Investment Opportunities in US Renewable Energy

New regulations in California spurred a surge in customer demand for solar energy.

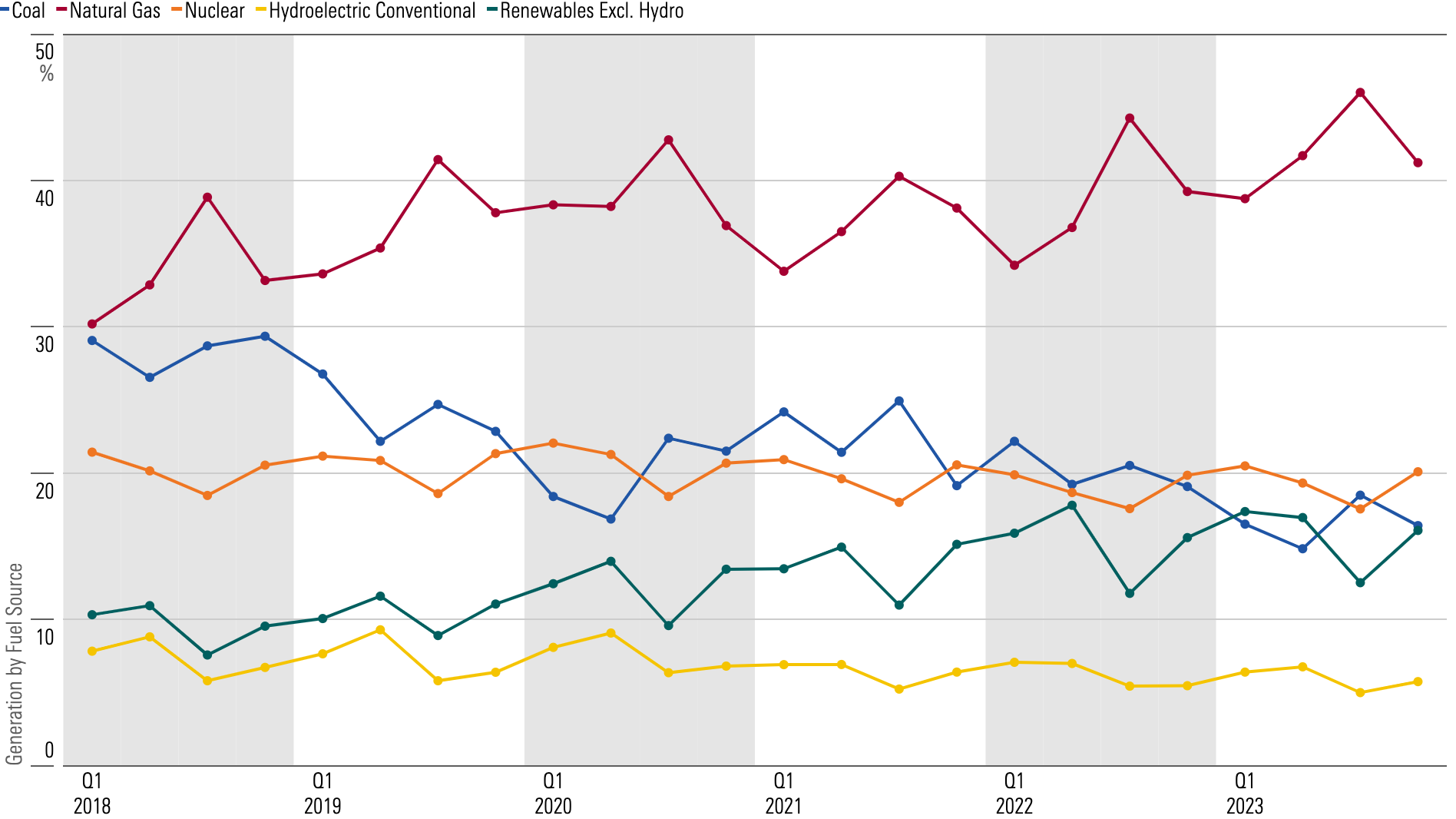

Although natural gas remains the dominant fuel source for US power generation (accounting for over 40% of generation in the fourth quarter of 2023), the overwhelming majority of new capacity additions have been concentrated in renewable energy, including solar, wind, and battery storage.

Natural gas benefits from its US abundance (low cost) and baseload qualities. Meanwhile, coal’s generation contribution fell to 16% in fourth-quarter 2023, down from 19% in fourth-quarter 2022.

Coal Continues to Lose Ground as Natural Gas, Wind, and Solar Account for Growing Share of Generation

Renewables (excluding hydroelectricity) saw the market share increase to 16% in fourth-quarter 2023, a modest increase from 15.5% in fourth-quarter 2022. Solar accounted for approximately 3.5% of utility-scale generation in the quarter, while wind comprised 12.5%.

Looking longer-term, we forecast wind and solar to rise to nearly 45% of generation by 2032, approximately 3 times current levels. The bulk of the share gains will be from coal, which we forecast to continue to decline because of its high emission profile.

Renewables, for their part, benefit from their zero-emission profile, low cost, tax incentives, and small average investment size (no large project risk). We expect renewables to continue to comprise the bulk of new capacity additions, with select natural gas additions to ensure reliability.

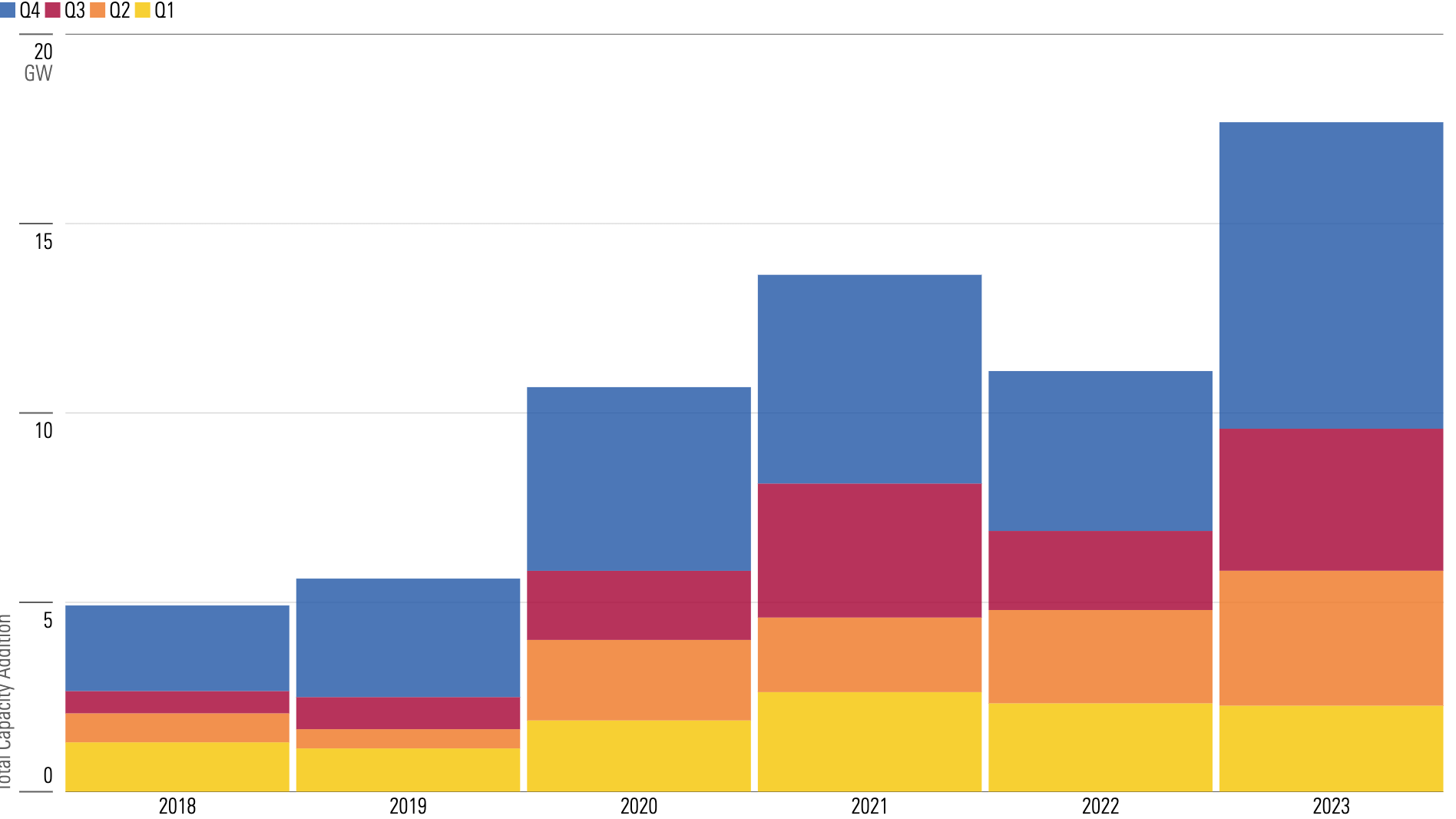

Solar Capacity Additions: A New Record in Q4 2023

Solar installations rebounded in 2023 after 2022 saw challenges caused by trade uncertainty on solar panel imports. For the full year, solar installations grew 60% year on year, including 90% in the fourth-quarter of 2023, the highest quarterly installations on record.

Based on data from the US Energy Information Administration for planned capacity additions in 2024, solar is expected to see another year of strong growth. The EIA’s planned capacity additions expect over 35 gigawatts of solar installed in 2024, representing an approximate doubling over 2023 levels.

We caution, however, that successful completion of all projects in planning may be difficult given continued project delays across the renewables sector. Additionally, a two-year moratorium on tariffs of imported solar modules is slated to expire in 2024, creating potential uncertainty.

Solar Set a New Record in 2023 ... Which We Expect to be Surpassed in 2024

Onshore wind installations, for their part, fell 30% for full-year 2023, largely due to US tax credit policy. While we expect similar trough levels of activity in 2024, based on EIA pipeline data, the industry should rebound in the coming years. The Inflation Reduction Act provides a long-term extension of the wind tax credit, which we expect to drive a rebound in industry activity.

And battery storage adoption, relative to wind and solar, is still in its early days. We foresee attractive long-term growth for battery adoption as storage offers a complement to wind’s and solar’s generation profile. The proportion of solar projects with a battery rose to just over 15% in 2023. We expect this percentage to continue to climb in coming years as developers look to batteries to store excess generation for later use.

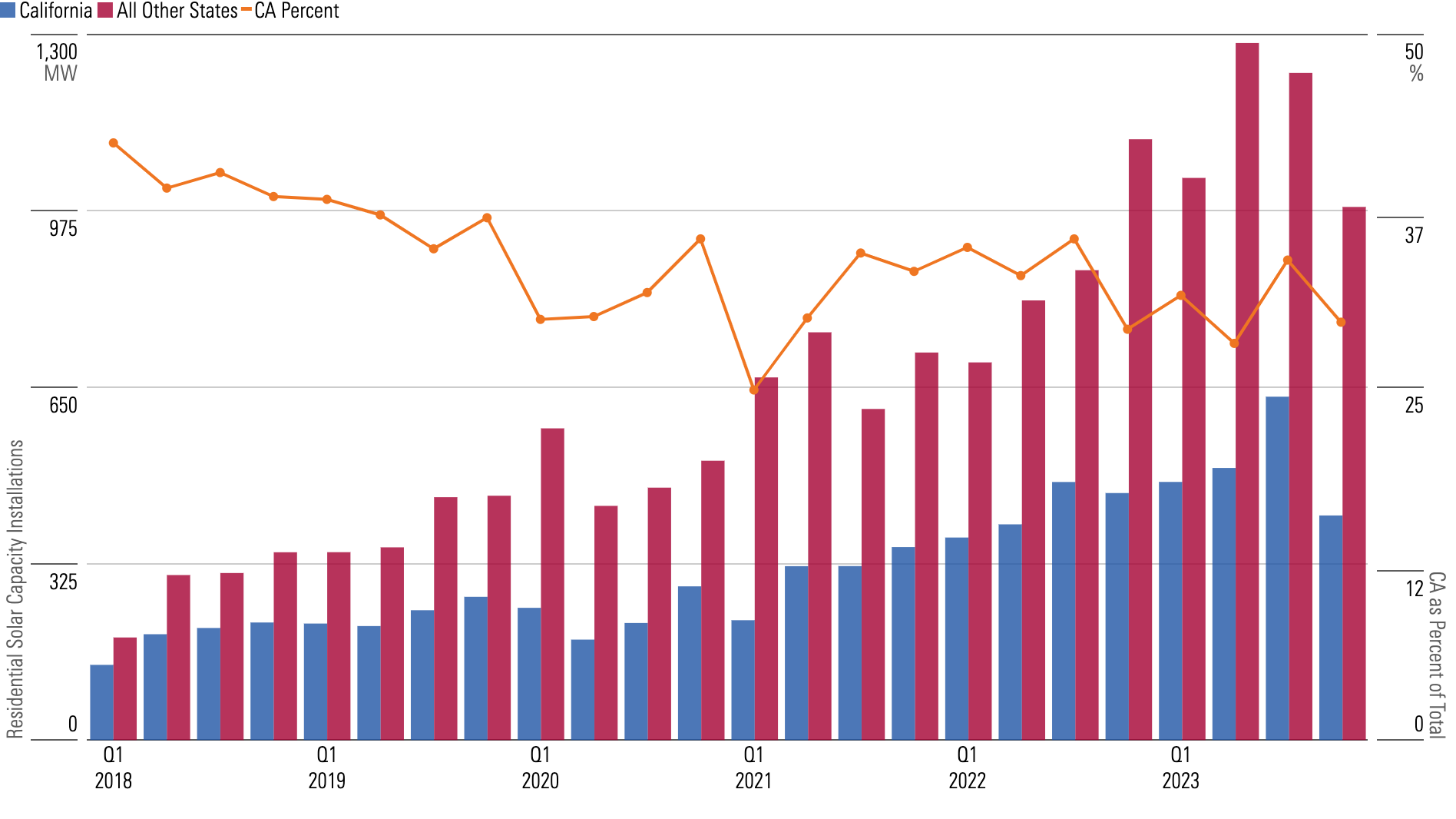

Key Regulatory Development: California’s Rooftop Solar Market Evolves Following Policy Change

California’s widely anticipated Net Energy Metering 3.0 policy change came into effect in 2023, spurring a surge in customer demand in the third quarter as customers rushed to install rooftop solar and take advantage of grandfathering under the prior regulatory regime.

That demand started to dissipate in fourth-quarter 2023, and we expect significantly lower California installations in 2024 as the regulatory change adversely impacts customer payback periods.

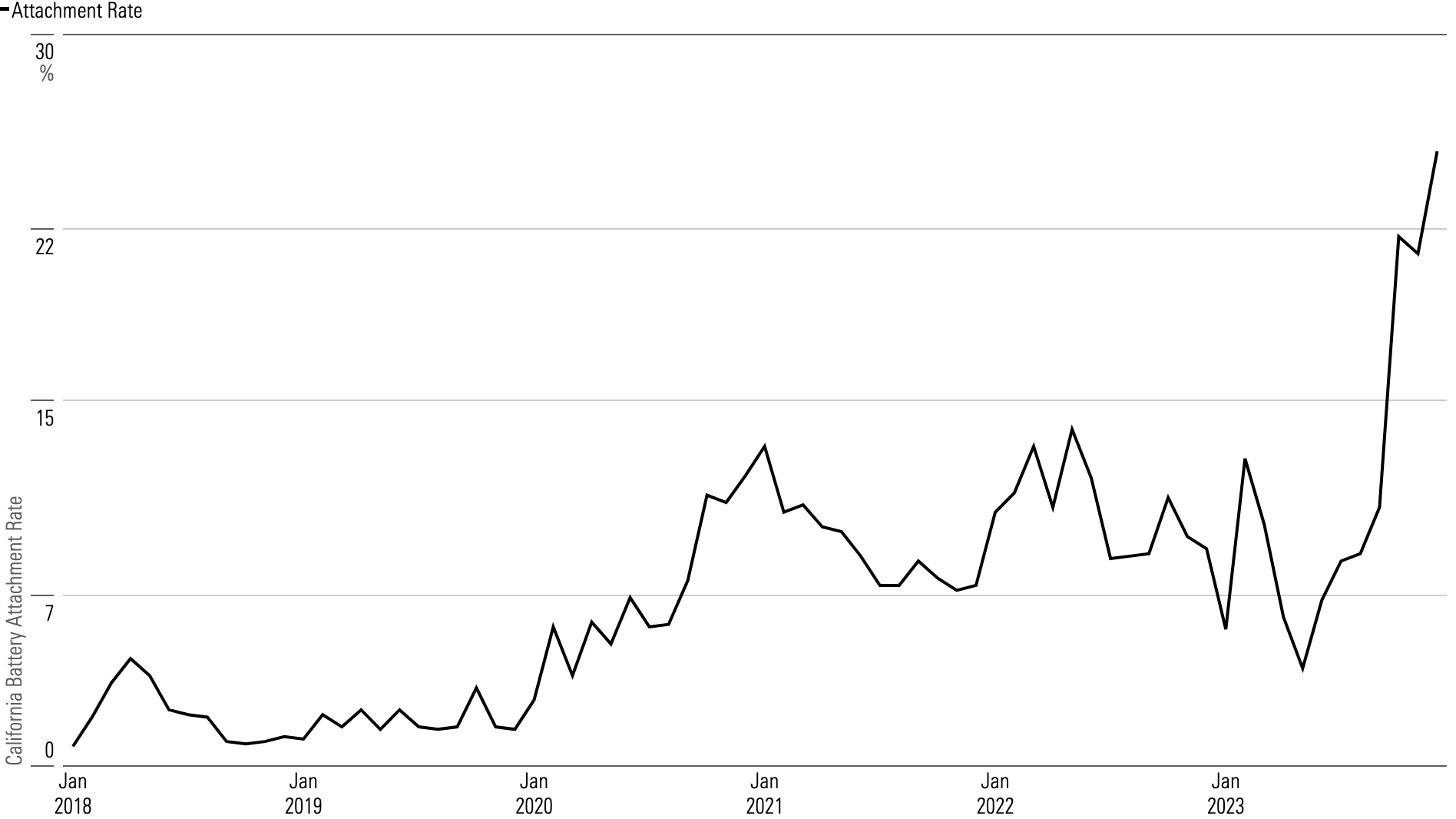

The bright side is home battery attachment rates are set to increase substantially. Our analysis of the data shows an approximate 25% battery attachment rate in December 2023 (versus around 10% historically), and we expect this to continue to climb in 2024.

California Rooftop Solar Installations Likely Peaked in Q3 2023...

...but Home Battery Adoption Is Set to Increase Substantially

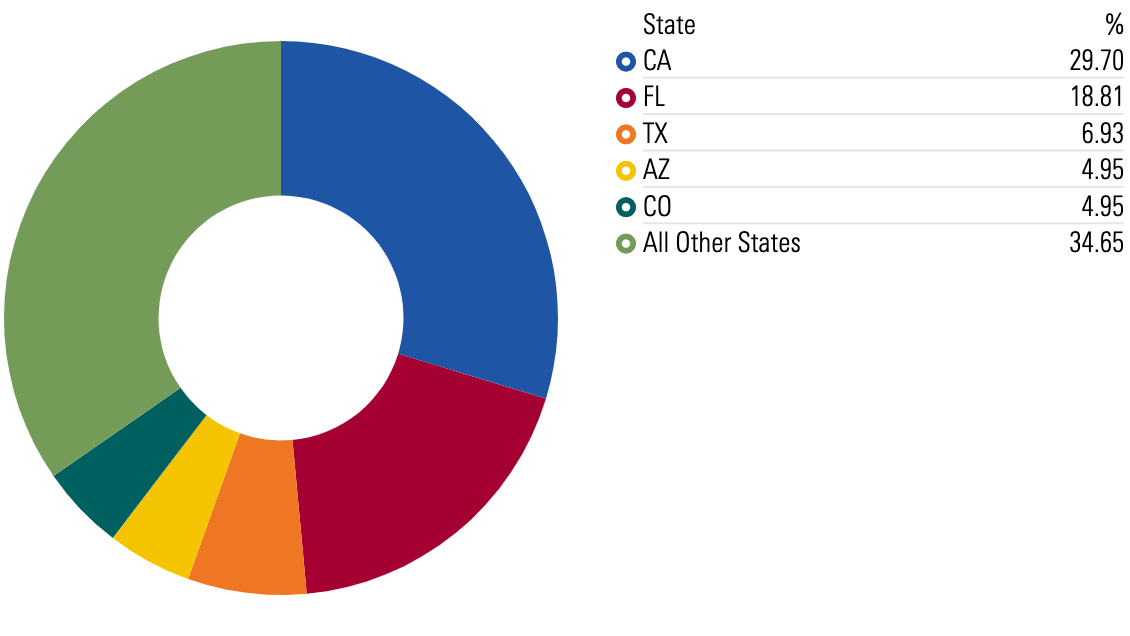

As California adjusts to this new regulatory regime, we expect the state to see lower rates of solar installations moving forward. States such as Florida and Texas will be critical to long-term rooftop solar growth given large populations and low penetration rates.

California Remains Largest Contributor, but Increasingly Less So

2 Top Picks for Investing in the US Renewable Energy Space

Our picks for the most attractive valuations in the renewable energy space are:

- First Solar

- Brookfield Renewable Partners

First Solar FSLR

- Morningstar Rating: 4 stars

- Moat Rating: None

- Fair Value Estimate: $185

- Price/Fair Value Estimate (as of March 25, 2024): 0.83

First Solar is the world leader in thin-film solar panel technology. The company’s module sales efforts have become increasingly focused on select end markets. The United States and India represent the vast majority of sales efforts, where policies leave the company in a more favorable competitive position. First Solar is one of the biggest beneficiaries of the solar manufacturing incentives included in the 2022 Inflation Reduction Act, which we expect to drive earnings per share to over $30 in 2026.

Brookfield Renewable Partners BEP

- Morningstar Rating: 4 stars

- Moat Rating: None

- Fair Value Estimate: $28

- Price/Fair Value Estimate (as of March 25, 2024): 0.82

Brookfield Renewable holds a well-diversified global portfolio of clean energy technologies assets. The company targets 12%-15% returns (best-in-class) via a combination of organic growth and mergers and acquisitions. Acquisitions are central to Brookfield’s strategy in which it invests alongside Brookfield Asset Management’s private equity funds. We think the current market volatility provides opportunities for Brookfield to find attractive deals, as evidenced by its history (Morningstar Capital Allocation Rating of Exemplary).

This article was compiled by Emelia Fredlick.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a3416e63-64d9-4054-99c0-22cd1547b5a2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3416e63-64d9-4054-99c0-22cd1547b5a2.jpg)