Leading the Charge in the Credit Card Comeback

Undervalued Capital One benefits from improving U.S. consumer and overall economy.

As the U.S. economy continues to rebound, we expect Capital One to be a prime beneficiary of a healthier consumer who is more willing to spend. In the years after the financial crisis, Capital One has been carried by its automotive and commercial lending lines as the U.S. consumer shed unsecured lending. Now, credit cards are primed to take the spotlight again as a growth engine for Capital One, a fact that we think investors aren't recognizing. Credit card lending growth was strong in 2014, a trend we expect to continue in 2015 thanks to lower unemployment, solid gross domestic product growth, and increasing disposable income. As one of the largest issuers of credit cards, Capital One will be in the driver's seat. With its overall diversification across automotive and commercial lending, we see no reason why the undervalued Capital One shouldn't be valued similarly to strong regional banks such as U.S. Bancorp or PNC Financial.

Strengthening U.S. Economy Bodes Well for Card Issuers We consider this to be an ideal economic environment for Capital One to outperform peers, which investors have not seemed to realize. In short, the following economic factors, which continue to improve, support our thesis for Capital One: GDP growth within a healthy range of 2.5%-3.0%; increased contributions from consumer spending to overall GDP growth; and lower unemployment, which generally correlates with improved consumer confidence.

With the exception of one quarter, the overall U.S. economy has continued to expand over the past three years. Furthermore, we are encouraged that a significant portion of the growth for the third quarter of 2014 came from consumption, which is a trend that continued into the fourth quarter of 2014.

While the fourth quarter's GDP growth of 2.6% came in significantly lower than the previous quarter, we still think the growth reflects a gradually improving economy. Morningstar's director of economic analysis, Robert Johnson, expects GDP growth to continue in the 2.5%-3.0% range, which in turn supports a better employment picture. It appears that employer confidence is growing, since job openings and hires have improved. Employee quits are also increasing, indicating confidence in their job prospects.

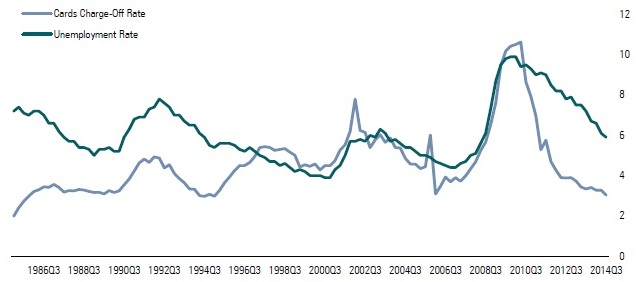

Historically, higher employment results in lower credit costs. In general, unemployment rates are significantly correlated with net charge-off rates on credit card receivables. After the financial crisis, banks were especially rigorous with their credit card lending standards, which is why charge-off rates have been particularly low since 2010. As banks expand their credit card lending, we expect charge-off rates to increase to normal levels that are generally 50-100 basis points higher than they are now. For Capital One, we have already built higher net charge-offs into our fair value estimate.

Strong Correlation Between Net Charge-Offs and Unemployment Rate

Source: Morningstar

Furthermore, compared with other forms of consumer credit, credit card lending has had significantly fewer delinquencies since 2010. Delinquencies on credit card receivables are now less than those realized before the financial crisis. In the near to medium term, we expect delinquency levels to remain stable.

How Do Improved Conditions Affect Capital One? The overall consumer picture has brightened over the past few years as the U.S. economy has improved, benefiting consumer lending. Automotive and student loan lending were the first to recover, but now we are seeing strength in credit card loans, which positions Capital One well. Given the improving economy, several company-specific factors are critical to our differentiated take on Capital One.

- Improved credit card purchasing and receivables volumes.

- A more profitable portfolio mix due to credit card lending growth, leading to higher yields and net interest margins.

- Lower levels of card charge-offs.

- Improving cost efficiency ratios.

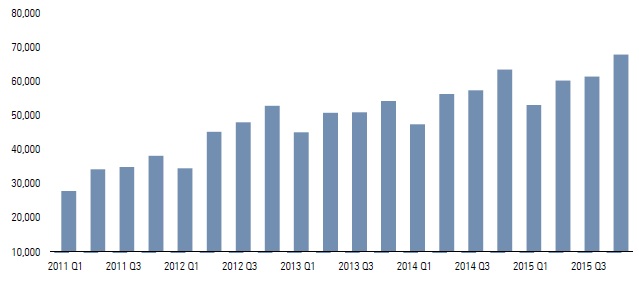

Credit card activity at Capital One has also jumped in the form of higher purchase volumes, which is important for revenue because the bank still realizes interchange fees as well as potential interest income from receivables that are not paid off immediately. While purchase volumes are largely seasonal, we expect them to increase for Capital One in 2015 and 2016.

Credit Card Purchase Volume at Capital One ($ billions)

Source: Capital One, Morningstar

After stagnating for much of 2013, credit card receivables for Capital One finally increased in the second quarter of 2014 and continued for the remainder of the year. With a stronger consumer experiencing less credit stress and improved employment prospects, we expect credit card receivables to continue growing in 2015.

While loan yields have generally fallen over the past year, the increase of credit card receivables in the loan mix should help improve net interest margin. With an average yield on consumer credit cards currently at 14.6% compared with 6.45% for consumer banking and 3.33% for commercial banking, the growth of the credit card portfolio should protect the overall loan yield of 9.04% realized in the fourth quarter of 2014. Compared with similar-size regional banks, Capital One's loan yield far exceeds that of U.S. Bancorp (4.14%) and PNC Financial Services Group (3.63%). In turn, this better product portfolio mix leads to some of the strongest net interest margin performance versus peers.

However, the higher margin for Capital One compared with peers can be attributable to a riskier loan mix with significantly more rich-yielding unsecured consumer lending than traditional consumer and commercial loan products. While net charge-offs are also generally higher at Capital One because of its credit card portfolio, the overall ratio of nonperforming loans/total loans at Capital One is generally lower than peers, generally due to a faster disposition of seriously delinquent credit card loans. In terms of expenses and efficiency, Capital One also compares favorably with its peers for a couple of reasons. First, the bank has higher-yielding assets given its higher proportion of credit card loans. Second, Capital One has relatively fewer branches. Capital One's $228 million in average deposits per branch far exceeds the $120 million per branch for U.S. Bancorp and $81 million for PNC.

Capital One Is Cheap When we recommended Capital One as an investment two years ago, we believed that its moves to become more diversified across its loan portfolio deserved a multiple closer to peers such as U.S. Bancorp and PNC Financial. While we still believe in that thesis for the bank, we think the positive trends for the U.S. consumer and overall economy match up well with Capital One's original credit card business. During 2015, higher-yielding credit card balances should continue to grow in the medium term given there are few signs of an overall slowdown in the U.S. economy. In turn, we think net interest margin should improve because of this positive mix shift, especially if growth in other loan categories slows. With solid margin, expense, and credit metrics versus peers, we think the valuation of Capital One remains low. Trading at a 14% discount to our fair value estimate, we believe Capital One is presenting another attractive opportunity for investors.

/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)