What Upcoming Index Changes Mean for Two Factor ETFs

BlackRock is switching benchmarks for two of its factor ETFs, but this change may help one ETF more than the other.

In 2013,

In the original quality index, MSCI assigns quality scores to each stock in the broad MSCI USA Index. These scores are based on return on equity, debt/capital, and variability in earnings growth over the past five years. It then selects the top-scoring stocks, regardless of sector membership, and weights them according to both the strength of their quality characteristics and their market capitalization. This currently gives QUAL greater exposure to the technology and consumer cyclical sectors than the MSCI USA Index and less exposure to financial services, utilities, and telecom stocks.

The sector-neutral version of the quality index assigns sector-relative quality scores to each stock in the MSCI USA Index. This puts stocks from different sectors on a level playing field. For example, a stock in the energy sector could receive a higher sector-relative quality score than a tech stock with even stronger absolute quality characteristics, if the tech stock looks less remarkable relative to its sector peers. MSCI then selects the top-scoring stocks regardless of sector classification until it reaches a predetermined target number of stocks, representing around 30% of the market capitalization of the parent index. Stocks that make the cut receive weightings according to both their sector-neutral quality scores and market capitalization. On the semiannual portfolio reconstitution dates, MSCI matches the portfolio's sector weightings to the MSCI USA Index's and rescales the constituents' weightings in each sector to achieve that objective.

In order to maintain sector neutrality, the fund must assign larger weightings to stocks with lower absolute ROE, higher debt/capital, and greater variability in earnings growth than it otherwise would if it ignored sector membership. In some cases, the sector-neutral quality index may include stocks that wouldn't have made the cut in the original quality index. However, accounting statements and net income tend to be more comparable among companies within a sector than across sectors, which could work in favor of the sector-neutral quality index.

BlackRock argues that the changes shouldn't have a material impact on the fund's overall quality exposure. But a regression analysis of the (mostly) back-tested performance of the two quality indexes revealed that the sector-neutral version had a slightly lower quality tilt, as measured by its exposure to the "Quality Minus Junk" factor, which principals from AQR developed based on profitability, safety, growth, and payout rates. I found a similar result using the profitability factor, which Nobel Prize winner Eugene Fama and Kenneth French constructed, in place of the quality factor. Profitability is an important measure of quality because it reflects the productivity of a firm's assets and it is positively correlated with durable competitive advantages. The sector-neutral quality index was also a little more sensitive to market fluctuations (higher beta) than the unconstrained version because it looked more like the market.

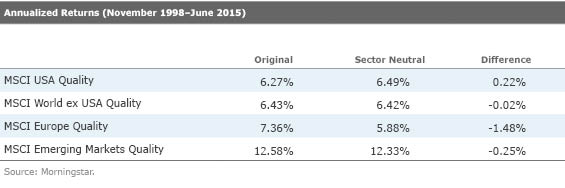

These changes probably won't have a big impact on long-term returns, and it is difficult to predict whether they will help or hurt. From the end of November 1998 through June 2015 (which is mostly back-tested data), the MSCI USA Sector Neutral Quality Index outpaced the original version by 22 basis points annually. During that time, the developed-markets focused MSCI World ex-USA Sector Neutral Quality Index matched the return of the MSCI World ex-USA Quality Index. However, the MSCI Europe Sector Neutral Quality Index and MSCI Emerging Market Sector Neutral Quality Index underperformed their non-sector-constrained counterparts, as the table below illustrates. In each case, the sector-neutral versions were slightly more volatile than the original quality indexes.

In practice, the sector-neutral quality indexes will likely require higher turnover than the original versions as MSCI resets their sector weightings back to the corresponding values in the parent indexes. Even if the sector weightings are slightly off, they will require rebalancing. This may slightly increase transaction costs, which could detract from QUAL's performance.

iShares MSCI USA Value Factor The changes to VLUE are more significant. Its current index holds the same stocks as the broad MSCI USA Index, but it weights them according to fundamental measures of size, including book value, sales, earnings, and cash earnings. This approach causes the index to overweight stocks that are trading at low multiples of those fundamental metrics and underweight more-expensive stocks. When the index rebalances, it increases its exposure to stocks that have become cheaper relative to their peers and trims positions in those that have become more expensive. However, this dynamic approach can cause the index's value exposure to change over time.

BlackRock elected to change the fund's index to the MSCI USA Enhanced Value Index in an attempt to offer more-consistent value exposure and minimize unintended sector bets. This benchmark follows a very similar process to the MSCI USA Sector Neutral Quality Index. MSCI assigns sector-relative value scores to each stock in the MSCI USA Index based on price/forward earnings, price/book, and enterprise value/operating cash flow. The last metric controls for differences in debt, which can affect the other two valuation ratios. MSCI then selects the top-scoring stocks until it reaches its predetermined target number of securities, which represents around 30% of the parent index's market capitalization. Stocks are weighted according to both the strength of their value characteristics and their market capitalization. However, on the portfolio reconstitution dates, MSCI rescales its constituent weightings to match the sector weightings of the MSCI USA Index.

The enhanced value index should strengthen VLUE's value tilt because it targets a smaller and cheaper subset of the market than the index it is replacing. The value-weighted index does not exclude the most expensive stocks--it underweights them. These stocks will not make the cut in the new index. The enhanced value index's weighting approach may also strengthen the portfolio's value tilt. Fundamental weightings overweight stocks trading at low valuations, but these are correlated with size. For example, larger companies tend to generate a larger dollar amount of sales than smaller firms, but these may not be the cheapest stocks. The enhanced index directly incorporates valuations in its weighting approach but balances this against market capitalization. The net effect should skew the portfolio toward smaller names than its current index.

Consistent with these expectations, a regression analysis of the two indexes' back-tested returns from December 1997 through June 2015 revealed that the enhanced value index had slightly greater value and small-cap tilts than the value-weighted index. The indexes' current portfolios tell a similar story. At the end of June, the enhanced value index's constituents were trading at a lower average multiple of forward earnings (13.9) than the value-weighted index (16.4) and had a smaller average market capitalization ($47 billion and $63 billion, respectively). The enhanced value index's constituents were also trading at a lower multiple of forward earnings than the MSCI USA Value Index, which targets the cheaper half of the market and weights its holdings by market cap. This is despite the enhanced value index's greater exposure to growth-leaning sectors like technology and health care.

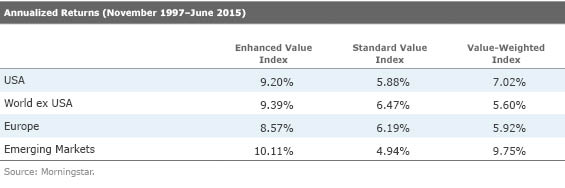

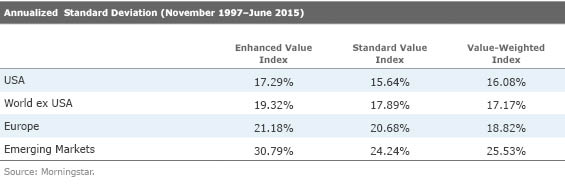

The new index may boost the fund's long-run return potential but may also increase its risk. From the end of November 1997 through June 2015, the back-tested MSCI USA Enhanced Value Index outpaced the MSCI USA Value Weighted and MSCI USA Value indexes by 2.2 and 3.3 percentage points annualized. This was partially because of its bigger value and small-cap tilts. But these higher returns came with greater volatility and sensitivity to market fluctuations. The results were similar for the MSCI World ex-USA Enhanced Value (which covers foreign developed markets), MSCI Emerging Markets Enhanced Value, and MSCI Europe Enhanced Value indexes, as the tables below illustrate. The enhanced value indexes all generated higher returns than their value-weighted and standard value index counterparts, with greater volatility and sensitivity to market fluctuations.

The enhanced value index may not offer as large of a performance advantage going forward. However, it offers cleaner exposure to the value effect than the value-weighted index. If value stocks continue to outperform over the long term, VLUE's new index should benefit a little more than its current index. As an added benefit, the fund's sector-neutral approach allows investors to avoid unintended sector bets. However, maintaining sector neutrality could require higher turnover, which can increase transaction costs and detract from returns.

Summary

- The upcoming index changes for iShares MSCI USA Quality Factor and iShares MSCI USA Value Factor may help investors avoid unintended sector bets.

- The MSCI USA Sector Neutral Quality Index may slightly reduce QUAL's quality tilt. In contrast, VLUE's new index will likely strengthen the fund's value characteristics.

- The index change for VLUE may increase its return potential as well as its risk. The corresponding change for QUAL will likely have a smaller impact on that fund's return and risk characteristics.

- In both cases, maintaining sector neutrality could increase turnover and transaction costs.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)