerging markets at 7%.

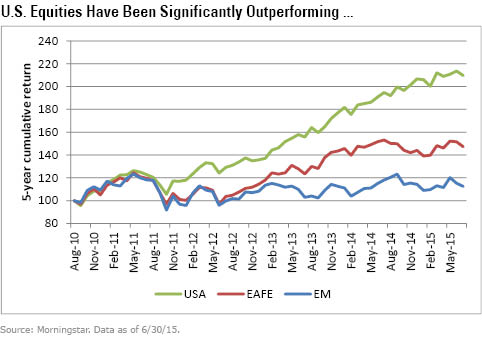

The U.S. equity market has enjoyed a bull run over the past few years and has significantly outperformed international-equity markets. If MSCI standard indexes for U.S. equities, EAFE equities (developed markets ex-North America), and emerging markets were used to calculate the cumulative returns of a $100 investment in each asset class over the past five years through July 2015, a $100 investment in U.S. equities would have resulted in a gain of $113, a $100 investment in developed equities would have resulted in a gain of $50, and a $100 investment in emerging markets would have resulted in a gain of $4.

Given this stark difference in relative performance, it is no surprise that regional weights within a market-capitalization-weighted benchmark have shifted. Within the MSCI All Country World Index (ACWI), U.S. equities have risen from a 42% weighting in 2010 to a 50% weighting in June 2015. Over that same time period, foreign equities have fallen from 57% to 50%.

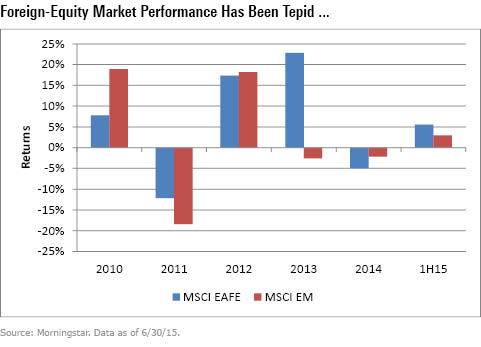

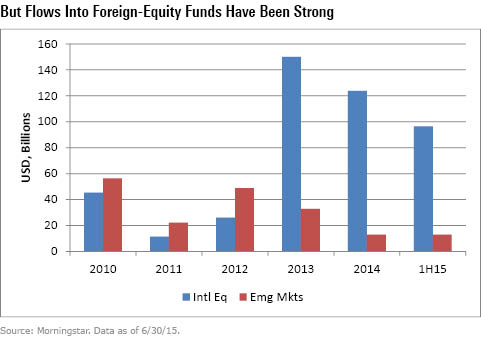

However, when looking at fund flows, it appears that investors have been proactively addressing their falling foreign-equity allocations caused by relative underperformance. This observation goes against the conventional wisdom that investors tend to chase performance. Flows have been very strong into foreign-equity funds (the blue bar in the figure below includes all international-equity funds but excludes diversified emerging-markets and world-stock funds), despite lackluster market performance. Even emerging- markets funds, which has had very weak performance, are seeing inflows.

As a result of strong inflows into foreign-equity funds, mutual fund investor allocations, as determined by total assets in the U.S. equity, international-equity, and emerging-markets fund categories (which includes both open-end funds and exchange-traded funds), have been more stable, relative to the MSCI ACWI.

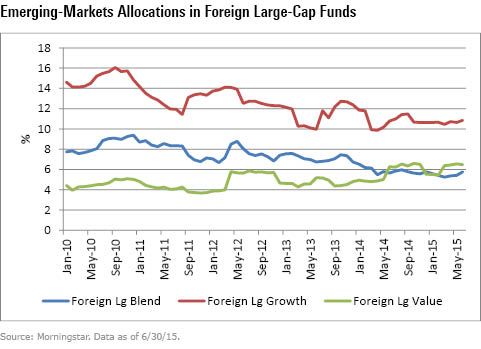

As a side note, those who use foreign large-cap funds (foreign large-blend, foreign large-growth, and foreign large-value) for their total international-equity allocation are getting exposure to emerging markets. However, within foreign large-cap funds, on average, emerging markets account for about 6% to 11% of the portfolio, which is significantly lower than the suggested 20% to 25% allocation within an international-equity allocation.

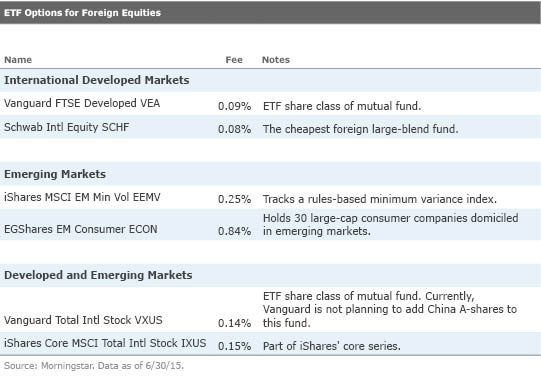

Individuals who have an underweighting in foreign equities can choose among

and

with Morningstar Analyst Ratings or the ETFs in the following table (Morningstar currently does not have ratings on ETFs). For international developed equities, there are a handful of cheap market-cap-weighted funds that are good options. For emerging markets, market-cap-weighted funds are also very cheap. But these funds, such as

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)