The Ins and Outs of Fund Flows

How we calculate flows and ways you can use the data.

Question: Morningstar talks about fund flows a lot. How are they calculated and why should I care about them?

Answer: The main benefit of this data is that it allows our readers to identify and track trends in the fund industry. But in addition to identifying broad trends, there are also some hands-on ways investors can use this data, as we discuss below.

How Fund Flows Are Calculated Morningstar calculates asset inflows and outflows for individual funds on a monthly basis, using an industry-standard approach: Estimated net flow is the change in assets not explained by the performance of the fund. (Click here for a full explanation of our methodology.)

Morningstar computes fund flows data over various time frames by broad investment type (for example, open-end funds, exchange-traded funds, or closed-end funds). Armed with data on individual funds, we can then combine the data and/or break it down; for instance, we can look at flows into active and passive strategies, or we can focus on flows by asset class, looking at international stock, U.S. stock, or bond fund categories broadly. The data can be filtered further, down to the separate stock- and bond-fund categories. We can even look at inflows and outflows from single fund families.

Where You Can Find the Data We frequently discuss fund flows on Morningstar.com in articles and analyst reports, particularly if there is a surprising or noteworthy trend. But there are also some places you can find monthly fund flows commentary.

Morningstar senior markets research analyst Tim Strauts discusses fund flows in a short, monthly video report that we feature on Morningstar.com. Here are some links to the last several reports:

- "Rate Hike Talk Not Deterring Bond Investors"

- "Investors Flock to Low-Cost Funds"

- "Indexing Fever Spreads"

On our corporate site, readers can also find monthly press releases that provide a broad overview of the trends we're seeing. (Click here to read the release for May 2015 fund flows.) In the press release, you'll also find the link to the full PDF report wherein Morningstar markets research analysts write a detailed commentary that takes a deep dive into the data.

If you are a user of Morningstar Direct, you will find fund flows information on the Asset Flows tab; the workspace provided allows you to sort and customize the data.

Ways You Can Use the Data As we mentioned earlier, analyzing fund flows data can help you get a handle on trends in the asset-management industry. Aside from broad industry-watching, though, there are some hands-on ways investors could use this information.

Checking Up on Your Investments Flows into a given fund or fund family might bear monitoring because they could affect the way the funds are managed. Large or sudden changes in flows can sometimes result in tweaks to a strategy to meet redemptions or accommodate the increased cash, particularly if the strategy plies less-liquid securities. If you notice that one of the funds you own has experienced large inflows or outflows, you would be wise to monitor the situation by keeping an eye out for updated Morningstar analyst reports and commentary by the fund management team.

In a recent example,

Investors in the MetWest fund may have noticed the big inflows, and they may be concerned that the team could be having trouble putting all that new money to work. In her recent analyst report, Morningstar senior analyst Karin Anderson said that she hasn't seen any indications that the increased assets are having a negative impact or that the managers should close the fund to preserve their long-successful strategy. The fund's overall cash stake has actually gone down in the wake of the inflows, and its stakes in corporate bonds and asset-backed securities have stayed the same. Though the managers have added to the fund's government-bond stake, this is a more-liquid area of the bond market, and it may benefit the fund to invest here if bond-market liquidity were to become constrained in a rising-rate environment, Anderson said.

Finding Opportunities Another way investors could use fund flows data is as a gauge of investor sentiment or a possible contrarian indicator. For example, every year, Morningstar director of manager research Russ Kinnel publishes a piece called "Buy the Unloved" in Morningstar FundInvestor. The strategy looks at the three categories with the largest redemptions and explores some picks in those categories that could be due for a rebound. As Kinnel points out, the strategy has historically pointed to more winners than losers. (Click here to read the latest installment of "Buy the Unloved.")

Keeping on Top of Trends Finally, fund flows data can help investors draw conclusions about broad trends in the asset-management industry.

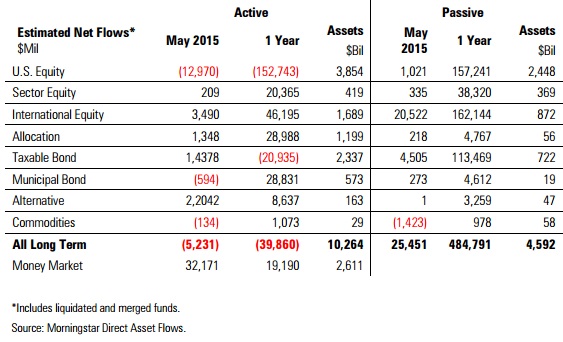

As the table above shows, $152.7 million has flowed out of U.S. equity active funds in the past 12 months, while $157.2 million has flowed into U.S. equity passive strategies. There are a few things going on here: For one, a large share of the flows into mutual funds during the past several years has gone to passive investments, often within retirement savings accounts. The other trend we've seen is that investors have been selling active U.S. equity funds and buying U.S. equity ETFs (the vast majority of which are passive strategies).

As previously mentioned, Morningstar markets research analysts write a monthly commentary that combines open-end fund flows and ETF flows to highlight and discusses trends (the table above originally appeared in the May 2015 fund flows commentary). Exchange-traded funds have become an increasingly large part of the asset-management industry, so combining the open-end and ETF fund flows allows readers to get a more complete picture of what's happening across the fund landscape.

"If you only look at mutual fund flows, it will look like investors are dumping U.S. equity, when in actuality they are just moving money from high-cost funds to low-cost funds," said Morningstar senior markets research analyst Tim Strauts.

Have a personal finance question you'd like answered? Send it to TheShortAnswer@morningstar.com.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)