Despite Recent Struggles, Thematic Funds Are Here to Stay

How to use our framework to assess the potential merits of a thematic investment.

Thematic funds were some of the biggest winners in the postpandemic recovery period—but they’ve also been some of the hardest-hit names in the subsequent market downturn.

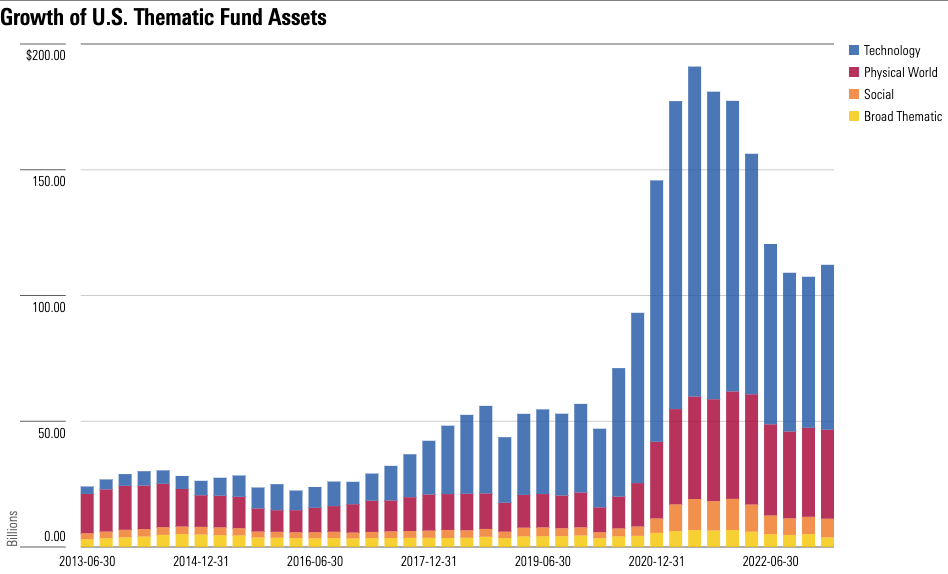

The chart below shows that thematic fund assets have tumbled more than 40% since markets peaked in mid-2021, but assets are still more than double where they were just before the pandemic.

What’s more, there’s reason to believe the market for thematic investing is here to stay. Muted net outflows, a strong pipeline of new fund launches, and limited closures hint that the market for thematic funds isn’t going anywhere.

Still, as always, it’s crucial that investors look beyond strong recent performance of a fund and a compelling narrative when considering a thematic investment.

Thematic Genie Is Out of the Bottle

The rising demand from investors to invest thematically isn’t contained to the United States. It’s a global story, driven by some global trends.

The first is growing irrelevance of traditional geographic and sector frameworks.

At a stock level, we can consider highly thematic tech giants such as Alphabet GOOGL or Amazon.com AMZN. These companies operate in a kaleidoscope of emerging and existing industries and globally are testing the traditional sector- and geographic-based frameworks like never before.

Many investors don’t feel the traditional investment lens fully captures the drivers of growth in the modern globalized world and increasingly favor a thematic approach.

The second key trend is the democratization and mass customization of finance. The rise of low-fee or commission-free trading on platforms like Robinhood HOOD and the rise of exchange-traded fund investing more generally has facilitated retail investment flows. Retail investors have historically been attracted to thematic investments, which has contributed to the popularity of stocks and funds connected with themes.

These investors also increasingly want to be able to customize their investments to align with their interests and values.

A Closer Look at Thematic Fund Performance

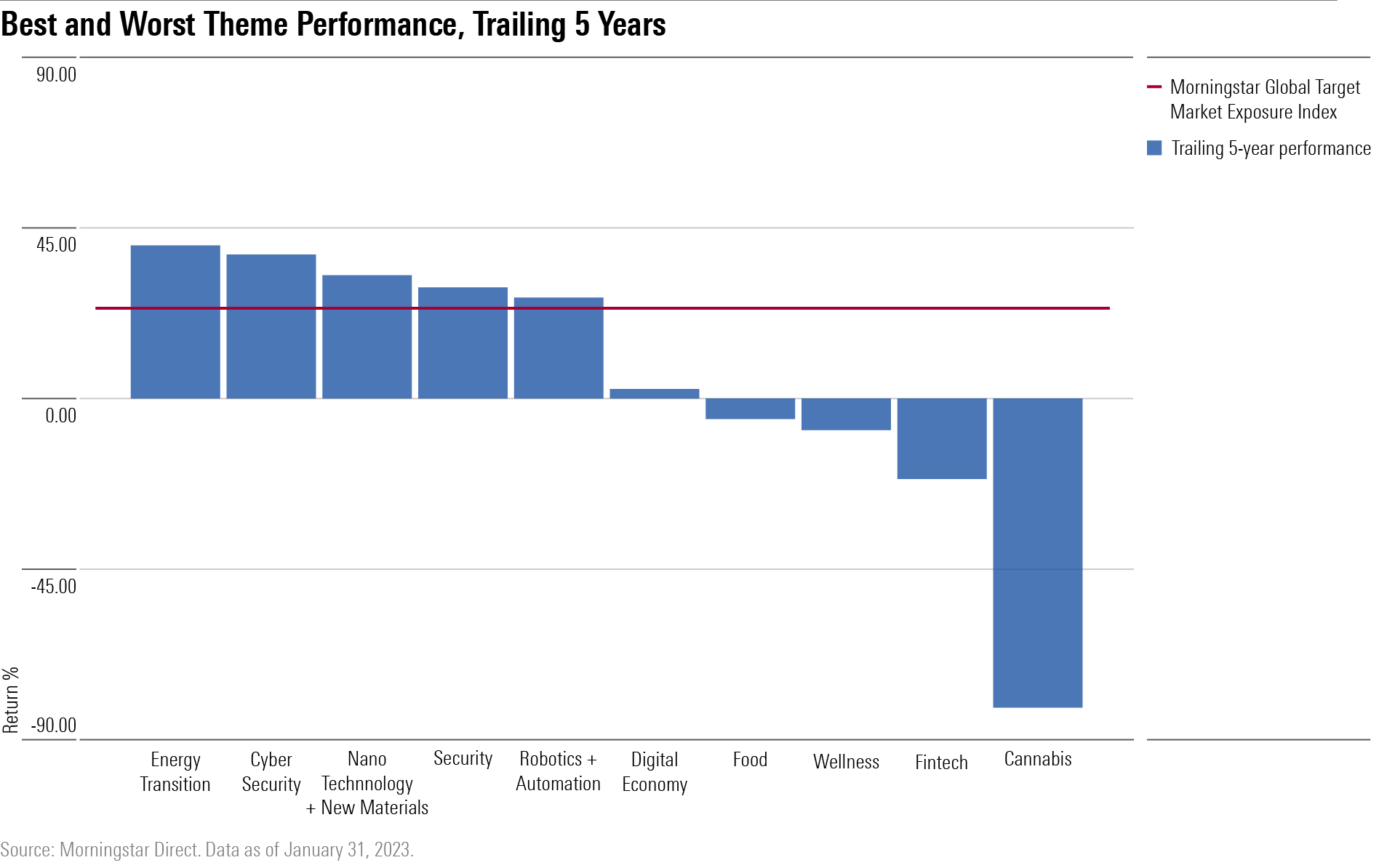

The chart below shows the performance of theme averages, which track the aggregate performance of all funds tracking a given theme. This data gives us an indication of how well a theme has performed through time.

It shows the best- and worst-performing themes we track over the trailing five years versus a global equity benchmark. Themes like Energy Transition and Cyber Security have performed well; themes like Cannabis and Fintech have lagged the benchmark.

While investors might pick a winning theme, the graph shows that the difference between selecting the right and wrong one can be far more than a few basis points.

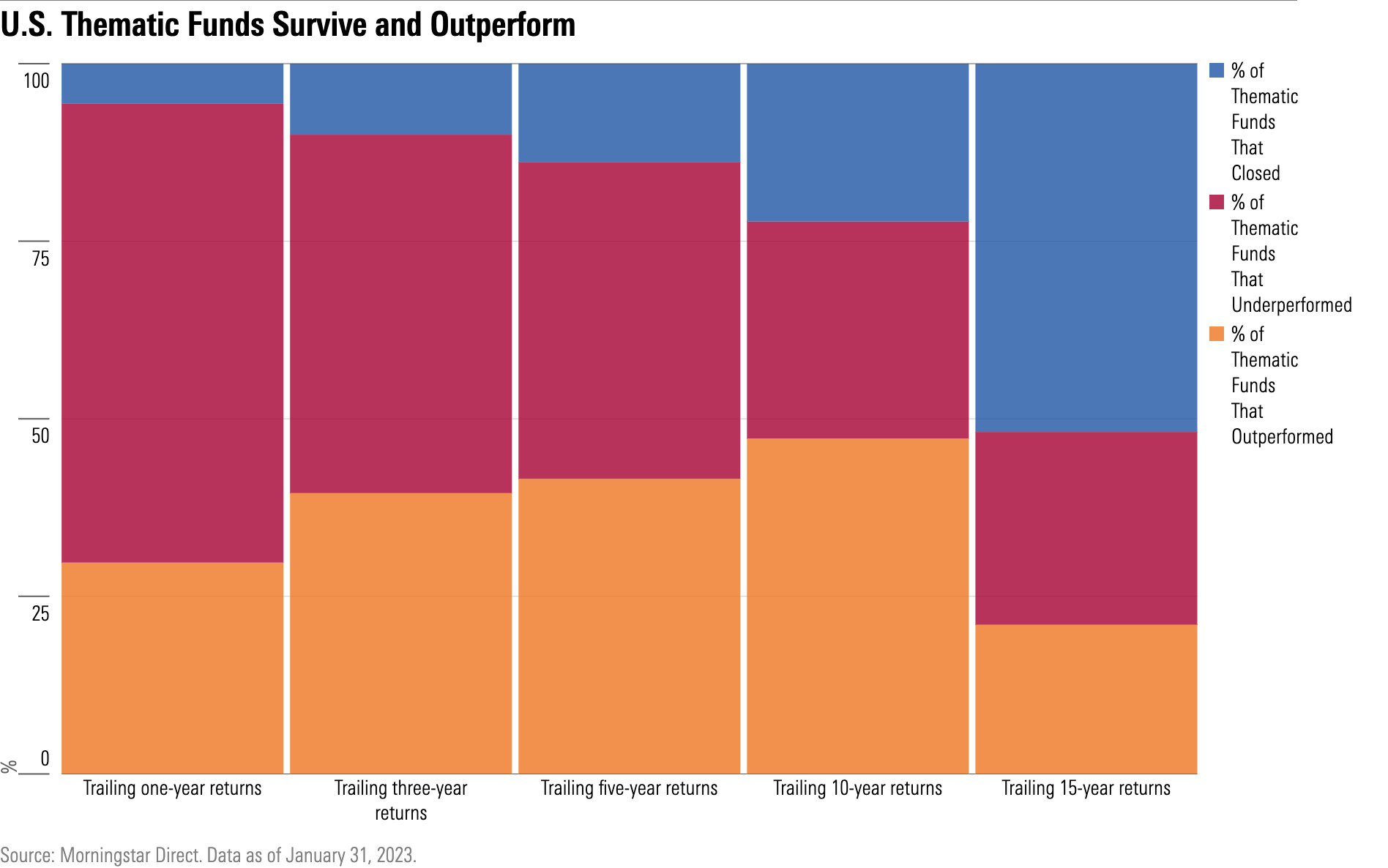

Conversely, the exhibit below shows a more general view of thematic performance. It charts the chances of a fund surviving and outperforming the global equity markets over different time periods for all U.S. thematic funds.

Over one year, just one in three thematic funds survived and outperformed. While the relative performance does gets better as we extend the observation period, the odds of picking a winner are still tough.

This data suggests that if you picked a thematic fund at random, your chances of that fund surviving and outperforming the global equity market never rose above 50% over any of the time periods highlighted. This is why it’s so important to have a robust framework for assessing these funds.

A Morningstar Framework for Assessing Thematic Funds

As with any other investment, thematic investors should start by assessing the fundamental characteristics that boost the chances of achieving long-term investment success—factors such as low fees, a seasoned management team, and a trusted parent organization.

That said, the distinctive characteristics of thematic funds do demand a more tailored approach to due diligence. To that end, we have developed a framework for use in assessing the merits of a thematic fund. The framework breaks down a thematic fund investment into three key parts.

1) The theme.

The first port of call when evaluating a thematic fund is the theme itself.

A robust theme should be logical. Is there a coherent and compelling growth story behind the strategy? Is there data to back it up?

A robust strategy should be loose enough to adapt as the specifics of the chosen theme inevitably evolve but also tight enough to provide exposure to the desired drivers of risk and return. As timely as they might seem now, some themes will age poorly. For example, thematic funds that rushed out to capture current short-term trends such as the COVID-19 environment or trade war funds should be avoided.

It is also important to understand the key risk and return drivers embedded in the theme. For example, when investing in a cannabis fund, it’s important to look beyond basic growth projections and to fully understand the regulatory risks associated with that theme.

2) The fund.

A strong narrative should not distract an investor from looking more closely at how a fund tracks its theme. Every thematic fund takes a different approach to defining and tracking its theme, and investors should understand the specifics of how thematic exposure is defined and how a fund selects and weights its holdings.

Even funds that claim to track similar themes can have surprisingly little overlap in holdings.

There are often few publicly traded firms that represent pure plays on any given theme, so deciding which to include in a portfolio can be tricky. There may also be cases where the theme is robust but can’t be capitalized on via publicly traded stocks.

3) Implementation.

You can select the right fund tracking the right theme, but it’s still essential to implement the strategy sensibly.

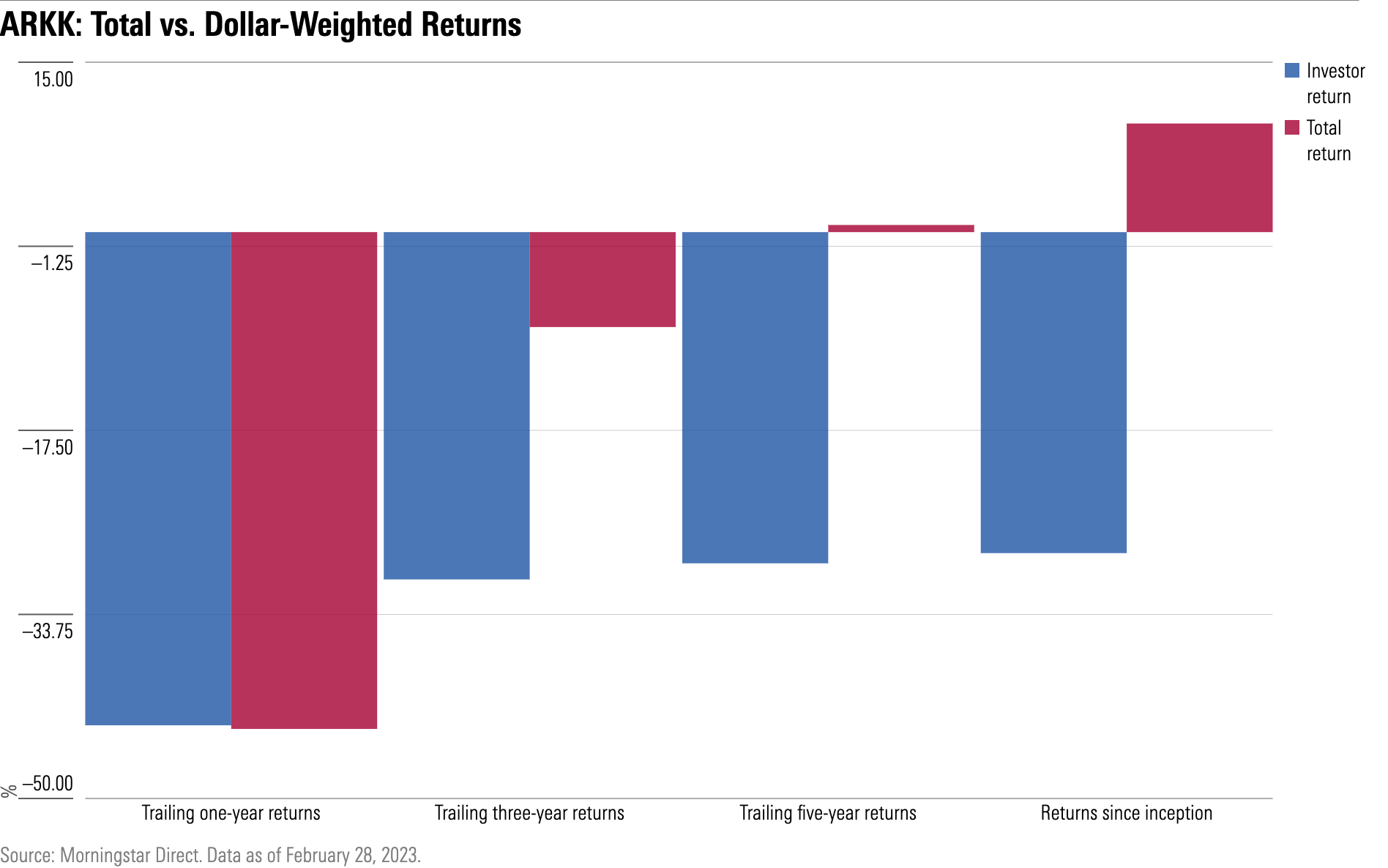

For example, in the chart below, we examine a poster child of thematic investing: ARK Innovation ETF ARKK.

The exhibit below highlights the differences between the fund’s total returns and dollar-weighted returns, which more accurately reflect the outcomes for the average investor, over various periods since inception.

The results are striking. While ARKK has registered positive returns since inception, the dollar-weighted returns show the average dollar invested in the fund lost more than 25%. This huge gap demonstrates that investors would often be better off adopting a buy-and-hold approach.

Finally, it’s key to understand how any thematic fund works within the context of a specific portfolio.

Thematic funds, particularly those served in an ETF wrapper, tend to offer a highly concentrated basket of stocks—which in most cases means that they should only constitute a small portion of an already diversified portfolio.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)