Healthy Relationships, High Returns

Spun off from GE, narrow-moat Synchrony Financial thrives by having strong ties with loyal retailers.

With most retail-focused financial institutions having fully rebounded from the 2008-2009 financial crisis,

The newly named

With a pullback in unsecured consumer credit by many banks since the financial crisis, Synchrony has been able to fill the need for credit through its retail card platform, its largest segment with 68% of revenue in 2013. This business is also the country's leading provider of private-label credit cards. Synchrony performs the underwriting for its partners and retains the receivables while paying out rewards to retailers through sharing arrangements. As the U.S. consumer recovers from the downturn and starts to spend income again, we think Synchrony will be well positioned to offer immediate credit to qualifying consumers with satisfactory credit scores.

Synchrony's payment solutions business offers financing for retailers of large-ticket items, primarily furniture, electronics, and appliances. Partners include chains such as Sleepy's, P.C. Richard & Son, and HHGregg HGG. Payment solutions accounted for 16% of revenue in 2013.

Synchrony's CareCredit division provides financing to consumers for elective health-care procedures and services such as dental, veterinary, cosmetic, vision, or audiology. Synchrony has agreements with more than 152,000 health-care providers. CareCredit accounted for 16% of revenue in 2013.

As a result of its durable partner relationships, Synchrony is able to generate high returns on equity with high-yield cards, while retailer partners have incentives to bring with them their valuable relationships with consumers. That helps garner profitable deals for both Synchrony and its partners. The unique model, which retains and nurtures retailers, helps Synchrony earn a narrow moat thanks in large part to high switching costs. Indeed, Synchrony generates a return on equity of 20% to 25%, far higher than the typical bank Morningstar covers and well above the 11% to 12% earned by

After a more than 20% runup over the last three months, Synchrony shares are currently trading just under Morningstar's fair value estimate of $33.00. But this narrow-moat, high-return financial company is worth keeping on the radar in case the shares again become available at a more attractive entry point.

Counting Cards

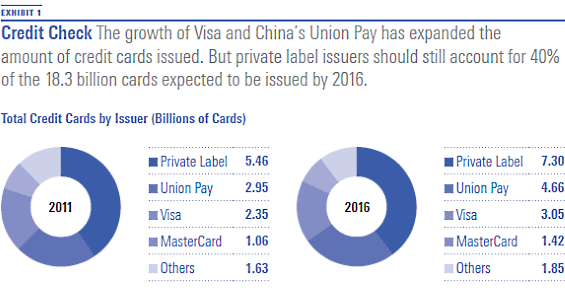

Industry observers anticipate private-label cards will make up approximately 40% of all cards issued in 2016 (Exhibit 1). While that is similar to the 2011 level, this percentage has been declining slowly because of the rapid expansion of

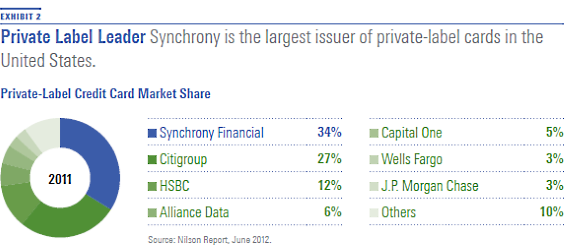

Synchrony, however, remains the largest issuer of private-label cards in the United States, with a market share of approximately 34% (Exhibit 2).

Morningstar's equity analysts think Synchrony has a narrow economic moat because it has built high switching costs around its ecosystem of partners. The primary reason why retail card partners stick with Synchrony is because of the retailer share arrangements, which provide payments to retailers from Synchrony once economic performance levels of a card program exceed a contractually defined threshold. These shared economics enhance partners' engagement with Synchrony and provide an incentive to support the program through in-store promotions such as discounts when shoppers open a new credit account.

In 2013, Synchrony paid out $2.4 billion in retailer share arrangements. For the retailers, these agreements also include the elimination of interchange/exchange fees, which occur when customers purchase goods with general purpose cards or debit cards. The costs for executing those transactions are assumed by Synchrony, not the retailer. Nevertheless, Synchrony did receive $324 million of interchange fees during 2013 from dual cards transactions, which is an increase from $287 million during 2012. Dual cards are credit cards that function as a private-label credit card when used to purchase goods and services from Synchrony's partners and as a general purpose credit card that can be used elsewhere. As a result of high card yields, interchange fees, and durable partner relationships, Synchrony is able to generate high returns on equity.

Synchrony also gains an advantage because it maintains deeply integrated technology within its partners' systems and processes, enabling it to provide customized credit products and solutions to partners' customers at the point of sale. Synchrony's online and mobile technologies are capable of being integrated into its partners' systems with little difficulty, enabling customers to check available credit, manage their account, gain access to customer service, and participate in partner loyalty programs. We think that the stickiness of the partner relationships, as demonstrated by the average 15-year relationship between Synchrony and its retail card partners, gives it a competitive advantage over other bank card issuers, particularly in the private-label arena.

Bull and Bear Case Morningstar's fair value estimate of $33 per share represents a multiple of 10.3 times our 2015 earnings estimate and 2.4 times 2015 book value. In our bear case, we assume that net interest margins compress to 17% over the projected period. We also assume net charge-offs increase by 33% to 6% over the projected period and that the equity/assets ratio is maintained at 17%. Under these conditions, our fair value estimate would be $14, or 4.1 times 2015 estimated earnings and 1 times book value for 2015.

In our bull scenario, we assume that net interest margins increase to 21% over the projected period. With improved credit quality, we assume net charge-offs decrease to 3% over the projected period and that the equity/assets ratio declines to 10% by 2018. Under these conditions, our fair value estimate would be $57, which is 16 times our earnings per share forecast for 2015, or 4.1 times book value for 2015.

It makes sense Synchrony's IPO pricing would allow for substantial upside. GE has committed to returning $90 billion to shareholders by 2016, and the Synchrony asset is a key contributor to that goal. We believe that by underpricing the initial 15% stake and potentially benefiting from a strong initial stock price performance, GE will draw more investor interest in the value of its remaining 85% stake, making it easier to sell in 2015.

We think there are a few things that would detract from Synchrony's positive attributes. If consumers continue to make more and more payments directly from their accounts using mobile devices without the use of a credit card, that will have a negative impact on firms such as Synchrony by taking them out of the payments system. Second, the consumer protection regulation from the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 may have an impact on Synchrony's infrastructure, recordkeeping, and revenue should the new Bureau of Consumer Financial Protection impose its will as the lead regulator of consumer financial products and services. We have already seen limitations on bank interchange fees through the Durbin Amendment as a result of this legislation.

Other Considerations The average length of Synchrony's relationship for its 40 largest programs is 15 years. Those 40 programs accounted for 75.6% of revenue in 2013. Despite the lengthy relationships, contracts are often shorter and may be only for a few years, providing opportunities for a retailer to switch or renegotiate terms. About two thirds of the revenue generated by Synchrony's largest 40 programs is only under contact until 2017. We still believe the length of the relationships between Synchrony and these retailers indicates that the business model for maintaining the relationship is strong.

This article originally appeared in the December/January 2015 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)