After Nvidia Stock’s Huge Rally, 6 Key Things to Watch in Q2 Earnings

All eyes are on Nvidia’s data center business and artificial intelligence.

Nvidia NVDA is set to release its second-quarter earnings report after the close of trading on Wednesday, Aug. 23. With Nvidia stock surging 180% in 2023 and the intense focus on the company’s role in the artificial intelligence boom, its earnings report comes at a critical time. Here’s Morningstar’s take on what to look for in Nvidia’s earnings, along with our current view on its stock.

Key Morningstar Metrics for Nvidia

- Fair Value Estimate: $300

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What to Watch for in Nvidia’s Q2 Earnings

All eyes are on Nvidia’s data center business and artificial intelligence. Nothing else matters.

- Nvidia’s May earnings report had one of the brightest outlooks we’ve ever seen in semiconductors, as a host of tech titans are rushing to buy as many Nvidia graphics processor units, or GPUs, as they can in order to train large language models (ChatGPT is one example), both for themselves and for their cloud customers.

- Investors expected sluggish business conditions for data centers at the start of the year out of macroeconomic concerns, but the mix shift in spending here has clearly shifted toward artificial intelligence GPUs, and Nvidia’s H100 and A100 GPUs currently dominate that space.

- Only two years ago, Nvidia’s gaming segment was larger than its data center business. In fiscal 2024, we anticipate the data center business will be three times larger than gaming, perhaps even higher. The rise of AI has quickly transformed Nvidia into a data center leader, and it’s possible that no other business segment will move the needle on the company over the next decade.

We will continue to seek clues about how large Nvidia’s data center GPU business might become. We view Nvidia’s valuation as being closely tied to the length and depth of its AI GPU dominance, for better or worse.

- First, we’ll seek insight into how cloud leaders implement GPUs. Are these GPUs being used for AI training (where Nvidia dominates) or AI inference (which will likely be the bigger sub-segment of AI over the next decade)? Are they being used for internal AI models or rented out to cloud customers for their proprietary AI training?

- Next, we’d like to learn about the spending patterns in the cloud. Will cloud leaders like Amazon.com’s AMZN AWS or Microsoft’s MSFT Azure increase their spending to keep up in the AI race? Is recent spending a one-time massive up-front build, or do these spending patterns constitute a new normal? (Our guess is the latter.) Finally, how much cloud computing capital expenditure will shift from traditional cloud workloads (such as data management or website hosting) toward AI workloads?

- Finally, we’ll look for Nvidia’s comments about AI supply. The firm’s incredibly bright outlook for the July quarter was surprising in part because only one firm, Taiwan Semiconductor, manufactures such GPUs, and it is quite hard for any leading foundry to expand capacity quickly. Taiwan Semiconductor appears to be expanding its capacity for the types of chip packaging used explicitly by Nvidia for its data center GPUs, but it’s possible that GPU supply won’t be able to keep up with demand in 2023, and perhaps longer.

All these items will inform our estimates for future data center revenue growth, and in turn our predictions for free cash flow generation and our fair value estimate.

Nvidia Stock Price

Fair Value Estimate for Nvidia Stock

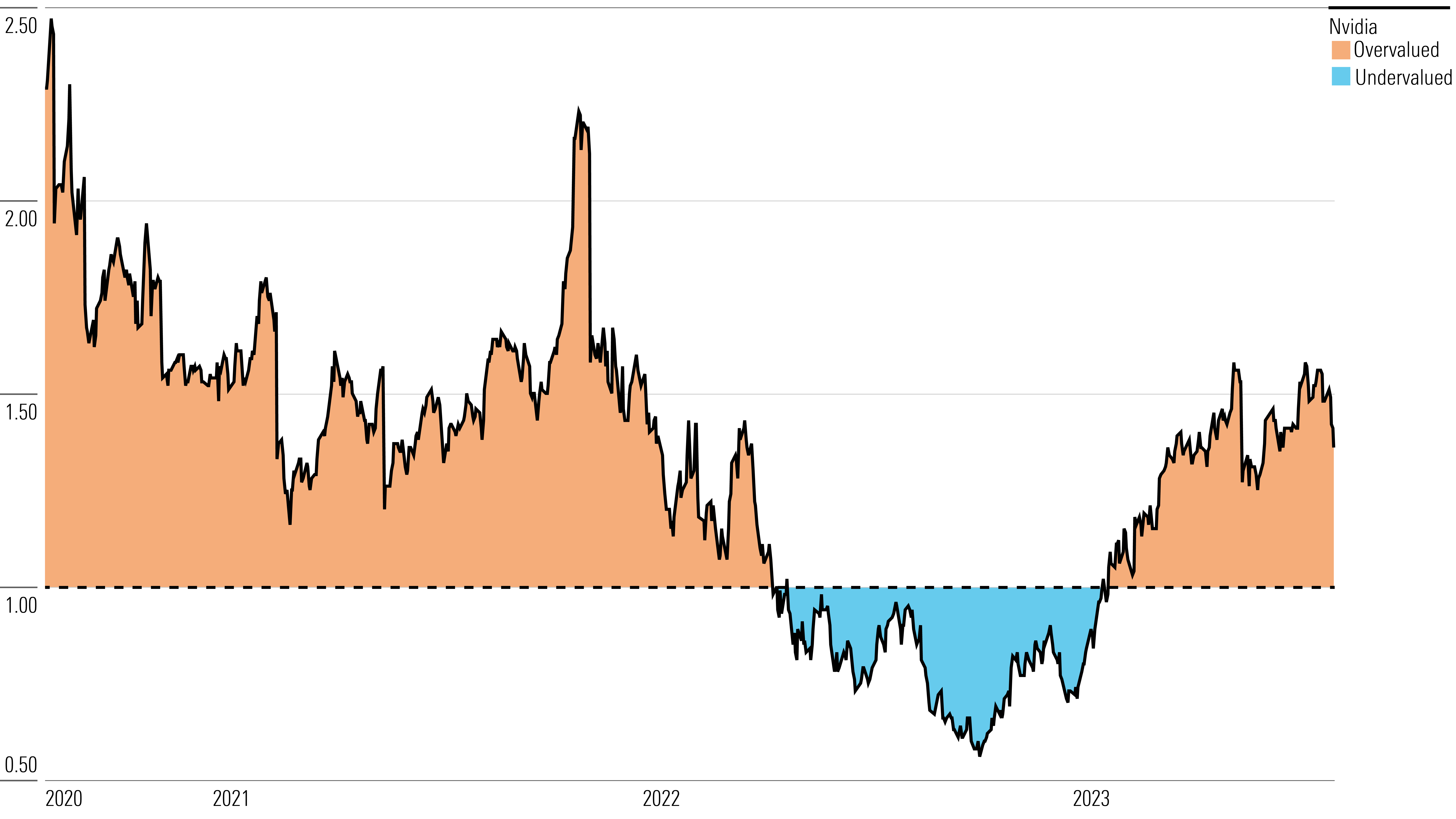

With its 2-star rating, we believe Nvidia stock is overvalued compared with our long-term fair value estimate.

Our $300 fair value estimate assumes a fiscal 2024 adjusted price/earnings ratio of 37 times. We project revenue will increase at a 23% compound annual growth rate through fiscal 2028 as the firm continues to diversify its revenue sources to areas of strong potential.

We think the data center segment will rise at a 30% CAGR through fiscal 2028, as we expect the firm to dominate the training portion of deep learning AI workloads. Key workloads that supported this growth included large language models (such as ChatGPT), other forms of generative AI, deep recommendation engines, and autonomous vehicle fleet data processing and training. We expect demand from Microsoft, Amazon, and Alphabet GOOGL to be robust as each firm invests in Nvidia’s latest H100 GPUs for both internal and external workloads. Meta Platforms META has also been spending heavily to build out the infrastructure to support its metaverse offering, which we expect to continue bolstering demand for Nvidia’s GPUs.

Read more about Nvidia stock’s fair value estimate.

Nvidia Historical Price/Fair Value Ratios

Economic Moat Rating

We believe Nvidia possesses a wide economic moat stemming from its intangible assets related to the design of GPUs. The firm is the originator of and leader in discrete graphics, having captured the lion’s share of the market from longtime rival Advanced Micro Devices AMD.

We think the market has significant barriers to entry in the form of advanced intellectual property. Even chip leader Intel INTC was unable to develop its own discrete GPUs despite its vast resources, and it ultimately needed to license IP from Nvidia to integrate GPUs into its PC chipsets (though more recently, Intel is again vying to develop its own discrete GPU). To stay at the cutting edge of GPU technology, Nvidia has a large research and development budget relative to AMD and smaller GPU suppliers, which allows it to continuously innovate and fuel a virtuous cycle for its high-margin chips.

Nvidia’s intangible assets originate with its popularization of GPUs in 1999. These units offload graphics processing tasks from a system’s central processing unit, increasing its overall performance. The firm has patents related to the hardware design of its GPUs in addition to the software and frameworks used to take advantage of GPUs in gaming, design, visualization, and other graphics-intensive applications.

The latest PC games also typically require system software updates, or drivers, which optimize GPU performance. In our opinion, Nvidia tends to provide more reliable drivers for most games, ones that allow gamers to take full advantage of its GPUs. AMD is unable to match Nvidia in the breadth and consistency of driver updates. Consequently, consumers have favored Nvidia’s GPUs for gaming, with the firm boasting over 80% share in the discrete PC GPU market, with little resistance from AMD at the leading edge. This has in turn enabled economies of scale that allow Nvidia to invest in designing chips at advanced process nodes while offering the latest GPU technology.

Read more about Nvidia’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Nvidia is High. The firm has benefited from strong PC gaming momentum in recent years. However, many of the most popular games are competitive multiplayer online games that require low-end discrete GPUs for latency reasons instead of high-end GPUs for cutting-edge graphics. The firm is also expected to benefit from virtual reality and the metaverse, but a shift to mobile gaming VR over PC VR could curb such opportunities, as Nvidia’s GPUs aren’t formidable in smartphones.

While Nvidia has historically generated most of its sales from gaming, its increasing data center presence for GPUs used in deep learning has helped propel the segment to the largest percentage of its total revenue. Nvidia has a first-mover advantage in chip solutions for AI and autonomous vehicles, though that lead may not last if superior alternatives arise.

Also, the rate of disruption tends to be quicker in these markets, which are very performance-sensitive. We note that GPUs were designed to do one thing very well: render graphics for realistic images, games, videos, and so on. Leveraging GPUs in deep learning applications and other areas mostly occurred due to a lack of better options. As alternatives arise, Nvidia’s recent explosive growth could be difficult to maintain.

Read more about Nvidia’s risk and uncertainty.

NVDA Bulls Say

- The proliferation of AI and deep learning, which rely on Nvidia’s graphics chips, presents a massive growth opportunity.

- The firm has a first-mover advantage in the autonomous driving market that could lead to widespread adoption of its Drive PX platform.

- The increasing complexity of graphics processors provides a barrier to entry for most potential rivals, as it would be difficult to match Nvidia’s large R&D budget.

NVDA Bears Say

- The AI opportunity remains nascent, and it is not a foregone conclusion that Nvidia’s GPUs will dominate.

- Nvidia’s automotive endeavors face plenty of competition, as numerous chipmakers are targeting the market.

- A large portion of sales comes from the maturing PC industry via PC gaming.

This article was compiled by Tom Lauricella

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)